Crypto News– Many cryptocurrency traders are eyeing the Bitcoin halving event in 2024 as a potentially transformative moment for the crypto market. However, analysts at Steno Research suggest that it could follow a buy the rumor, sell the news pattern.

The Bitcoin halving might trigger a ‘sell-the-news’ reaction

Bitcoin has undergone three halving events in its history, each reducing miner rewards: from 50 BTC to 25 BTC in 2012, then to 12.5 BTC in 2016, and finally to 6.25 BTC during the last halving on May 11, 2020.

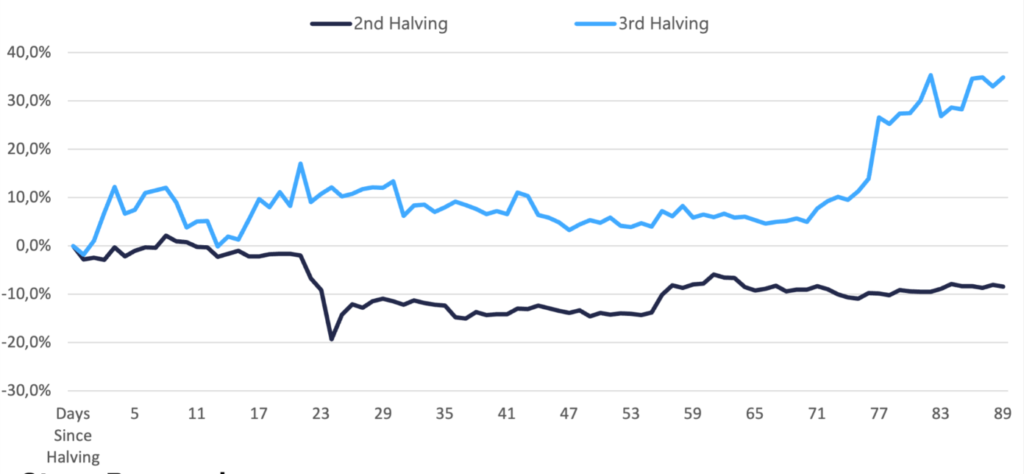

Steno Research points out that Bitcoin may replicate the selling pressure observed after the 2016 halving, which persisted for up to four months.

We anticipate the upcoming Bitcoin halving to be a short-term ‘buy the rumor, sell the news’ occurrence, echoing the pattern observed in 2016. This time, however, there is heightened anticipation among Bitcoin ETF holders.

Steno Research

Steno Research anticipates a rise in BTC’s value as the halving event approaches. Nonetheless, they suggest that within the initial 90 days following the halving, the value could potentially dip below its price at the time of the halving.

Steno Research analysts have drawn parallels between BTC’s price performance before and after the 2016 halving, suggesting that similar patterns may emerge with the upcoming event.

The report highlights that Bitcoin’s price remained below its pre-halving level throughout the entire 90 days following the halving. Steno Analyst Mads Eberhardt noted, Specifically, on the 90th day post-halving, Bitcoin was priced 8.4% lower than before the halving.

Data from CryptoQuant reveals that Bitcoin’s daily mining rewards have reached their highest level ever, coinciding with the cryptocurrency trading near its all-time high. This suggests that despite the upcoming halving reducing the number of BTC issued to the smallest amount yet, the value of this issuance in dollars will be substantial.

The report elaborates that with the current price hovering around $71,563, this reduction in daily mining rewards now equates to $224,512 worth of Bitcoin, compared to the $55,000 received by miners after the last halving.

Therefore, miners are expected to gradually sell all their Bitcoin over time to cover the expenses related to their mining activities, as highlighted in the report. This selling activity adds to the overall sell-side pressure, leading to a correction in the price of BTC in the months following the halving.

We believe the real bullish momentum of the halving will become apparent once the initial market adjustments have settled, and the weak hands – those investors who bought in anticipating quick gains, including some ETF investors – have exited.

Steno Analyst Mads Eberhardt

Leave a comment