BlackRock Leads $47 Million Investment in Securitize, Boosting Digital Asset Securities

BlackRock has taken the lead in a significant investment round, pouring $47 million into Securitize, a company specializing in the tokenization of real-world assets (RWA). This infusion of capital, announced on May 1, marks a pivotal moment in the advancement of digital asset securities.

Securitize intends to utilize this funding to drive product development, expand its global presence, and foster strategic partnerships across the financial sector. Among the investors participating in this round are Hamilton Lane, ParaFi Capital, and Tradeweb Markets, alongside notable entities such as Aptos Labs, Circle, and Paxos.

Carlos Domingo, co-founder of Securitize, expressed optimism about the transformative potential of blockchain technology, particularly in the realm of tokenization. “In our view,” Domingo remarked, “the transformative potential of blockchain technology to reshape the future of finance in general – and tokenization in particular – is promising.”

As a result of this investment, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, will assume a position on Securitize’s Board of Directors. Chalom emphasized BlackRock’s belief in the potential of tokenization to revolutionize capital markets infrastructure. “At BlackRock,” he stated, “we believe that tokenization has the potential to drive a significant transformation in capital markets infrastructure. Our investment in Securitize is another step in the evolution of our digital assets strategy.”

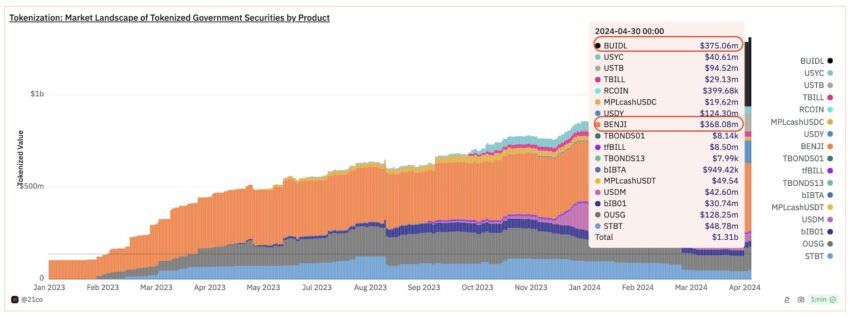

BlackRock’s collaboration with Securitize took a significant step forward in March with the launch of their inaugural tokenized fund on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This fund, designed to maintain a stable $1 value per token, distributes dividends directly to investors’ wallets on a monthly basis. By investing primarily in cash, US Treasury bills, and repurchase agreements, the fund aims to provide yield while ensuring liquidity on the blockchain.

Notably, BeInCrypto reported that BUIDL has become the world’s largest treasury fund tokenized on a blockchain as of May 1, surpassing Franklin Templeton’s Franklin OnChain US Government Money Fund in market capitalization. Since its launch just six weeks prior, BUIDL has garnered considerable market attention, with its market capitalization surging from $274 million to $375 million in April, representing an impressive 36.5% increase.

This surge in interest aligns with a broader trend towards debt-based, high-yield investments. As of April 26, the total value locked in tokenized real-world assets reached a record $8 billion, marking an almost 60% rise since February. These figures exclude fiat-backed stablecoins and encompass various assets, including commodities, securities, and real estate tokenization protocols.

Leave a comment