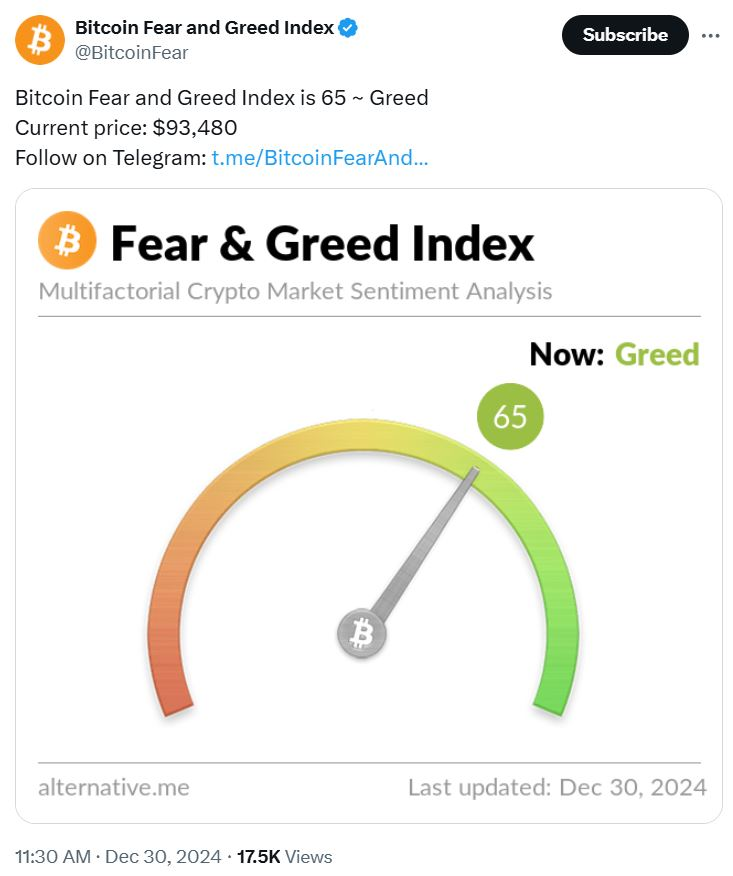

Crypto Fear Greed Index- Bitcoin’s 2024 Slump Pushes Crypto Sentiment into Greed Zone

The Crypto Fear Greed Index, a popular gauge of market sentiment for Bitcoin and the broader cryptocurrency market, has fallen back to October levels after a downturn in Bitcoin’s price in the final days of 2024. As of the latest update on December 30, the index sits at 65, indicating a sentiment of “greed” but still the lowest reading since October 15.

Bitcoin Price Drops Amid Volatility

According to CoinGecko, Bitcoin’s price has dropped to around $93,000, marking a 13.7% decrease over the past 12 days. Traders are cautious, with some predicting a significant “huge dump” of Bitcoin as many investors flock to stablecoins in response to recent volatility. Despite the slump, Bitcoin remains a popular asset with high market sentiment, evidenced by the Crypto Fear & Greed Index staying above 70 for much of November and December.

November and December Sentiment Surge

The Crypto Fear & Greed Index experienced a strong surge through November and December, particularly after the U.S. presidential election, where pro-crypto politicians gained ground in both the Senate and House of Representatives. The index hit its peak on November 22, scoring 94, indicating extreme greed. The index tracks various factors such as Google Trends, market momentum, social media signals, and volatility, all of which played a role in the market’s positive outlook during this period.

Analysts Predict Increased Volatility in 2025

Markus Thielen, head of research at 10x Research, in his December 29 report, noted that while some analysts were predicting a “timed parabolic move” leading up to the inauguration of President-elect Donald Trump, he expects “volatility to increase soon.” Thielen suggests that the market will likely experience heightened fluctuations as Bitcoin adjusts to changing political and economic conditions.

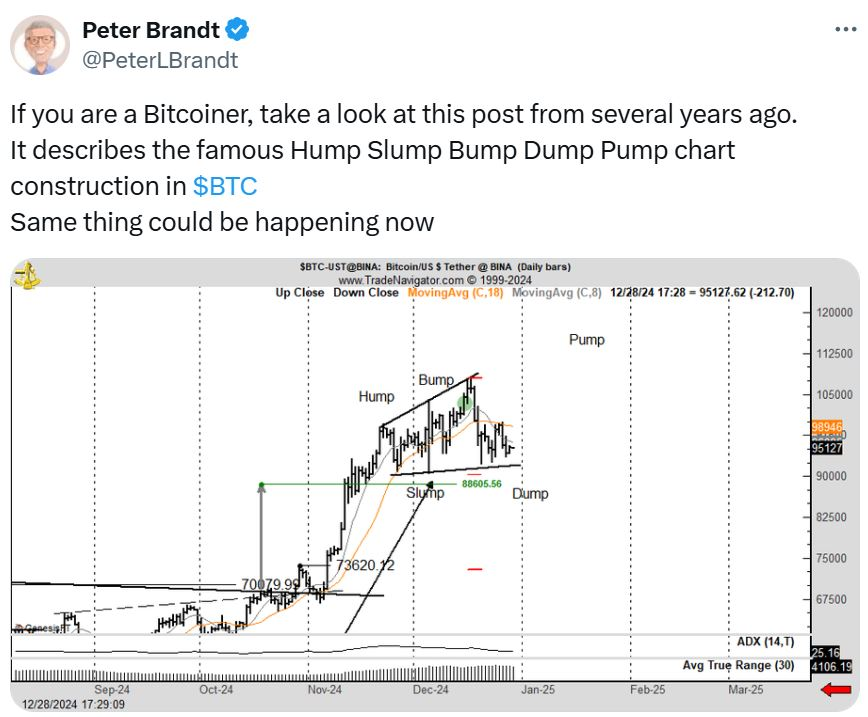

Bitcoin’s Pattern: Slump, Dump, and Rebound?

Veteran trader Peter Brandt speculated on December 28 that Bitcoin might follow a “Hump Slump Bump Dump Pump” pattern in the near future. This pattern suggests an initial rise (hump), followed by a decline (slump), a recovery (bump), another drop (dump), and a final rebound (pump). CryptoQuant’s CEO Ki Young Ju echoed Brandt’s assessment, agreeing with the potential for this pattern to unfold as the market grapples with increased volatility.

Bitcoin’s Long-Term Performance Remains Strong

Despite recent volatility, Bitcoin continues to outperform traditional assets over the long term. According to Prem Reginald, a blockchain researcher at CoinGecko, Bitcoin was the best-performing asset of the last decade, outperforming traditional assets by over 26,000%. In 2024 alone, Bitcoin saw a 129% return, surpassing gold, which posted a 32.2% return, and the S&P 500, which had a 28.3% return. This highlights Bitcoin’s dominance as a top-performing asset despite recent fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment