Shiba Inu Burn Tracker Sets the Record Straight on Token Burns and SHIB Price – Emphasizing Demand and Uniform Investments as Key Drivers

Shiba Inu Burns Explains Why It Has No Impact on SHIB Price

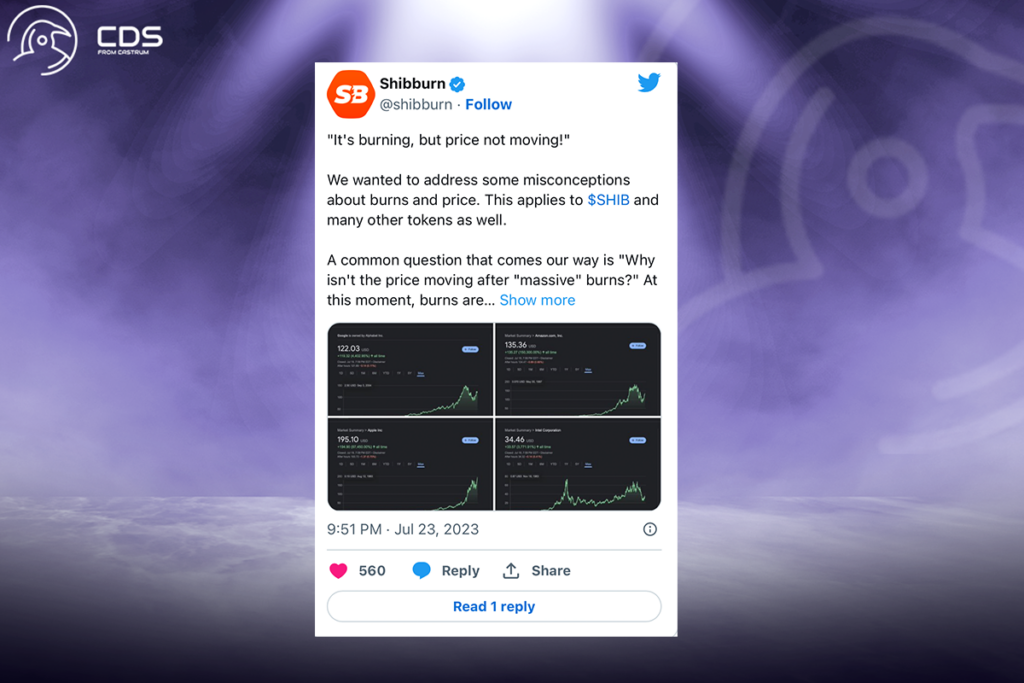

Shibburn, the renowned Shiba Inu burn tracker, took to Twitter to address misconceptions about the impact of token burns on Shiba Inu’s price dynamics. In a recent tweet, Shibburn made a significant point, highlighting that token burns alone are not sufficient to influence SHIB prices without uniform and substantial token investments.

The key takeaway from Shibburn’s clarification is that burning large amounts of tokens, even up to 10 billion a week, would not create a substantial price impact if larger token transfers happen regularly, and the overall price remains stable. According to Shibburn, the driving forces behind SHIB price movements lie in the demand for the token and the presence of uniform and substantial investments.

This insight from Shibburn sheds light on the complex factors that govern the price dynamics of Shiba Inu and reinforces the importance of understanding the broader market dynamics and investor behavior in evaluating the impact of token burns on cryptocurrency prices.

Shibburn firmly emphasizes that the price of a token is not solely dictated by token burns. In their view, even if a token burns a significant portion of its supply, its value is fundamentally governed by the principle of supply and demand.

A token can burn 90% of its supply, but if there’s no demand for that token, then it holds no value.

Shibburn

According to Shibburn’s analysis, token burns can have a psychological impact on investors, signaling a commitment to reducing the token supply and potentially increasing scarcity. However, the ultimate determinant of a token’s price is the balance between its availability (supply) and the level of interest from investors and users (demand).

In other words, token burns alone cannot guarantee a rise in price if there is insufficient demand or if other factors in the market counteract the positive effects of the burn. The interplay between supply and demand dynamics, as well as various market forces, plays a critical role in shaping the value of a token.

In regards to the distribution of Shiba Inu tokens, Shibburn highlighted that a significant portion, approximately 400 trillion of the token’s supply, is held by the top 100 accounts, which are primarily centralized exchanges. This concentration of tokens in a limited number of accounts raises concerns about centralization.

However, Shibburn provided reassurance that despite this uneven distribution, the price of Shiba Inu can still experience upward movements based on market demand. In bullish market conditions, where more people continue to buy the token, exchanges may also increase their purchases, leading to an increase in Shiba Inu’s price.

Leave a comment