Crypto News– Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week.

Over $1 billion worth of United States Treasurys have been tokenized across Ethereum, Polygon, Solana, and other blockchains amidst a growing trend of real-world asset tokenization.

Finance Redefined Highlights: 1B Dollars in US Treasurys Tokenized; Base TVL Doubles in One Month

A U.S. judge has ruled that Coinbase’s self-custody crypto wallet doesn’t classify it as a broker, which legal experts argue is a “significant setback” for the U.S. Securities and Exchange Commission (SEC) and a boon for DeFi.

Coinbase’s layer-2 platform Base has recently seen a surge in its total value locked (TVL) on-chain, doubling in just a month, driven partly by the frenzy surrounding meme coins.

On-chain tokenization of U.S. Treasurys has surpassed the 1 billion Dollars mark

Across Ethereum, Polygon, Solana, and other blockchains, the total value of United States Treasurys has surpassed $1 billion, thanks in part to the recent introduction of the BlackRock USD Institutional Digital Liquidity Fund.

BlackRock‘s offering, named BUIDL, debuted on Ethereum on March 20 and currently holds a market cap of $244.8 million.

As per Etherscan data, four transactions amounting to $95 million were directed to the fund over the week, contributing to its growth and elevating it to the position of the second-largest tokenized government securities fund.

Coinbase Wallet’s victory in the face of SEC accusations marks a significant triumph for DeFi

Legal experts in the cryptocurrency field are praising a recent decision by a U.S. judge to dismiss allegations against Coinbase Wallet, recognizing it as a victory for self-custody wallets and DeFi applications.

On March 27, U.S. District Judge Katherine Failla rejected Coinbase’s request to dismiss an SEC lawsuit, stating that the SEC had provided sufficient evidence that Coinbase was operating without a license and that its crypto staking service constituted unregistered securities.

Furthermore, the judge concluded that the SEC had not presented enough evidence to support the claim that Coinbase engaged in brokerage activities through Coinbase Wallet, which functions as a self-custody crypto wallet app, empowering users with full control over their assets.

Solana’s Jupiter DEX initiates a native DAO with an initial capital injection of 137 million Dollars

The Solana-based decentralized exchange (DEX) Jupiter is allocating $10 million worth of USD Coin (USDC) and $100 million worth of its native JUP token, totaling $137 million, to kick-start its Jupiter DAO.

provides the DAO with the capability to fund ideas with USDC and to have the JUP allocation for long-term incentive alignment with J.U.P Contributors. To ensure the DAO’s ability to execute crucial tasks over the long term, we will aim to replenish the same budget annually.

Jupiter DAO

Base TVL Surges Twofold in One Month Amid Predictions of Memecoins Fueling Adoption

In less than a month, the Total Value Locked (TVL) on Ethereum layer-2 network Base has doubled, reaching $2.13 billion, with experts suggesting it could emerge as the next hub for memecoins.

Base achieved $1 billion in TVL on Feb. 27, just 226 days after its launch in August 2023. Remarkably, the network surpassed the $2 billion milestone a mere 25 days later, on March 23, as per data from L2Beat.

Analysis of the Decentralized Finance (DeFi) Market

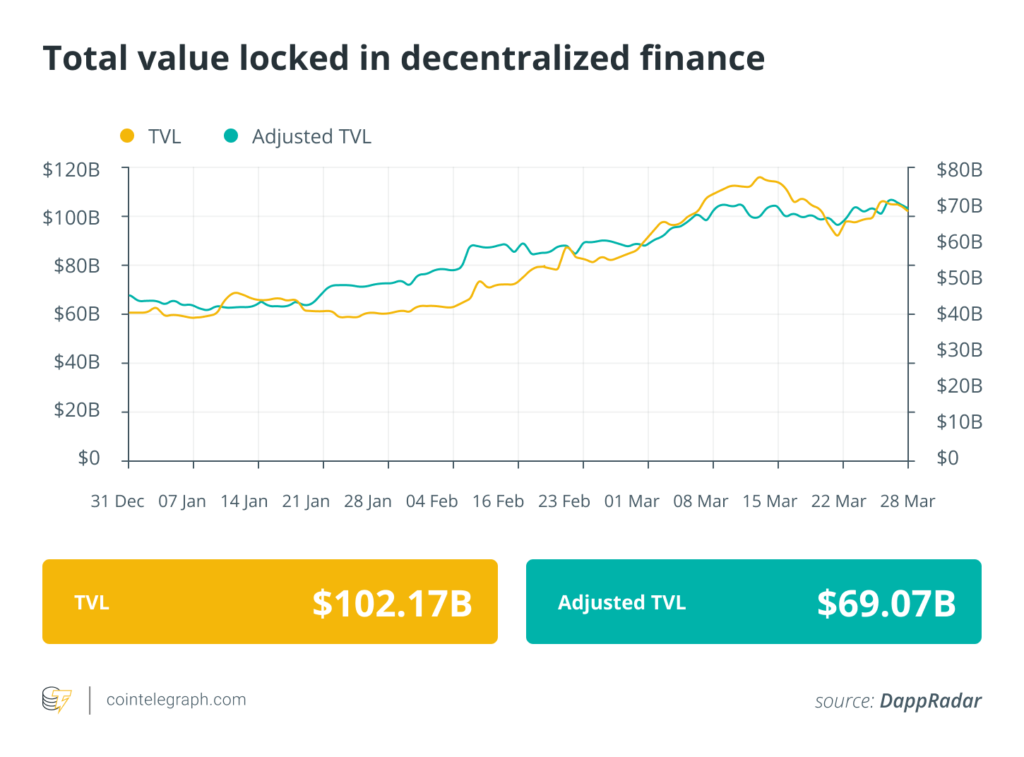

According to data from Cointelegraph Markets Pro and TradingView, the top 100 tokens in the Decentralized Finance (DeFi) sector experienced a bearish week, with the majority trading in the red on weekly charts. However, the total value locked in DeFi protocols saw a resurgence, climbing back above the $100 billion mark.

Leave a comment