Crypto News – Every Bitcoin halving in history has occurred a year or two prior to a new all-time high.

Bitcoin Halving from Past to Present: Why 2024 Halving Could Be Different from the Others?

This is partially due to the fact that halving potentially increases the scarcity of bitcoin by lowering the amount of new bitcoin issued by half and paying miners a block reward. According to some market experts, the three prior Bitcoin halvings happened during the run-up to an all-time high, which was followed by a price decline until the subsequent halving helped spark another rally. The impending halving, however, has reversed this pattern. In the short run-up to the halving, bitcoin reached an all-time high this month, surpassing $70,000 for the first time in its history. But how is this halving different from the others? To understand this, it is necessary first to take a look at the other three halvings.

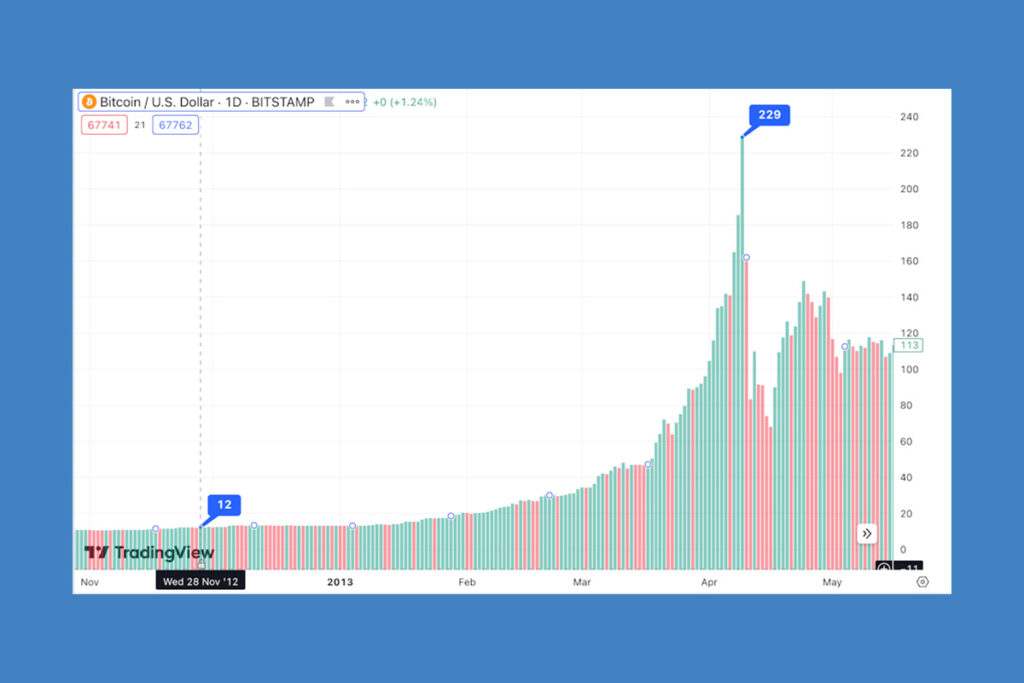

First Halving – November 28, 2012

The first halving of the Bitcoin network occurred over four years after the genesis block was mined. The emerging Bitcoin community wasn’t sure if prices would rise as a result of the supply slowdown or if the halving had already been priced in. According to TradingView, the price of bitcoin increased from about $12 in the run-up to the first halving in November 2012 to $229 by April 2013 and finally to over $1,132 by November of the same year.

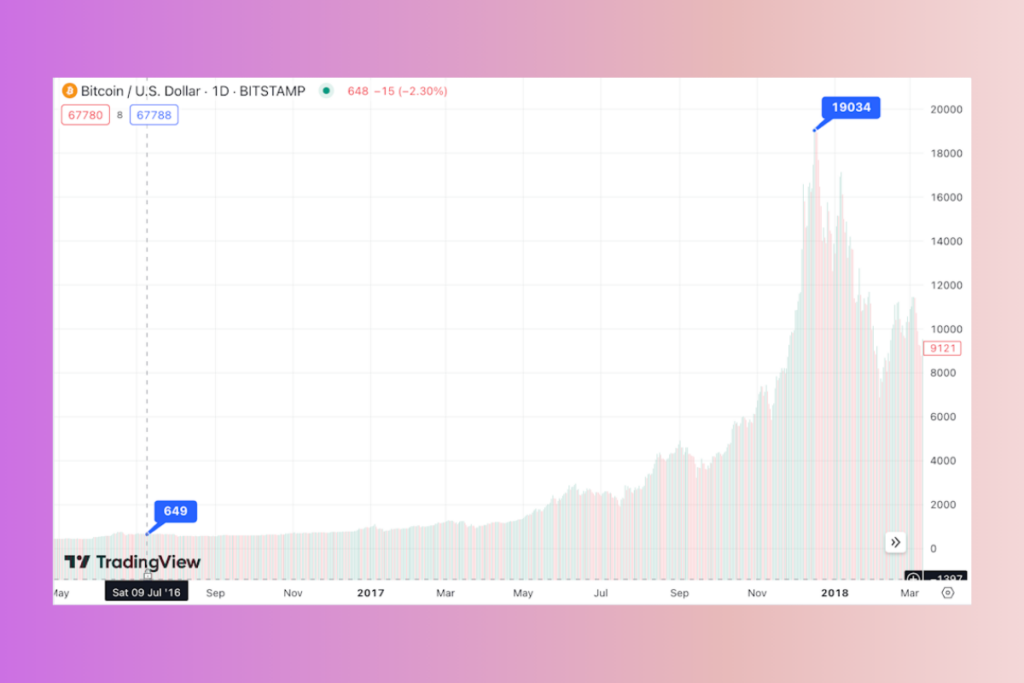

Second Halving – July 9, 2016

A plethora of new cryptocurrencies emerged in 2016. Regarding how the price of Bitcoin would be impacted by the second halving, Bitcoiners were divided. Following the second halving, the price of Bitcoin increased gradually for several months before gaining speed in May 2017. A year and a half after the halving, in December 2017, bitcoin reached a new high of about $19,188.

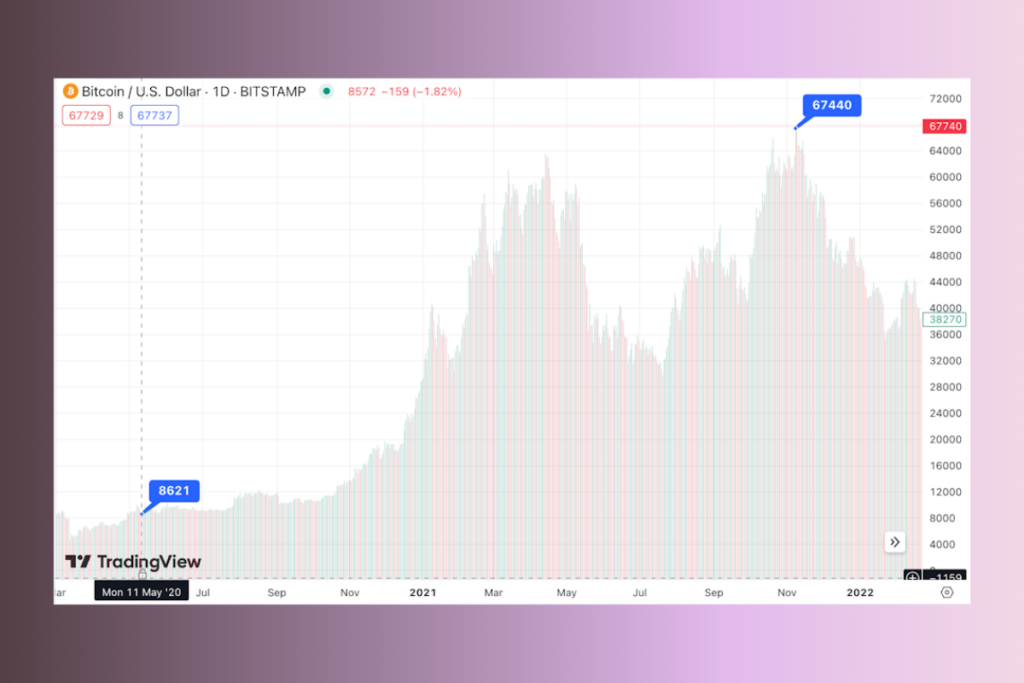

Third Halving – May 11, 2020

By the time of the third halving, Bitcoin had been around for more than ten years and had grown in popularity. After the May 2020 halving, the price of Bitcoin increased to almost $40,000 by January 2021. Before reaching a peak of $67,000 in November 2021—nine years after the initial halving—Bitcoin surpassed $63,000 in April.

Fourth Halving – April 2024

At this point, it seems pointless to wonder if the upcoming Bitcoin halving would cause a price run, but the situation is clearly different this time. Following the resolution of the ten-year battle to get the SEC to approve spot bitcoin ETFs in January, the price of bitcoin began an unabated rally that propelled it past $73,000. In the past, halvings have occurred when the price of bitcoin was far lower than its previous high; this is new ground.

%s Comment