Crypto News – The cryptocurrency community is anticipating with great anticipation a momentous industry event: on April 30, Hong Kong will begin trading spot Bitcoin and Ether ETFs.

6 Significant Things to Know Ahead of Hong Kong Spot Crypto ETF Launch

On April 30, three Chinese companies—China Asset Management, Bosera Asset Management, and Harvest Global Investments—are anticipated to introduce cryptocurrency ETFs on the Hong Kong Stock Exchange (HKEX) through their Hong Kong subsidiaries.

The event, which comes after the historic introduction of spot Bitcoin ETFs in the US in January 2024, will represent another significant step forward in the global development of regulated crypto investment products and ETFs. We have looked at six essential pieces of knowledge for this approach.

Spot ETFs Previously Available on HKEX

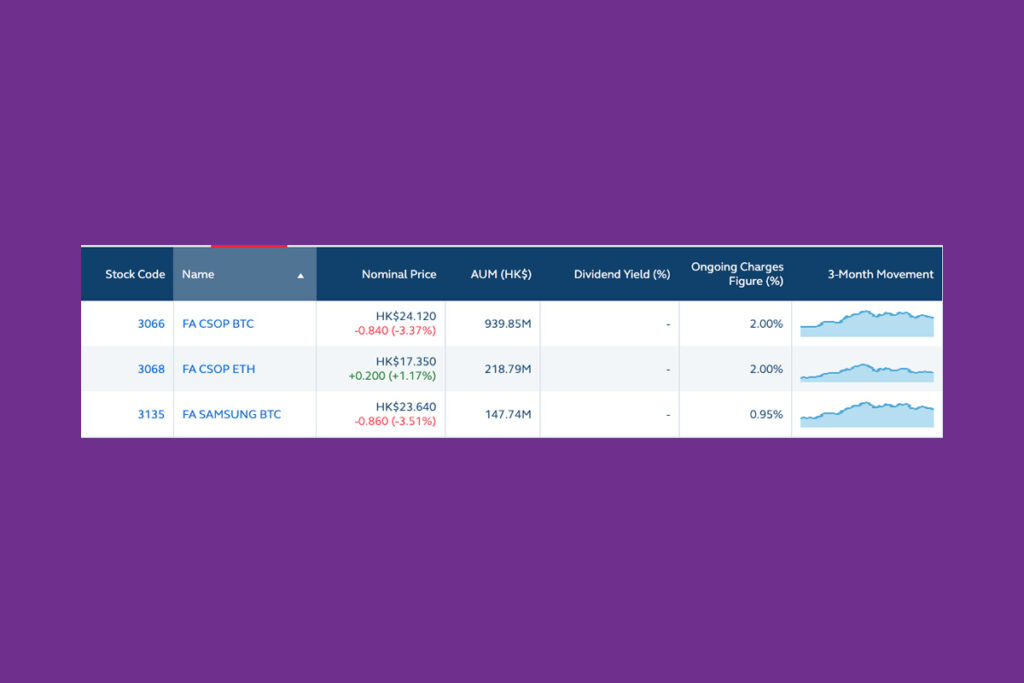

It’s not the first time that spot cryptocurrency ETFs have been offered on the Hong Kong Exchange (HKEX). With the launch of the CSOP Bitcoin Futures ETF and the CSOP Ether Futures ETF, both managed by CSOP Asset Management, crypto ETFs were first offered on HKEX in late 2022. The Chicago Mercantile Exchange (CME) is the trading venue for cash-settled Bitcoin futures contracts and Ether futures contracts, which are tracked by the ETFs.

Hong Kong’s ETF Market is Small Compared to the US

The information provided makes it clear that, in comparison to the ETF market in the US, the Hong Kong market is far smaller. On the other hand, Bloomberg data analyst Jack Wang estimates that the size of the Hong Kong ETF market is $50 billion.

June 2019 saw the listing of Hong Kong’s first active ETF, according to HKEX. 24 active ETFs with a combined capitalization of 8.6 billion Hong Kong dollars ($1 billion) were listed on HKEX by the end of 2023.

Where Hong Kong ETFs Differ from U.S. ETFs Is How They Redeem

The way that Hong Kong’s spot crypto ETFs are redeemed is one of the main characteristics that sets them apart from their American equivalents. Hong Kong’s spot crypto ETFs, in contrast to U.S. spot Bitcoin ETFs, will be produced in-kind, which means that ETF intermediaries give issuers money using real cryptocurrencies like Bitcoin when they want to establish additional ETF shares.

I think the reason why Hong Kong did in-kind is because ultimately we’re trying to differentiate ourselves from the United States,

Rebecca Sin, Bloomberg’s senior ETF

Hong Kong is Not First to Launch Spot Ether ETFs

The debut of the spot crypto ETFs in Hong Kong is intriguing because it would include a spot Ether ETF, which is still pending approval in the US, in addition to the in-kind spot cryptocurrency ETFs. It is anticipated that U.S. securities regulators will reject applications for spot Ether ETFs in May and postpone deciding on the issue.

However, several ETFs have been introduced globally outside the spot Ether ETF in Hong Kong. In April 2021, Canadian regulators authorized the first Ether futures exchange-traded funds (ETFs), placing the nation among the first globally to introduce such investment instruments.

Users in Mainland China may not be able to use ETF Products

Despite the ETF issuers’ strong contacts with mainland China, it is anticipated that mainland Chinese nationals will not be allowed to buy Hong Kong’s spot cryptocurrency ETFs. Crypto ETF investments are prohibited in China since the country forbids its nationals from engaging in any cryptocurrency-related activity, according to Wang, a Bloomberg analyst. In the near future, he thinks Chinese investors won’t put money into this kind of product.

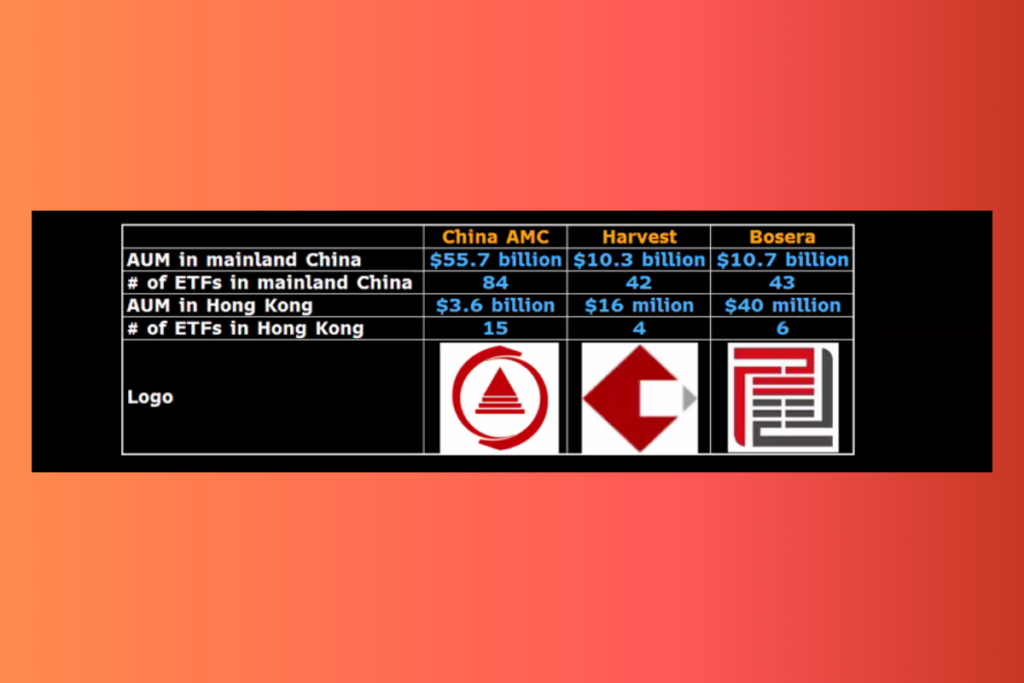

China AMC Emerges as the Largest Asset Management Firm in Hong Kong

The largest asset management firm among the three spot crypto ETF issuers in Hong Kong is China AMC, which is China Asset Management’s Hong Kong subsidiary. Bloomberg data indicates that China AMC manages $3.6 billion in assets across 15 ETFs in Hong Kong. Located in the Chinese mainland, its parent business oversees $55.7 billion, or 1,400% greater assets. The two other issuers in Hong Kong, Harvest, and Bosera, manage $16 million and $40 million in AUM, respectively.

Leave a comment