Cryptocurrency Market Rises Following Federal Reserve Announcement by Chair Jerome Powell

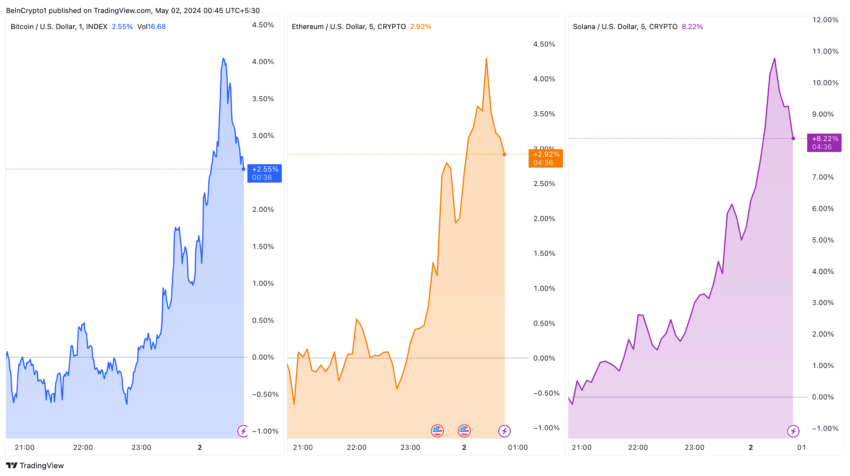

Bitcoin, Ethereum, and Solana witnessed substantial rebounds in their prices subsequent to the latest pronouncement from Federal Reserve Chair Jerome Powell.

The surge in Bitcoin, Ethereum, and Solana prices coincided with Powell’s insights shared during the Federal Open Market Committee‘s meeting.

Crypto Market Soars as Jerome Powell Addresses the Public

The Federal Reserve opted to maintain the prevailing benchmark interest rate, choosing a cautious stance despite persistent concerns regarding inflation. Powell underscored the ongoing difficulties in curbing inflation to the Fed’s targeted 2%, indicating that the central bank’s forthcoming actions are unlikely to include a rate hike.

Instead, the focus will remain on a prudent monetary approach, reflecting the committee’s preparedness to adapt as necessary to uphold economic stability.

“This year’s data, thus far, have not instilled in us a significantly greater confidence, particularly regarding inflation, which, as I mentioned earlier, has exceeded expectations. It’s probable that achieving such enhanced confidence will take longer than previously anticipated,” Powell remarked.

In light of these developments, the cryptocurrency market responded positively, indicating investor confidence in a stable interest rate environment. Bitcoin surged by 5% to reach $59,440, Ethereum rose by 5.02% to $3,015, and Solana experienced an 11% uptick to reach $136.

Historically, stability in interest rates often leads to heightened investments in riskier assets such as cryptocurrencies, as evidenced by the notable increases across major digital currencies.

Furthermore, the Fed announced a deceleration in the pace of its balance sheet reduction, slated to commence in June. This adjustment aims to mitigate market volatility akin to that witnessed in September 2019.

Beginning June 1, the Fed will reduce the monthly runoff of Treasuries to $25 billion, down from $60 billion, while continuing to allow $35 billion monthly runoff in mortgage-backed securities, with excess funds being directed into Treasuries.

This strategic pivot reflects a broader intent to transition towards predominantly holding Treasuries, with the aim of streamlining the central bank’s balance sheet operations and bolstering its responsiveness to market dynamics. Concluding his address, Powell reiterated the Fed‘s vigilance towards inflation risks and its commitment to a restrictive policy stance to temper economic activity.

3 Comments