BTC Price Surge Explained: Key Support at $100,000

BTC Price Hits $101,714 – Bitcoin (BTC) has witnessed a significant surge over the past week, crossing the $100,000 threshold and settling at $101,714. This represents a notable 9% increase in value, a strong indicator of the cryptocurrency’s resilience after several weeks of consolidation. However, despite the recent growth, investor sentiment remains cautious, with some fearing that short-term holders could trigger a market correction.

Bitcoin’s Recent Price Surge and Market Resilience

Bitcoin’s climb above the $100,000 mark is a noteworthy event in the cryptocurrency market. After a period of relative stagnation, the digital asset has shown impressive growth, signaling potential for a broader rally. The 9% weekly growth reflects Bitcoin’s resilience, especially in the face of challenging market conditions. Despite this progress, the market remains cautious, with many investors wary of the potential for a pullback due to profit-taking activities.

Over the last few weeks, Bitcoin had been consolidating, moving sideways before this recent jump. This consolidation phase had created an environment where traders and investors were uncertain about the next big move. Now, as Bitcoin pushes past $100,000, a new phase of growth could be on the horizon. However, several risk factors remain in play that could influence the digital currency’s near-term trajectory.

Muted Investor Sentiment Despite Bitcoin’s Price Surge

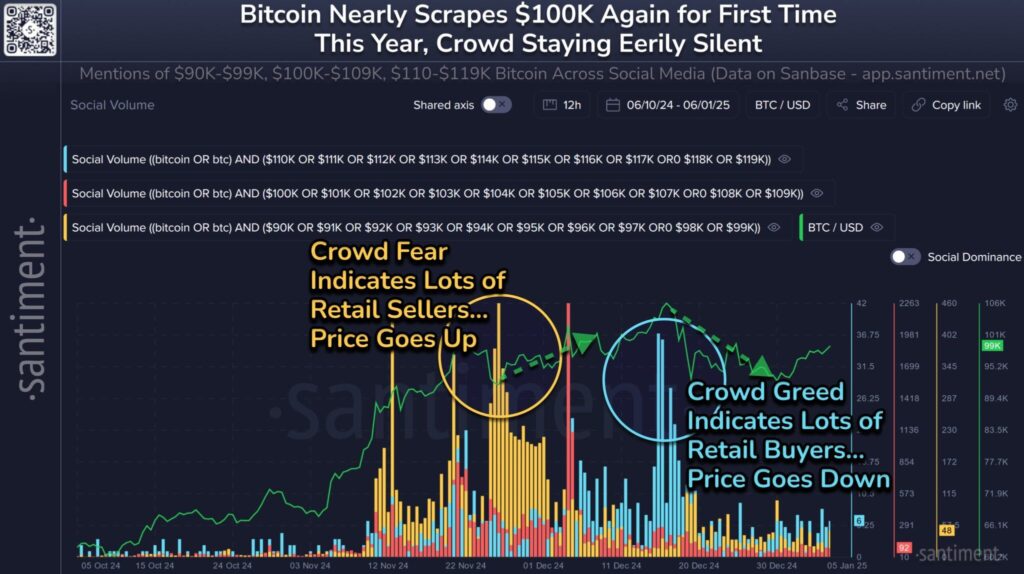

In contrast to previous price milestones, Bitcoin’s crossing of the $100,000 threshold has not been met with widespread enthusiasm. Social media platforms, typically a hotbed for euphoria during bullish periods, have shown relatively muted reactions this time around. This is in stark contrast to previous instances where such price points often led to extreme optimism or pessimism, signaling strong market moves.

Currently, Bitcoin investors seem to be taking a more measured approach. There has been no major influx of retail buying or panic selling, signaling that market participants are not rushing in with extreme emotions. This cautious outlook is shared by both seasoned investors and retail traders, suggesting a more prudent approach to market conditions. This relative quietness could either point to market indecisiveness or an underlying sense of caution as traders wait for clearer signals.

The Role of Short-Term Holders and Profit-Taking Risks

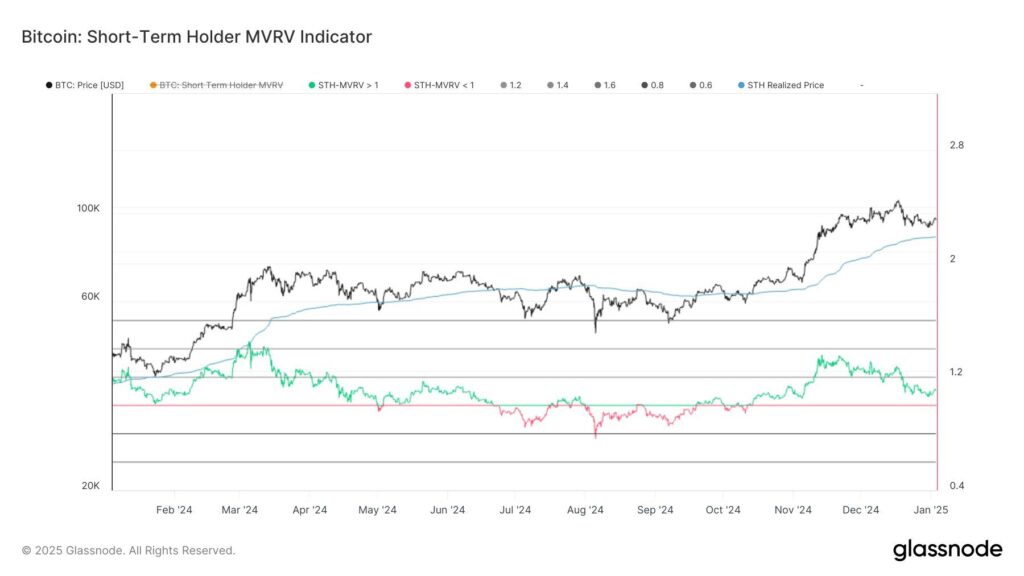

A key area of concern in the current market is the behavior of short-term holders (STHs). These investors, who have recently bought Bitcoin, are now sitting on substantial profits. The short-term holder MVRV ratio, which measures the average profit or loss of these holders, is currently showing a 10% profit. Historically, when STHs are in profit, they have been quick to sell at signs of gains, potentially contributing to market volatility.

The MVRV ratio is a useful tool for understanding market sentiment, as it highlights whether short-term holders are likely to take profits. If the ratio continues to rise, the likelihood of a sell-off increases, as profit-taking by these holders could trigger a market correction. However, the broader market still shows resilience, with long-term investors holding their positions and mitigating the potential for a significant downturn.

The balance between long-term holders and short-term sellers will be crucial in determining the next move for Bitcoin. If the short-term holders begin to liquidate their positions, it could lead to a sharp drop in prices, creating a self-fulfilling correction. Conversely, if they decide to hold, it could bolster the market’s upward momentum.

Bitcoin Price Outlook: Support at $100,000 and Potential for Further Gains

As of now, Bitcoin is trading at $101,714, a critical level above the psychological $100,000 mark. If Bitcoin can maintain $100,000 as a support floor, there is a potential for further upward movement, possibly targeting the next price level of $105,000. The ability to hold $100,000 as support would solidify the market’s bullish sentiment and pave the way for new highs in the near future.

However, failure to maintain this support could trigger a correction, with potential downside targets around $95,668. If Bitcoin falls below $100,000, it could negate the recent bullish momentum and result in a reversal that erases a significant portion of the recent gains. This would dampen investor enthusiasm and shift the market into a more cautious stance.

Key Takeaways: Is a Bitcoin Sell-Off Imminent?

Bitcoin’s recent price action, crossing the $100,000 mark, has drawn attention to the cryptocurrency market’s potential for further gains. However, investor sentiment remains cautiously neutral, with short-term holders potentially posing a risk of profit-taking. The MVRV ratio suggests that these holders may soon look to sell, which could create downward pressure on Bitcoin’s price.

For Bitcoin to continue its upward trajectory, it is crucial that the $100,000 level holds as support. If this key level is secured, Bitcoin could aim for new highs above $105,000. However, failure to maintain this support could lead to a correction, with the possibility of revisiting lower levels around $95,668.

In summary, Bitcoin is at a critical juncture, with the potential for both upside and downside movements. The next few days and weeks will be crucial in determining whether Bitcoin can maintain its momentum or whether short-term profit-taking will cause a market pullback. Investors and traders alike will need to stay vigilant as the market unfolds.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment