The next Bitcoin halving is rapidly approaching, which means big changes for miners and the network itself.

Bitcoin Halving Clock Is Ticking: What You Need to Know About BTC Halving

This event cuts the reward miners get for adding new blocks to the blockchain in half. So, what does it really mean for the future of Bitcoin? Let’s dive in!

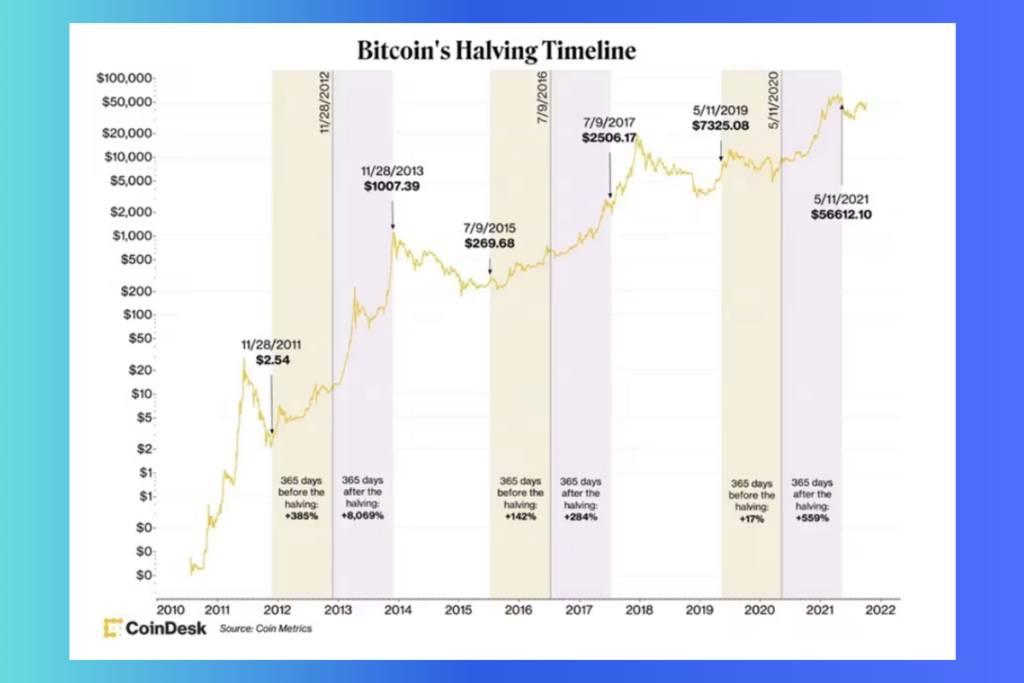

Bitcoin Halving History: A Look Back

We’ve already seen three halvings:

November 28, 2012: Rewards dropped from 50 BTC to 25 BTC per block.

- July 2016: Rewards fell further from 25 BTC to 12.5 BTC per block.

- May 2020: The most recent halving cut rewards to 6.25 BTC per block.

Why is this important? Bitcoin has a finite supply – only 21 million coins will ever exist. With over 19 million already in circulation, halvings slow down the release of the remaining coins.

Bitcoin Basics: A Quick Refresher

Bitcoin runs on a decentralized ledger called a blockchain – picture it like a giant, unchangeable record book.

This blockchain is maintained by nodes (computers) all over the world, making the network secure and resistant to tampering.

Want to join the fun? Running a node means downloading the entire Bitcoin blockchain (currently a whopping 551+ gigabytes!).

Bitcoin transactions get bundled into “blocks“.

Miners (people with powerful computers) race to solve complex puzzles to add those blocks to the blockchain.

Winners of this puzzle-solving race get rewarded with brand new bitcoins! This is how new bitcoins enter the system.

BTC Halving: Understanding the Impact

Bitcoin halvings are pre-programmed into the network’s code to control the release of new bitcoins.

These events happen roughly every four years.

The reward for miners? It gets slashed in half! This means less bitcoin created with each new block.

How Bitcoin Halving Impacts the Crypto Landscape

Bitcoin halvings are major events in the cryptocurrency world. Let’s break down what they are and why they matter:

The Clock is Ticking

Every 210,000 blocks mined triggers a halving. They’re supposed to happen roughly every four years, but faster or slower mining can change the timing. The next halving is predicted for April 20, 2024.

What Does This Mean for Bitcoin Miners?

The big question: will fewer rewards make BTC mining less profitable? Here’s what the experts say:

- Matthew Niemerg (Aleph Zero co-founder): Profitability hangs on factors like electricity costs, Bitcoin’s price, and the efficiency of mining equipment. Older tech might be in trouble.

- Sanjay Gupta (Auradine): Energy efficiency is even more crucial now. Without it, some miners won’t survive.

- Sukhveer Sanghera (Earth Wallet): DeFi and layer-2 solutions on Bitcoin offer new ways for miners to earn, keeping the network strong.

- The Silver Lining: While rewards shrink, the value of Bitcoin itself could rise after the halving, potentially offsetting the impact.

Understanding the Halving

When Will the BTC Halving Happen?

While April 20th is the target, the exact timing is tricky. Bitcoin block production is intentionally a bit random. Here’s why:

Carlos Mercado (Flipside Crypto): Simulations show April 20th is most likely, but fluctuations make a precise date impossible to predict.

Satoshi Nakamoto’s Design: Bitcoin adjusts its difficulty to keep block creation times roughly consistent as more miners join the network. This prevents all 21 million coins from being released too quickly.

The Difficulty Adjustment: Every 2,016 blocks, Bitcoin checks past mining speeds and tweaks the puzzle complexity. Faster mining means harder puzzles, and vice versa.

What Halving Means for the Crypto World

The halving’s impact is a hot debate in the crypto community. Reduced miner rewards could change the mining landscape, forcing upgrades and potentially impacting Bitcoin’s price.

Anticipated Bitcoin Halving Set for April 20

The upcoming Bitcoin halving event, projected to occur on April 20, continues to be a topic of significant interest within the crypto community. This event, occurring approximately every 210,000 blocks, reduces the rewards for miners by half. As Bitcoin’s fourth halving at block height 840,000 approaches, miners will see their rewards decrease from 6.25 BTC ($259,000) to 3.125 BTC ($129,500).

Countdown Uncertainty and Simulations

With 12,510 blocks remaining, the precise date for reaching this block height remains uncertain. Various countdown websites provide different estimates, ranging from April 11 to April 21. Carlos Mercado, a data scientist at Flipside Crypto, conducted 500 simulations of Bitcoin block times, suggesting a likely alignment with the Super Bowl for cannabis enthusiasts.

Regulated Randomness in Bitcoin Block Times

The Bitcoin network’s design ensures that blocks are not solved too quickly, regardless of the number of active miners. Despite an increase in miners and hash rate, the network maintains a balance to prevent blocks from being mined too rapidly. Satoshi Nakamoto‘s intention was to distribute the 21 million bitcoins over an extended period, potentially exceeding a century.

Dynamic Difficulty Adjustments

Miners contribute computing power (hash rate) to solve blocks, and Bitcoin adjusts the difficulty level every 2,016 blocks to control production rates. This adjustment ensures that if blocks are produced faster than expected, the difficulty increases, and vice versa. Mercado emphasizes the significance of this adjustment, stating, The bitcoin hash rate is the defining factor, but the difficulty adjustment every 2,016 blocks is a wholesale shift in how effective the hash rate is.

Uncertainty Persists in Real-Time Block Production

Despite Bitcoin adding 147 blocks per day over the past year, the difficulty adjustment indirectly influences block mining times. The real-time outcomes remain highly unpredictable, with blocks discovered within seconds or, conversely, delayed by over an hour, as observed in a recent block mined earlier this week with no transactions processed during that period.

Bitcoin’s Post-Halving Trajectory: BTC Opinion from Four Experts

As the highly anticipated Bitcoin halving event approaches in April, experts weigh in on the potential impact on the cryptocurrency‘s future trajectory. Analysts project a target price range of $150,000 to $200,000 by the middle of the next year, sparking discussions within the crypto community about the market’s readiness for the halving’s effects.

Year of the Dragon Ignites Bitcoin’s Momentum

Dubbed the Year of the Dragon, Bitcoin is poised for significant developments, fueled in part by the impending halving event scheduled for April. The halving occurs approximately every four years, signaling a shift in the rewards miners receive for creating new blocks on the network. This event effectively reduces the daily supply of newly minted Bitcoin entering the market.

Halving’s Impact on Bitcoin’s Value

Scheduled for mid-April, the upcoming halving will witness a reduction in miner rewards from 6.25 Bitcoin to 3.125 Bitcoin. The scarcity resulting from fewer Bitcoins in circulation suggests a potential rise in the asset’s value due to increased demand.

Divided Perspectives among Experts

Despite the consensus on the halving’s significance, research institutions, seasoned experts, and analysts present varying viewpoints. Some argue that Bitcoin has already entered a phase leading to new all-time highs, while others see the halving as a pivotal catalyst for substantial growth in the coming year and beyond.

Insights from Bernstein Analysts

Traditionally, Bitcoin has experienced surges in value following previous halving events. However, Bernstein analysts note a unique blend of factors influencing price dynamics ahead of the upcoming halving. Heightened demand from exchange-traded funds (ETFs) and the anticipated supply squeeze resulting from the halving contribute to the current market dynamics.

The analysts at Bernstein predict Bitcoin to reach a cycle high of $150,000 by mid-2025, with expectations of touching all-time highs in 2024. Notably, Bitcoin achieved a record high of nearly $69,000 in November 2021.

Successful Launch of Spot Bitcoin ETFs

Adding to the discussion, DL News reported on Tuesday that the launch of spot Bitcoin exchange-traded funds in the United States this year has marked a historic success in the ETF space. This achievement further adds to the complexities influencing Bitcoin’s price dynamics, reinforcing the multifaceted nature of the cryptocurrency market.

Anthony Scaramucci Foresees Bitcoin Surpassing $170,000 Post-Halving

Anthony Scaramucci, the founder of Skybridge Capital, confidently predicts a substantial surge in Bitcoin’s value following the upcoming halving event in April. Scaramucci initially shared his forecast with Reuters in January, stating that by multiplying the price on the day of the halving by four, Bitcoin could reach $170,000 or higher within the next 18 months. During an interview on The Wolf of All Streets podcast, Scaramucci elaborated, indicating a conservative starting point of $35,000 at the halving.

As Bitcoin recently breached the $50,000 mark, Scaramucci’s calculation could potentially lead to a $200,000 valuation by July 2025 if the current price holds during the halving in April. Expressing a long-term perspective, Scaramucci envisions Bitcoin achieving half the market capitalization of gold, potentially reaching around $6.5 trillion in total circulation, a significant leap from its current valuation of approximately $1 trillion.

Grayscale’s Michael Zhao Cautions Against Assured Post-Halving Gains

Michael Zhao, a research analyst for Bitcoin ETF provider Grayscale, issues a cautionary note regarding the anticipated price increase post-halving. He emphasizes that the surge is not guaranteed, challenging models linking scarcity to price gains. Zhao points out that historical observations, such as those from Litecoin’s halving events, indicate that scarcity alone doesn’t guarantee price increases. Instead, broader economic conditions and events, like the European debt crisis in 2012 or the economic stimulus during the 2020 Covid-19 pandemic, have significantly impacted Bitcoin’s value.

Zhao highlights the importance of considering macroeconomic factors and investor sentiment alongside the scarcity narrative to understand Bitcoin’s price dynamics thoroughly.

SynFutures CEO Rachel Lin: Halving Alone Unlikely to Trigger Full-Fledged Bull Run

Rachel Lin, co-founder and CEO of SynFutures, a decentralized derivatives trading platform, offers a pragmatic perspective on the halving’s impact. While acknowledging that the halving supports the markets by introducing an anti-inflationary measure and making mining new BTC more challenging, Lin argues that it is unlikely to drive a comprehensive bull run.

In her editorial published in Fortune on January 26, Lin emphasizes that, in the absence of substantial crypto adoption, the halving alone may not be sufficient to propel Bitcoin back to its peak of nearly $69,000, let alone surpass it. She underscores the importance of considering broader market dynamics and adoption trends in assessing Bitcoin’s future trajectory.

Bitcoin’s Fourth Halving: Understanding Implications for Investors

In the imminent month of April, Bitcoin is poised for its fourth halving event, a pivotal occurrence that transforms the supply dynamics of the cryptocurrency. Historical trends indicate that such events are intricately linked to subsequent price surges not only for Bitcoin but also for the broader crypto space. This discussion delves into the concept of a Bitcoin halving, its potential impact on prices, and what investors should consider in light of this significant event.

What is a Bitcoin Halving?

A Bitcoin halving occurs when the rate of new bitcoins entering circulation is reduced by half, happening approximately every four years. This cyclical schedule is projected to continue until the last bitcoin is mined around the year 2140, with the total supply capped at 21 million BTC. Conceived by Bitcoin’s creator(s), this mechanism aims to enforce scarcity and deflationary characteristics, aligning with the idea that growing adoption of the Bitcoin network will consistently drive up the asset’s value. In essence, Bitcoin’s monetary policy is designed as a counterweight to fiat money, maintaining scarcity where traditional currencies tend to devalue over time.

Significance of the 4th Bitcoin Halving for Investors

Impact on Bitcoin Price:

Historically, each halving event has preceded substantial price rallies in Bitcoin. The continuous growth in Bitcoin adoption, coupled with its deflationary circulation, has resulted in price increases after each halving. While past performance does not guarantee future results, recognizing the potential implications of a disinflationary asset with growing adoption is crucial.

BTC Market Sentiment and Speculation:

Anticipation of the halving can fuel increased interest in Bitcoin, leading to speculation and the potential for a “sell the news” event. A parallel can be drawn to the surge in prices preceding the approval of U.S. spot bitcoin ETFs in January, where a subsequent sell-off occurred after approval. Investors should remain vigilant regarding market sentiment and speculative trends leading up to the halving to strategically position themselves.

Understanding the Long-Term Bitcoin Investment Perspective:

Taking a long-term view over five or ten years, the impact of Bitcoin halvings on supply becomes even more compelling. Beyond the excitement of short-term price spikes, the true value lies in the enhanced scarcity of the asset. Considering that broad retail and institutional access to Bitcoin has only recently been facilitated with the approval of spot bitcoin ETFs, the potential for future demand over the coming years is significant.

Final Thoughts on Bitcoin Halving:

The forthcoming Bitcoin halving is anticipated to significantly alter the circulating supply of Bitcoin. While short-term price appreciation is expected, the real emphasis lies in the collision of Bitcoin’s programmed scarcity with growing demand and increased utilization of the Bitcoin network, especially with the recent expansion of access through spot Bitcoin ETFs.

- all-time highs

- Bernstein analysts

- Bitcoin

- Bitcoin block

- Bitcoin entering

- Bitcoin halvings

- Bitcoin's price

- block mining

- blockchain

- BTC

- cryptocurrency

- DeFi

- DL News

- ETFs

- fiat money

- fourth halving event

- Grayscale

- halving

- hash rate

- Layer-2 solutions

- Michael Zhao

- nodes

- price rallies

- Rachel Lin

- sell the news

- SkyBridge Capital

- Spot Bitcoin ETFs

- SynFutures

Leave a comment