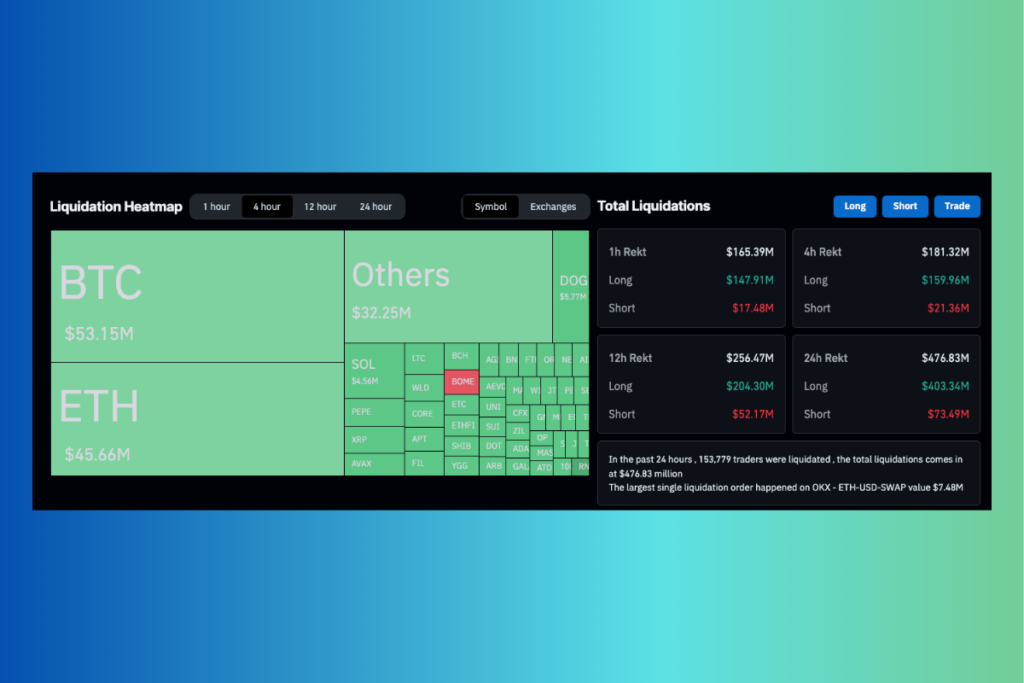

Crypto News – In less than two hours, traders with leveraged exposure to Bitcoin and other cryptocurrencies lost over $165 million due to a rapid 5% decline in the price of the cryptocurrency on Tuesday.

BTC Price Sudden Crash: 5% Fall Causes Leveraged Traders to Lose $165 Million

According to TradingView statistics, on April 2, Bitcoin fell 5% from $69,450 to as low as $65,970 in less than 30 minutes.

Over $165 million in leveraged positions were lost during Bitcoin’s steep decline, according to statistics from Coinglass. The majority of this amount was made up of more than $40 million in Ether longs and just over $50 million in Bitcoin longs.

Impact of BTC’s Decline on the Market

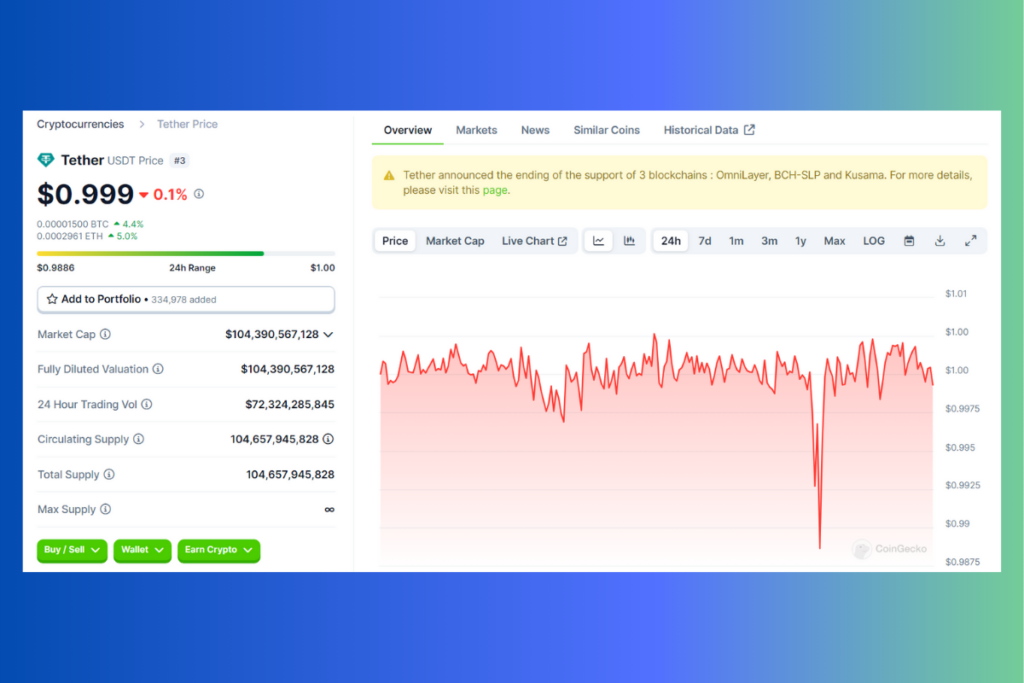

Following Bitcoin and Ethereum, almost $6 million in long Dogecoin holdings and $4 million in Solana positions were liquidated. According to FarSide statistics, Bitcoin ETFs reported a net outflow of $86 million at the same time as the dip, ending a four-day positive inflow streak. According to CoinGecko data, Tether‘s value fluctuated roughly 1% during the same period as the Bitcoin flash crash, momentarily dropping from its $1 peg to $0.988. In summary, this sudden drop affected not only Bitcoin investors, but also many people and assets that are actively present in the market.

Leave a comment