Crypto News – Bitcoin will experience a significant change in about two months, which will reduce the incentive for miners who successfully complete a block by half.

Grayscale Analysts Warn: Bitcoin Miner Revenues May Fall After Halving

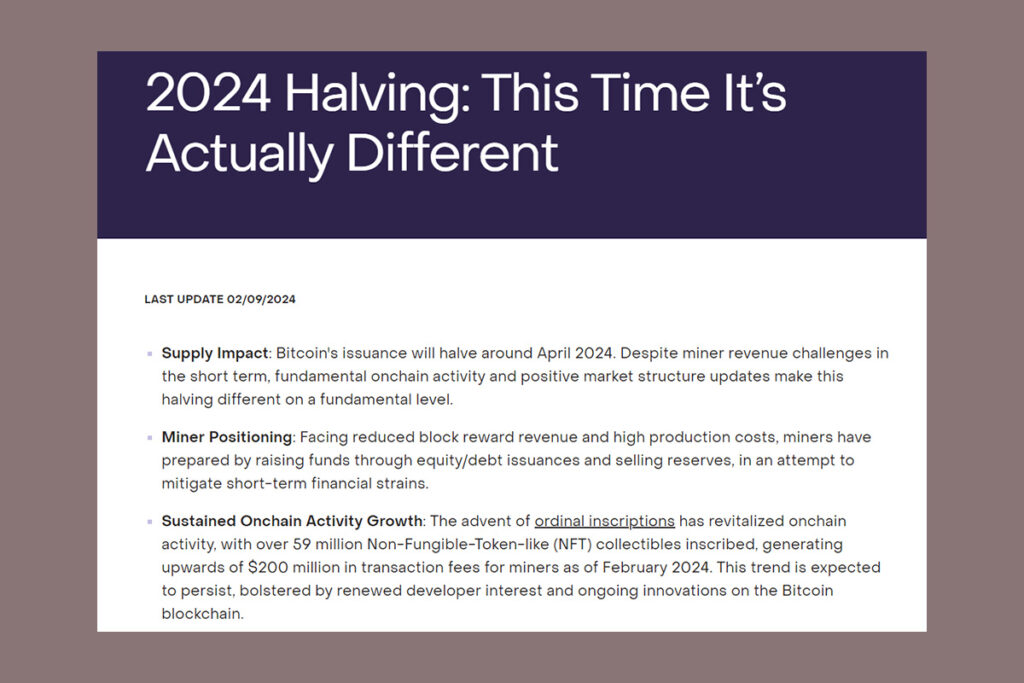

Often referred to as “the halvening” or “halving,” the event is viewed as bullish for Bitcoin because, in the past, multiple halvings have been followed by steady price increases. Grayscale researchers caution that a more comprehensive explanation for those price spikes than a straightforward stock and flow analysis is possible.

other cryptocurrencies with similar halving mechanisms, such as Litecoin… (have) not consistently seen price appreciation post-halving. This suggests that while scarcity does sometimes influence price, other factors also play a role,

the analysts

The analysts caution in their report that there is no assurance that prices will rise following a halving event. But since block rewards account for the majority of their income, it will pose a problem for Bitcoin miners. This year’s all-time high for the Bitcoin network’s mining difficulty combined with a drop in block rewards could put miners in a “tense position.”

Can Ordinals Be a Light of Hope for Miners?

Nonetheless, there is a bright side for miners. For miners, transaction fees associated with Ordinals activity on the Bitcoin chain have created a sizable income potential. To date, miners have received payment in excess of $200 million in transaction fees associated with Ordinals; as of now, Ordinals transactions account for 20% of miners’ total earnings.

Miners want more revenue, and Ordinals have brought about a renaissance on Bitcoin with massive demand for block space,

Bob Bodily, co-founder and CEO of Ordinals marketplace Bioniq

Leave a comment