Mastercard Unveils Innovative Blockchain Payment Startup Program

Crypto News- On May 15th, the fintech juggernaut Mastercard made waves by welcoming five dynamic startups into its prestigious Start Path Blockchain and Digital Assets program. This accelerator initiative, dedicated to pioneering future applications alongside startups globally, has gained significant traction.

Diverse Expertise: Meet the Newest Stars of Mastercard’s Startup Program

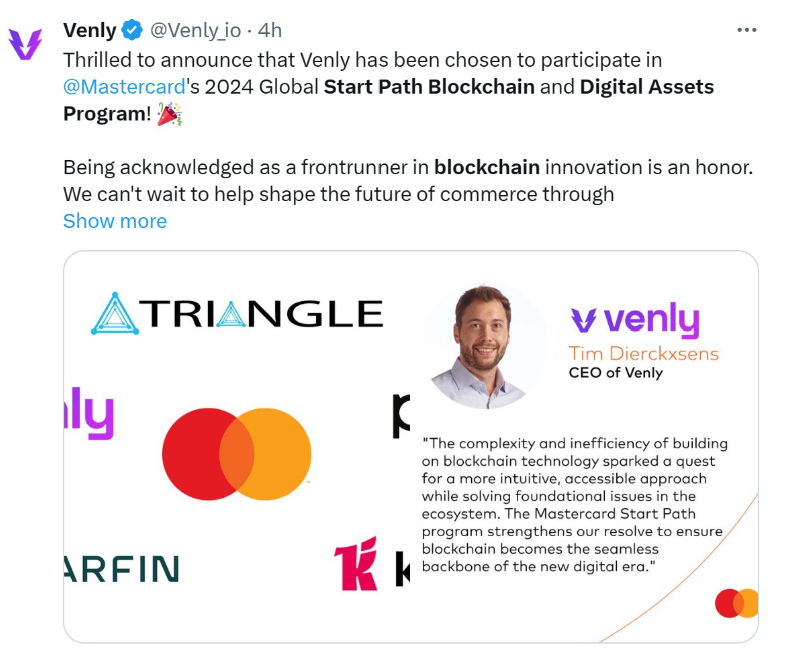

The latest additions to the program encompass a diverse array of expertise. Among them are Kulipa, a trailblazer in crypto payments and card issuance, Parafin, a leading blockchain software innovator, and peaq, a visionary in decentralized physical infrastructure networks. Additionally, the roster includes Triangle, a cutting-edge data platform, and Venly, an esteemed blockchain developer.

Mastercard’s press release underscored the program’s commitment to tackling specific challenges through targeted use cases and trials. The emphasis lies on exploring various currency formats, ranging from regulated money to stablecoins and CBDCs, to address real-world issues.

Exclusive Opportunities for Promising Innovators

Only startups demonstrating exceptional promise in blockchain, digital assets, and Web3 technologies earn consideration for the program. Those selected gain access to invaluable collaboration opportunities, tailored training, and Mastercard’s extensive customer base and distribution channels throughout the intensive four-month program.

Since its inception in 2014, Start Path has nurtured over 400 startups across 54 countries, solidifying Mastercard’s position as a frontrunner in the fintech and blockchain payments landscape.

Recent collaborations underscore Mastercard’s commitment to innovation. Teaming up with Israeli fintech firm Kima, the duo aims to revolutionize credit cards by integrating decentralized finance protocols, potentially redefining the credit landscape.

Furthermore, Mastercard’s alliance with U.S. banking giants, including Citigroup, Visa, and JP Morgan, signals a concerted effort to explore distributed ledger technology for banking settlements, leveraging tokenization for enhanced efficiency and security.

Bridging Traditional and Digital Finance: Mastercard’s Revolutionary Debit Card

In a groundbreaking move in April, Mastercard and 1inch unveiled a groundbreaking debit card equipped with cryptocurrency-to-fiat bridge functionality. This innovation empowers cryptocurrency users to seamlessly conduct cash withdrawals and point-of-sale transactions at establishments accepting debit cards, bridging the gap between traditional and digital finance realms.

FAQs

What is Mastercard’s Start Path Blockchain and Digital Assets program?

Mastercard’s Start Path Blockchain and Digital Assets program is an accelerator initiative dedicated to collaborating with startups globally to pioneer future applications in fintech. It aims to explore innovative solutions in blockchain, digital assets, and Web3 technologies.

What kind of startups are selected for the Start Path program?

Startups selected for the Start Path program are those demonstrating exceptional promise in blockchain, digital assets, and Web3 technologies. These startups offer diverse expertise, ranging from crypto payments and blockchain software to decentralized infrastructure networks and data platforms.

What benefits do startups gain from participating in the Start Path program?

Startups selected for the Start Path program gain access to invaluable collaboration opportunities, tailored training, and Mastercard’s extensive customer base and distribution channels. They also receive support throughout the intensive four-month program to refine their solutions and scale their innovations.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment