Crypto News – This week’s Crypto Biz highlights the launch of BlackRock’s new tokenized fund, the Avalanche connection with Stripe, the MicroStrategy earnings results, and the Coinbase Lightning Network rollout.

Crypto Biz Newsletter: What Happened in the Crypto Sector This Week?

For crypto, newsletters are one of the best sources for users to find out what’s happening in the industry on a daily, weekly, or monthly basis. Accordingly, Crypto Biz has compiled a comprehensive review of what’s happening this week. Based on this review, we have highlighted the most important parts for you.

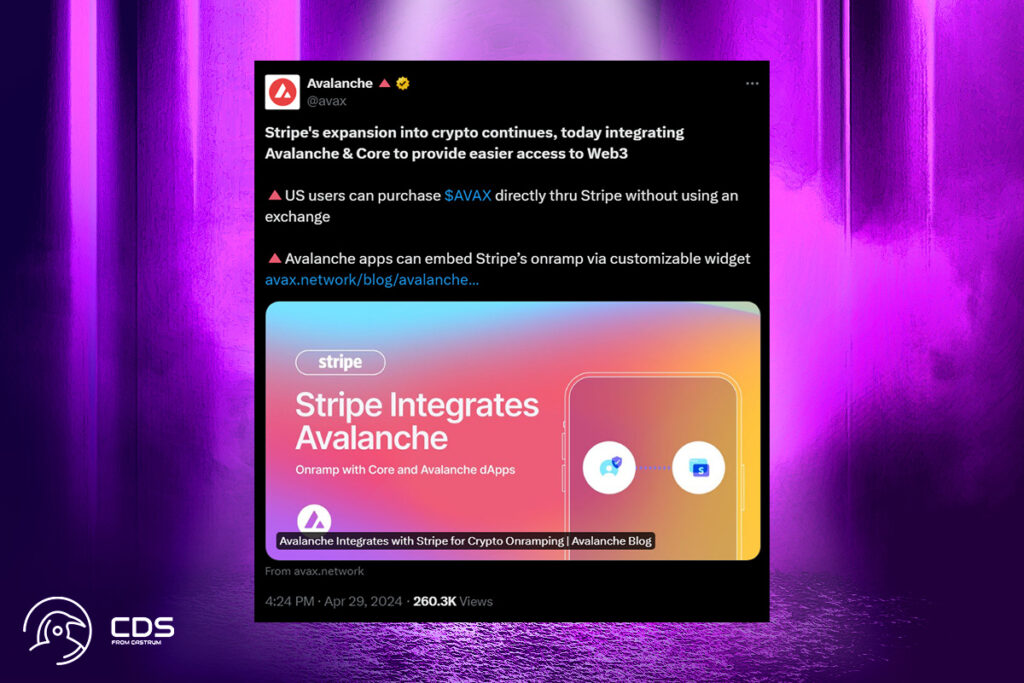

Avalanche to Get Support from Stripe as it Transitions from Fiat to Crypto

According to Ava Labs, the network developer, the Avalanche C-Chain network has linked with payment company Stripe, enabling verified Stripe users to purchase Avalanche’s token and send it to their wallets. The platform has also been integrated with eight Avalanche Web3 apps. The post claims that Avalanche app developers may now incorporate a configurable widget into their user interfaces that enables customers to use Stripe’s platform to convert fiat to cryptocurrency.

MicroStrategy Continues to Buy Bitcoin Despite Q1 Net Loss

In the first quarter of 2024, MicroStrategy recorded a net loss of $53.1 million, mostly as a result of a $191.6 million impairment loss on digital assets—a substantial increase over the same period the previous year. Revenue for the company dropped to $115.2 million from the same period in 2023, a 5.5% drop. The corporation bought an additional 214,400 Bitcoin in April at an average purchase price of $35,180, bringing its total holdings of the cryptocurrency to $13.5 billion.

BUIDL Beats BENJI to Become the World’s Largest Tokenized Treasury Fund

Overtaking Franklin Templeton’s comparable fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is now the biggest treasury fund tokenized on the blockchain. Based on data from Dune Analytics, BlackRock’s newly established BUIDL fund has surpassed the $368 million market value of the Franklin OnChain U.S. Government Money Fund (BENJI), which has been in existence for a year, with a market cap of $375 million.

Coinbase Announces Lightning Network Integration

Users now have the choice to send Bitcoin over the Bitcoin network or Lightning due to Coinbase’s support for the Bitcoin Lightning Network. Customers of Coinbase can transfer Bitcoin more quickly and affordably than with transactions on the Bitcoin blockchain by using the Lightning Network. However, Coinbase issued a warning on April 30 saying that in certain situations, a unique implementation or fee structure may allow Lightning transactions to fail or take many hours.

Leave a comment