Crypto News – The incentives given to miners have officially decreased from 6.25 Bitcoin per block to 3.125 Bitcoin following Saturday’s Bitcoin halving. Experts are already focusing on where Bitcoin might be at the next halving in 2028, though.

What Will the Price Be in the 2028 Bitcoin Halving, According to Crypto Analysts?

Although miners receive a lower payment for their efforts to secure the network, many observers believe that halving events signal major gains in the price of Bitcoin. The lead analyst of Swyftx, Pav Hundal, forecasted a price gain of at least 100% by the 2028 halving, putting Bitcoin at or near the $120,000 mark, based on the market movement that followed previous halvings.

We’ve gone from trough to peak price gains of more than 60,000% in 2013, to 12,000% in 2017, and then 2,000% in 2021. Our central scenario is for this trend to continue and to see a high double, or low triple digit percentage point increase in price by the next halving.

Hundal

Henrik Andersson, the chief investment officer of the Australian cryptocurrency investment business Apollo Crypto, has a slightly more optimistic outlook, estimating that Bitcoin will peak at roughly $200,000 before 2028. According to Andersson, the eleven newly authorized spot Bitcoin ETFs in the US would contribute to a broader institutional adoption of Bitcoin, which would support the price movement of the cryptocurrency.

Growing Concerns About The Next Halving

But there are still issues surrounding this Saturday’s Bitcoin halving and the one that will occur in 2028. The main one is that miner incentives can be lowered to the point where mining Bitcoin becomes unprofitable over time.

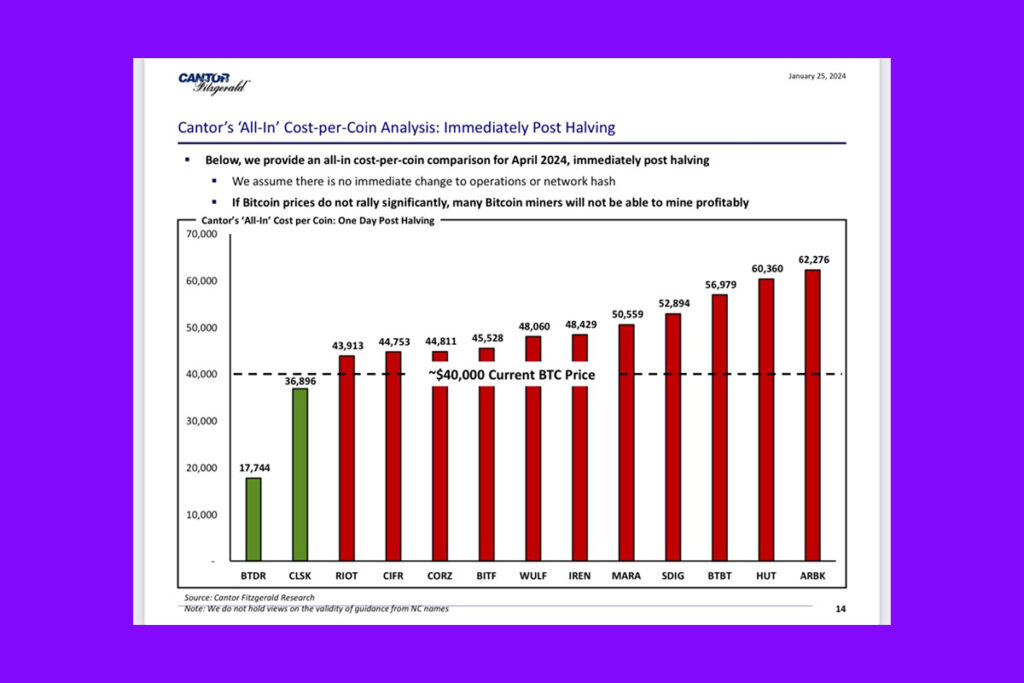

In research published on January 26, Cantor Fitzgerald stated that in order for the majority of publicly traded Bitcoin mining companies to continue operating in the long run, the price of Bitcoin would need to remain stable above $40,000. For most miners, this is not a problem at the present price. But if Bitcoin dropped below $40,000, that may raise questions about valuation.

Leave a comment