The Distinct Risks of Ethena (USDe) Stablecoin: A Critical Analysis

Crypto News – In a recent report, CryptoQuant highlighted the distinctive risks associated with holding Ethena (USDe) compared to other dollar-denominated tokens, shedding light on the complexities of its operational model.

With a current market capitalization exceeding $2.3 billion, USDe emerged onto the scene in late February, swiftly establishing itself as the fastest-growing stablecoin in history. A key allure lies in its unique proposition of generating yield for its holders, a departure from the norm where leading stablecoins retain all profits internally.

However, the very mechanism underpinning this attractive feature also injects a nuanced layer of risk into the protocol’s business model.

CryptoQuant pointed out on Tuesday via Twitter, “Risks emerge for Ethena during sharp price corrections in cryptocurrency markets, particularly when the funding rate turns negative due to the liquidation of long positions by traders and the desire to initiate short positions.”

Ethena maintains its dollar peg through a delta-hedging strategy, backing USDe with Bitcoin (BTC) and Ethereum (ETH), and mitigating value fluctuations through holdings in perpetual futures shorting both assets.

In contrast, traditional stablecoin issuers typically secure their tokens with reserves consisting of cash and U.S. treasuries, with the latter constituting a significant portion of their profits. Relative to this conventional model, Ethena’s reserves boast greater censorship resistance, given the on-chain foundation of many components within the system.

However, a critical juncture arises for USDe.

Given the historical bias towards long positions in Ethereum and Bitcoin futures markets, shorts receive regular payouts, thereby providing Ethena with inherent revenue. Nevertheless, when funding rates dip into negative territory, these payouts transform into penalties, which are entirely covered by Ethena’s reserve fund.

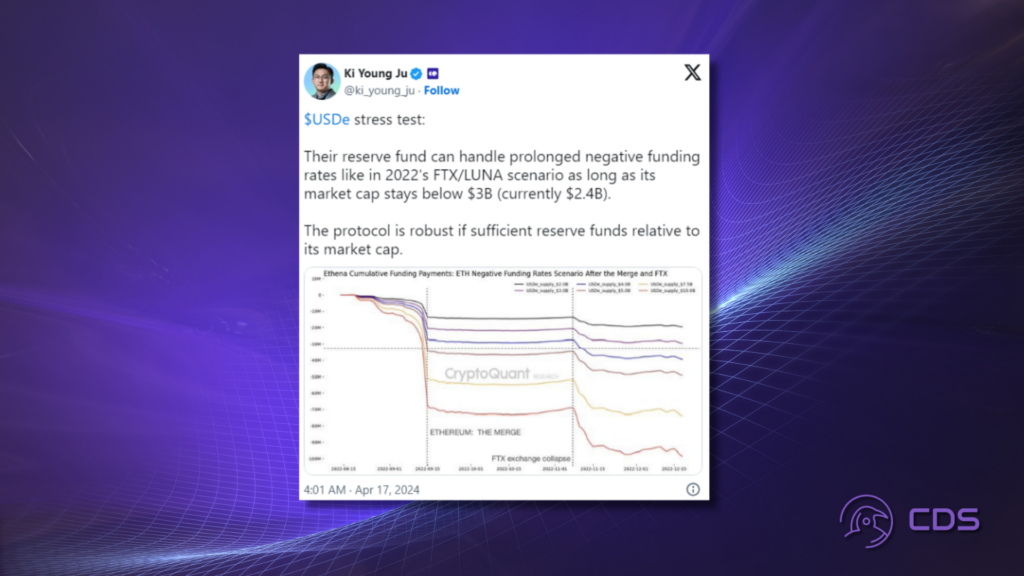

“The central question revolves around whether Ethena’s reserve fund can sufficiently absorb all negative funding rate payments to prevent the liquidation of their short positions,” CryptoQuant opined.

According to CryptoQuant’s analysis, Ethena’s current reserve fund of $32.7 million provides adequate protection for USDe holders as long as the token’s market cap remains below $4 billion. This estimation is predicated on a realistic scenario involving significantly negative Ethereum funding rates, akin to the period surrounding the September 2022 Merge upgrade.

Should USDe’s market cap surge to $10 billion, USDe’s reserve fund would need to scale up to $80 million to maintain a comparable level of safety.

“Investors must vigilantly monitor the adequacy of Ethena’s reserve fund relative to the market capitalization of USDe to weather periods marked by exceptionally large negative funding rates,” CryptoQuant concluded.

Leave a comment