Featured News Headlines

Chainlink Price Analysis: 50% Weekly Gains Signal Potential $46 Target

Chainlink’s remarkable price surge has captured market attention this week, with the token soaring over 50% amid significant whale accumulation and groundbreaking institutional partnerships.

Chainlink Hits 7-Month High Amid Massive Rally

Chainlink (LINK) reached an impressive $24.28 on Wednesday morning Asian time, marking its highest level in seven months. The cryptocurrency has delivered exceptional returns with weekly gains exceeding 50% and an astronomical 123% surge from its yearly low. This dramatic price action has pushed Chainlink’s market capitalization beyond the $16.4 billion threshold, cementing its position among top-tier digital assets.

The token’s performance stands out in a market often characterized by volatility and uncertainty, demonstrating strong underlying fundamentals driving sustained investor interest.

Whale Wallets Drive Accumulation Trend

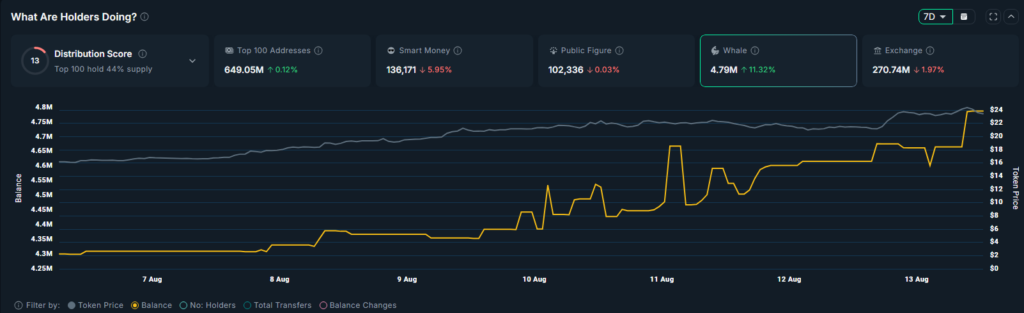

Data from Nansen reveals compelling evidence of institutional-level buying pressure. Whale addresses have increased their LINK holdings by 8.5% over the past seven days, now controlling 4.65 million tokens compared to 4.29 million recorded on August 6th. This represents a significant jump from the 3.42 million tokens held by whales in mid-May.

Such accumulation patterns typically signal bullish sentiment among sophisticated investors, often preceding additional price appreciation. The consistent buying from deep-pocketed market participants suggests confidence in Chainlink’s long-term value proposition and technological capabilities.

Swift Integration Marks Institutional Breakthrough

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) has achieved a major milestone through integration with Swift, the international banking network serving over 11,500 financial institutions worldwide. This partnership enables traditional banks to interact directly with blockchain networks using existing infrastructure.

The successful trial involved prestigious institutions including Euroclear, Clearstream, ANZ, Citi, BNY Mellon, BNP Paribas, Lloyds Banking Group, and SIX Digital Exchange. Additionally, Chainlink recently partnered with Intercontinental Exchange, NYSE’s parent company, to provide real-time pricing feeds for foreign exchange and precious metals markets.

Technical Analysis Points to Further Upside

LINK’s weekly chart displays a multi-month ascending broadening wedge pattern with confirmed double-bottom formation at $10.9. The breakout above the $18 neckline historically indicates bullish reversal potential. With the 50-day moving average positioned above the 200-day, medium-term trends remain favorable.

Analysts project potential movement toward $40 (representing 65% upside) or even $46 if current momentum sustains through continued institutional adoption and trading activity.

Comments are closed.