CAKE Rally Stalls: Is a Big Rebound Coming?

Bulls in PancakeSwap (CAKE) have done well to push prices upward over the last two weeks, but they were unable to hold the $2.55 support. The 1-day chart showed a fair value gap as a result of the significant gains made on March 17.

The range formation, the liquidation heatmaps, and this FVG all provided clues about support levels where a bullish reversal would occur. Moreover, since the beginning of 2025, PancakeSwap has been trading in a range structure. It ranged from $1.37 to $2.94, with the mid-range amount at $2.16, and was indicated in purple.

PancakeSwap Bulls Struggle as Liquidity Clusters Signal Key Support Levels

The highs in the $2.94 region and perhaps the round number resistance at $3 were anticipated to be tested by CAKE. But on the weekend, the bears forced a rejection at $2.85. Additionally, a significant fair value difference was left behind by the price change, indicated in white. A move below the mid-range support at $2.16 was probable in the upcoming days due to the decline below the $2.55 support.

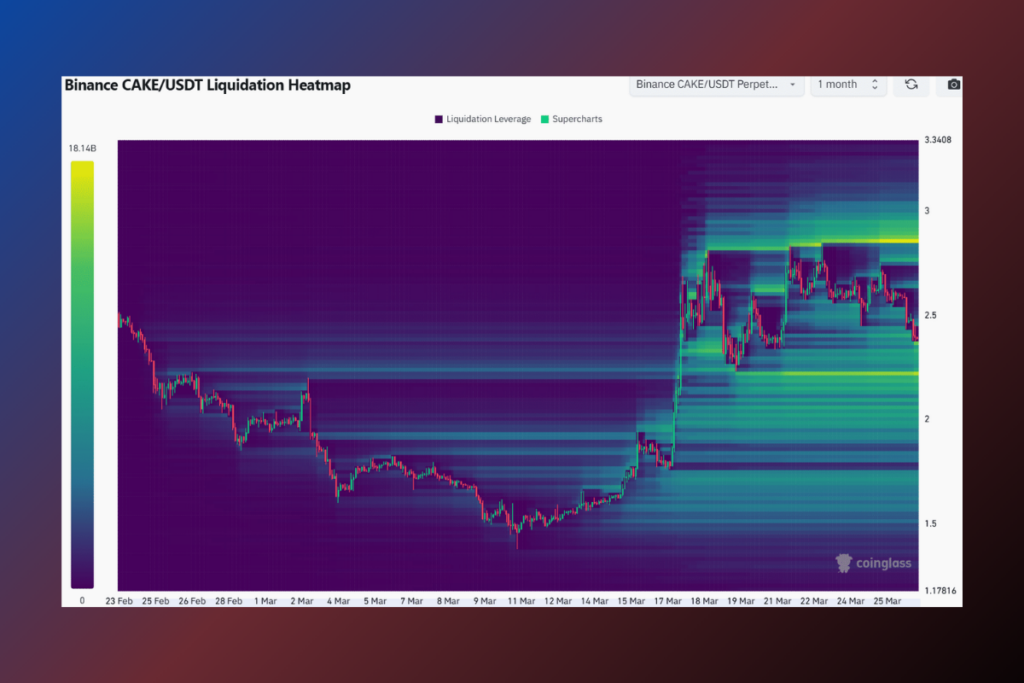

The short-term range that CAKE had developed between the $2.22 and $2.84 levels within the previously described 3-month range was depicted in the 1-month liquidation heatmap. A cluster of liquidity was visible on the heatmap around $2.36, which is somewhat less than the current market price. The heatmap showed another liquidity pocket at $2.22. Consequently, a positive reversal could occur at these levels.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment