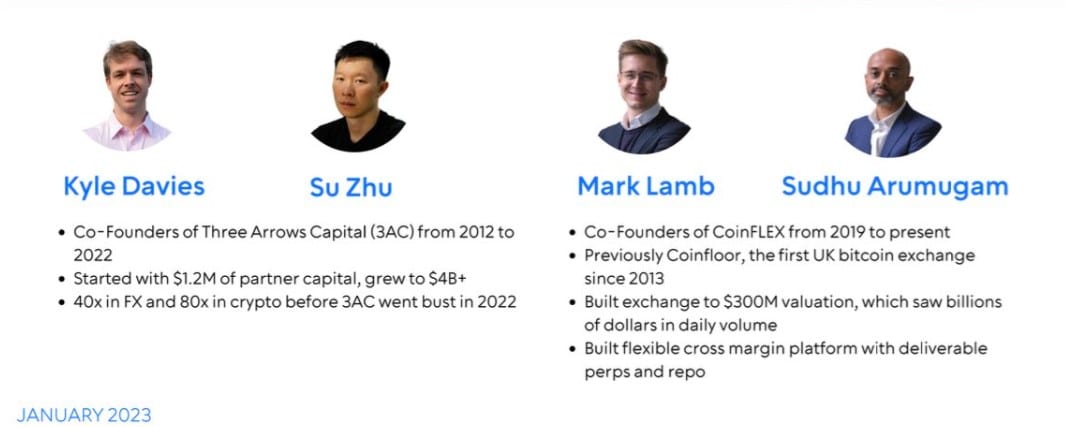

Su Zhu and Kyle Davies, founders of crypto hedge fund Three Arrows Capital, which declared bankruptcy last year, want to launch a new exchange called “GTX”.

About the GTX Exchange

Su Zhu and Kyle Davies are seeking $25 million in funding for a new exchange. The new exchange will focus on bankrupt crypto businesses, especially FTX. As we all know, the collapse of FTX has caused enormous losses to many crypto investors. The new GTX exchange is a reference to FTX, which collapsed last year.

Connection with FTX

The name GTX for the new exchange is a play on words. The letter “G” comes after the letter “F”, indicating that the new exchange is replacing the FTX in the alphabet. It claims that the exchange was given such a name because it aims to fill the gap created after FTX. For the exchange to establish, it was thought to be the last exit door for millions of people who lost their money with the FTX crisis, but it did not go beyond being a mockery for many people.

Focusing on Bankrupt Firms

The founding team of the new exchange GTX includes Mark Lamb and Sudhu Arumugam, co-founders of the cryptocurrency exchange CoinFlex. The GTX exchange also plans to enter the stock securities loan industry. CoinFlex’s technology will use to launch the GTX exchange. At the same time, requests from customers of bankrupt businesses such as BlockFi and Voyager will check. GTX is scheduled to launch in February.

Leave a comment