SEC Approves Eight Spot Ether ETFs, Paving the Way for Wider Ethereum Investment

Following the SEC approval of 19b-4 applications, VanEck Investments promptly launched a compelling 37-second advertisement, inviting viewers to “Enter the ether.”

In a landmark decision on Thursday, May 23, the U.S. Securities and Exchange Commission gave the green light to eight spot Ether ETFs simultaneously, mirroring their previous approach with spot Bitcoin ETFs.

The SEC approved 19b-4 filings from prominent financial institutions including BlackRock, Fidelity, VanEck, Grayscale, ARK 21Shares, Franklin Templeton, Bitwise, and Invesco Galaxy. These ETFs are set to be listed on three major national exchanges: CBOE, NYSE ARCA, and NASDAQ, thereby broadening Ethereum’s reach to a more extensive range of investors.

However, it’s important to note that while the SEC’s approval of the 19b-4 filings is significant, issuers cannot begin trading these ETFs until they obtain approval for their S-1 registrations. According to Bloomberg analyst James Seyffart, this process is expected to take several more weeks.

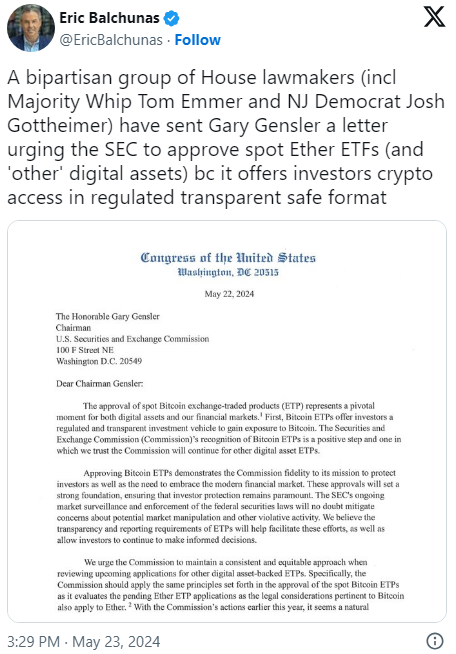

The approval of these Ethereum ETFs caught many by surprise, suggesting potential political influences. Earlier that day, a group of House lawmakers, including Majority Whip Tom Emmer and New Jersey Democrat Josh Gottheimer, sent a letter urging the SEC to approve the ETFs.

The SEC provided its rationale for the approval, citing the strong correlation between CME Ethereum futures and certain spot Ethereum trading platforms. The regulator noted that extensive data demonstrated this high correlation, and that surveillance and sharing agreements with CME and others would help prevent fraud and manipulation.

In response to the 19b-4 approval, VanEck Investments swiftly released a 37-second advertisement encouraging viewers to “Enter the ether.”

“Could it be the fuel to a less centralized and open-source economy?” VanEck’s ad questions. “What could Ethereum be? That’s up to you and me.”

enter the ether 🫴 pic.twitter.com/YXgKQFP5Nr

— VanEck (@vaneck_us) May 23, 2024

Until the SEC grants the final S-1 registration approvals, VanEck’s advertisements will be pivotal in drawing potential investors to their Ethereum fund.

Meanwhile, Coinbase CLO Paul Grewal hailed the Ethereum ETF approval as a triumph, affirming the ‘commodity’ status for the cryptocurrency.

Despite the ETF approval, Ethereum’s price remains steady at $3,800, showing no significant momentum beyond the $4,000 mark.

Leave a comment