Crypto News – This newsletter not only provides a comprehensive summary of the past week, but also highlights events you may have missed.

Weekly Finance Redefined DeFi Newsletter: What Happened Last Week?

Similar to the height of Ethereum’s popularity in 2017, Solana is currently experiencing a nearly week-long network congestion problem that is causing a high transaction failure rate. The problem has been reclassified as a defect rather than a design error, and Solana engineers have set April 15 as their goal date for resolution.

By investing in BounceBit, a Bitcoin-native restaking mechanism, Binance Labs has refocused its DeFi efforts on the cryptocurrency. In other news, withdrawals from the Solana-based DeFi protocol MarginFi surged by more than $190 million in response to rivals’ accusations that the company hasn’t lived up to expectations and an apparent management collapse. You can see the details of this news and much more in the rest of the article.

Will Solana Solve the Bug by April 15?

In order to address an “implementation bug” that recently led to a sharp increase in Solana’s transaction failure rate, the platform’s developers plan to deploy the remedy by April 15.

Solana’s current issue is not a design flaw; it’s an implementation bug,

Mert Mumtaz, the CEO of Helius Labs

Arkham Claims Rivals Are Spreading False Rumors

After inquiries over the company’s transfer of its native ARKM tokens surfaced, blockchain analytics company Arkham accused its rivals of “spreading false rumors” in an attempt to sow fear, uncertainty, and doubt (FUD). Not very long ago, a statement by rival blockchain analytics company Nansen stated that Arkham had transferred approximately 25.2 million ARKM ($56 million) to unregistered wallets and cryptocurrency market Binance within the last two days.

Binance Labs Invested in BounceBit

The world’s biggest cryptocurrency exchange, Binance, has invested in BounceBit, a Bitcoin-native restaking protocol, through its venture capital arm, Binance Labs. According to the co-founder of Binance and head of Binance Labs, BounceBit combines centralized finance and DeFi characteristics to increase the utility of Bitcoin.

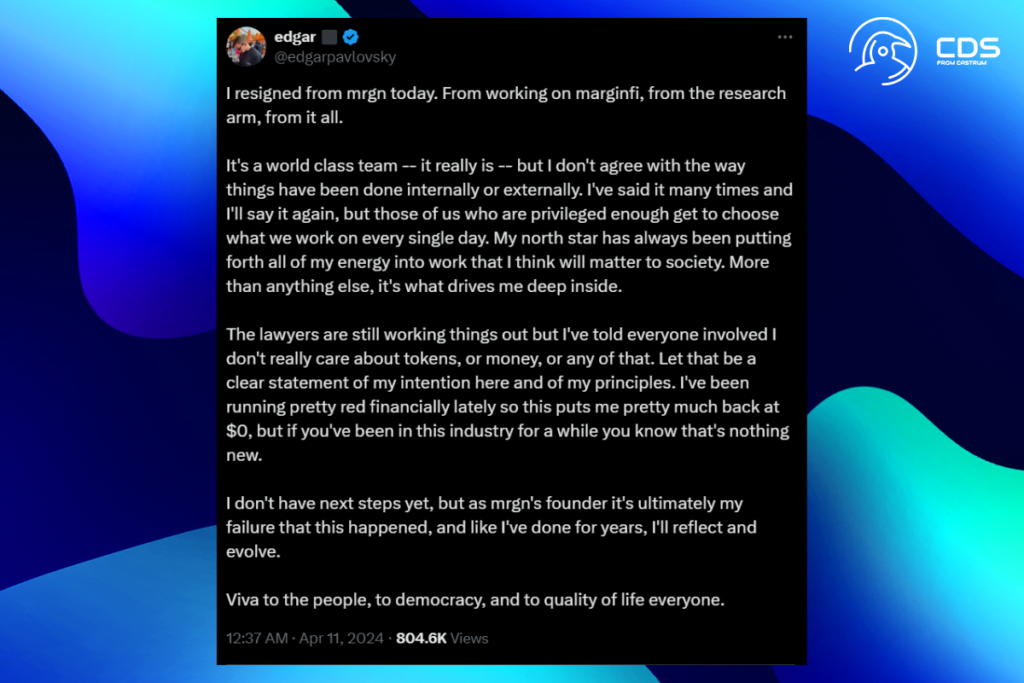

After 190 Million Outflows, MarginFi’s CEO Resigns

After the CEO of the Solana-based lending protocol, MarginFi abruptly resigned and its rivals accused it of misconduct, around $200 million in user funds had left the network in the previous two days. Edgar Pavlovsky, the CEO of MarginFi until recently, abruptly announced his resignation on April 10th, claiming conflicts had arisen both inside and outside the company.

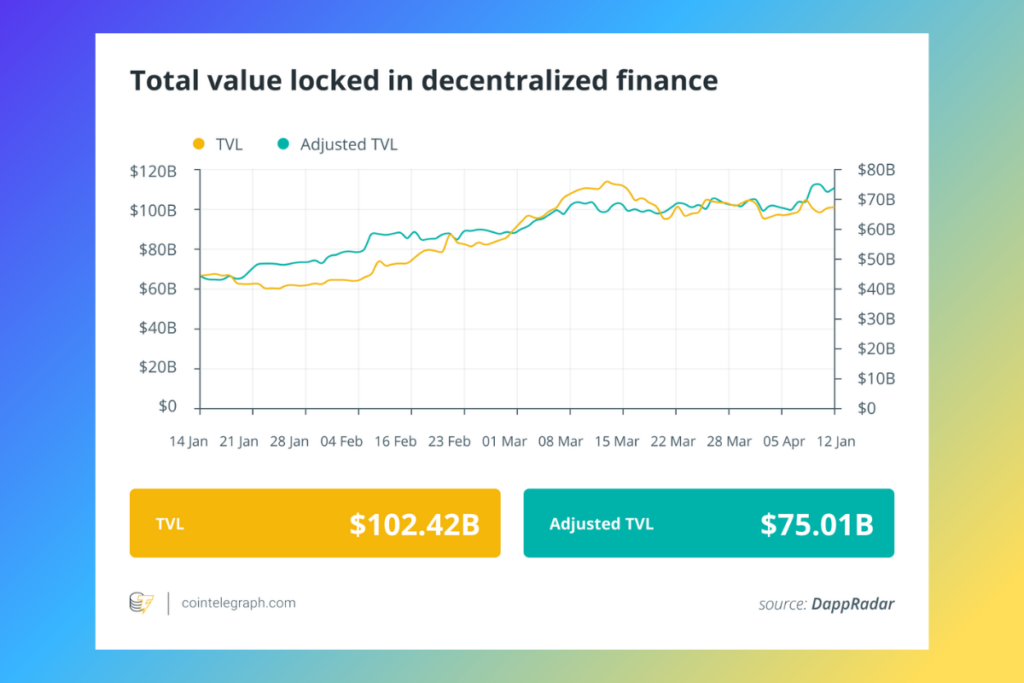

The Total Value Locked in DeFi Protocols is $100 Billion

DeFi’s top 100 tokens by market capitalization had a positive week, with the majority of them trading in the green on the weekly charts, according to data from Cointelegraph Markets Pro and TradingView. DeFi technologies have over $100 billion in total value locked in them.

%s Comment