Amid a continuous drop in Litecoin’s (LTC) value, significant holders have begun liquidating their assets to mitigate further losses. Currently trading at $65.73, LTC has experienced a nearly 15% decline over the past week.

Large Holders Unload Litecoin

The persistent depreciation of Litecoin in recent weeks has prompted substantial holders to transfer their coins to cryptocurrency exchanges. On-chain data reveals a 464% surge in the netflow of LTC from large holders to exchanges over the past seven days. This metric, which tracks the net transfer of tokens into or out of exchanges by significant holders, indicates a preparation to sell. An increase in this metric suggests mounting selling pressure, potentially leading to further price declines.

Conversely, a decrease in the netflow metric implies that large holders are withdrawing tokens from exchanges, possibly intending to hold them long-term. This behavior often stems from market uncertainty or a strategy to re-enter at more favorable conditions.

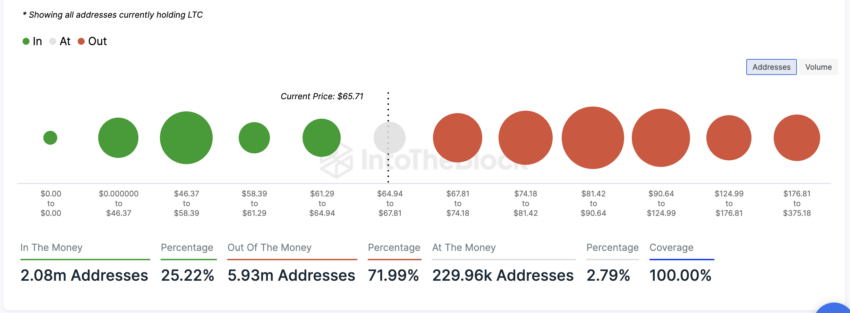

A closer look at LTC’s financial statistics sheds light on why these holders are selling. Currently, 72% of LTC holders, or approximately 5.93 million addresses, are “out of the money.” This term refers to addresses holding assets priced below their purchase cost. In contrast, around 2.08 million addresses, accounting for 25% of LTC holders, are in profit.

The ongoing price decline is likely to increase the number of investors in a loss position. To avoid further losses, LTC whales have escalated their profit-taking activities.

LTC Price Outlook: Bearish Sentiment Prevails

Analysis of LTC’s Moving Average Convergence/Divergence (MACD) indicator confirms a bearish outlook for the cryptocurrency. Traders utilize the MACD to identify price trends, momentum, and potential trading opportunities. Currently, LTC’s MACD (blue line) is positioned below both its signal line (orange) and the zero line. This configuration is typically a bearish signal, suggesting that selling activity is outpacing buying momentum.

However, a shift in market sentiment from bearish to bullish could drive LTC’s value upward, potentially reaching $68.60.

Leave a comment