Celebrating Bitcoin’s One Billionth Transaction: Milestone Achieved Amidst Scalability Debates and Market Resilience

Bitcoin (BTC), the leading cryptocurrency by market capitalization, has achieved a significant milestone with the processing of its one billionth transaction. This accomplishment underscores the enduring activity and expanding adoption of Bitcoin despite the volatile nature of the market.

The Bitcoin community, especially on social media platforms such as X (Twitter), is alive with jubilation. The fervor surrounding this milestone underscores its importance to investors and enthusiasts alike.

Looking Forward: Bitcoin Post 1 Billion Transactions

On-chain data has confirmed this historic event for Bitcoin. Clark Moody’s dashboard reveals that the total transaction count on the Bitcoin network has now surpassed 1,000,193,647. Furthermore, data from Swan indicates that the milestone of 1 billion transactions was reached at block height 842,241.

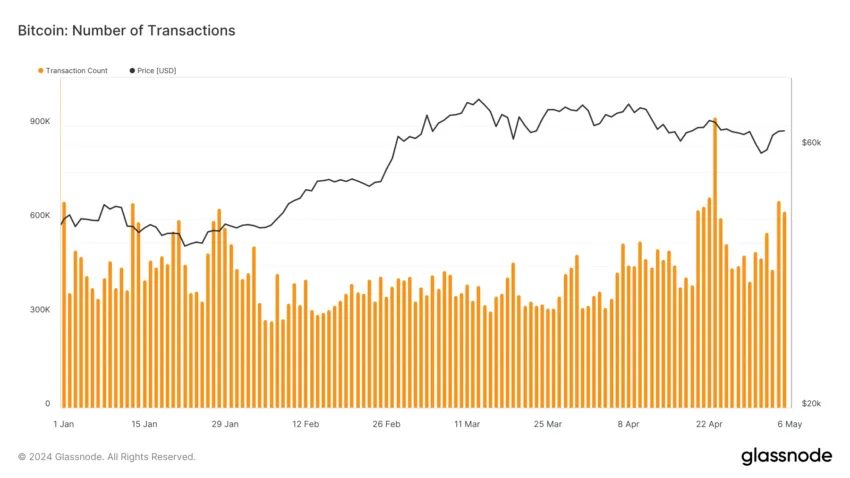

Recent data from Glassnode points to April 23 as the day with the highest number of Bitcoin transactions in 2024 thus far. On that day, 926,842 transactions were recorded, coinciding with Bitcoin’s price of $66,403. However, the transaction count for the previous day stood at 625,859, with Bitcoin priced around $64,000.

Despite reaching this milestone, discussions around Bitcoin’s scalability persist. Crypto analyst Colin Talks Crypto shared his insights, noting that challenges and potential scaling issues remain as Bitcoin continues to expand.

He anticipates that Bitcoin’s price could experience “euphoric blow-off tops,” resulting in significant congestion and a notable rise in transaction fees. Such circumstances could render transactions unaffordable for many, as fees might exceed the balances in over 90% of Bitcoin addresses, effectively rendering these balances unspendable.

Colin elaborated, stating, “It could also entail weeks or even months of waiting for the backlog of transactions to clear from the mempool. This is when I believe there’s a chance for change. […] Only when congestion and fees reach a point where most people are priced out of using the system will there be enough outcry to finally increase the block size. In my view, it may require conditions worse than the 2015-2017 transaction backlog and high fees to trigger this shift.”

Colin’s perspective underscores a pivotal debate within the Bitcoin community between ‘big blockers’ and ‘small blockers.’ While the former advocate for increasing the block size to accommodate more transactions and reduce fees, the latter resist such changes, prioritizing the preservation of decentralization and security.

Furthermore, Colin critiques the efficacy of the Lightning Network, a proposed solution for Bitcoin’s scalability issues, suggesting that it fails to address core concerns at the base layer.

As Bitcoin grapples with these challenges, the community remains divided on the optimal path forward. While some advocate for significant protocol changes to enhance scalability, others believe that the current infrastructure, including secondary layers like the Lightning Network, will evolve to meet demand while preserving the foundational principles of Bitcoin.

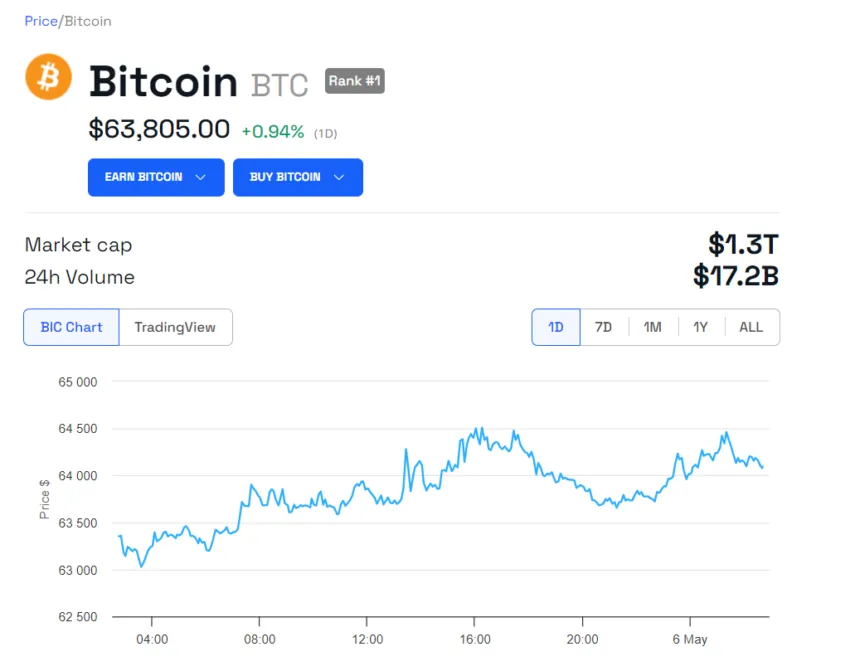

Amidst this new milestone, Bitcoin’s market performance continues to command attention. At the time of writing, Bitcoin is trading at $63,805, representing a 0.94% increase over the last 24 hours. This recent uptick follows a climb from below the $60,000 threshold, spurred by a favorable US labor report the previous Friday.

However, a recent report from Bitfinex suggests a potential period of price stabilization for Bitcoin, expected to last up to two months. This projected stability could offer a reprieve for the market, allowing users and developers to focus on long-term solutions for scalability and usability.

Leave a comment