Bitfinex Suggests Bitcoin Might Have Hit its Local Bottom

Bitfinex Suggests– After experiencing a significant sell-off in June, Bitcoin might have hit a possible low point, according to a recent report from analysts at Bitfinex exchange.

Bitcoin’s price dropped below the 120-day range on July 3, hitting as low as $53,219 amidst rising concerns linked to the commencement of Mt. Gox creditor repayments and other issues.

Bitfinex analysts suggested on July 8 that Bitcoin could have reached a local bottom based on weekend market data, despite the pending distribution of 94,457 BTC—roughly 67% of the total BTC repayments for creditors.

Bitfinex also noted that the decline in BTC was partly influenced by the German law enforcement agency Bundeskrimanalamt (BKA) selling Bitcoin on exchanges, triggering high-volume sales from various investor types.

According to Bitfinex, there are several factors indicating that Bitcoin’s downward trend may soon stabilize.

A mere 4% of BTC transactions since 2023 were attributed to sales by the U.S. and Germany

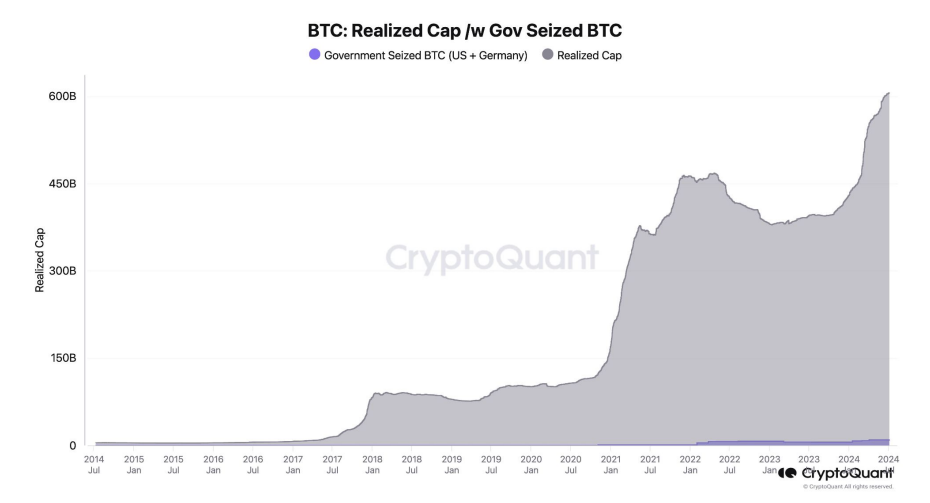

One reason is that despite the significant nominal value of BTC transferred to exchanges by the German government, it represents a relatively small proportion of all Bitcoin transactions since 2023.

According to analysts, the total realized capitalization of Bitcoin flowing into the market since 2023—meaning the total value of BTC bought and sold—totals $224 billion.

This contrasts with just $9 billion in Bitcoin seized and subsequently sold by governments, including the United States and Germany, noted Bitfinex analysts. They added that this amount constitutes only 4% of the total cumulative realized value since 2023.

The bottom of price corrections is often signaled by low SOPR and negative funding rates

Another factor suggesting that Bitcoin might rebound soon is the decrease in the spent output profit ratio (SOPR) along with negative funding rates.

SOPR is a financial measure that assesses whether wallets of a specific group of investors realize profit or loss on a given day. It’s calculated by comparing the total USD value of all coins spent to their value when initially acquired.

According to research from Bitfinex, the SOPR for short-term holders hit 0.97 as of July 6, indicating that these investors aren’t selling at a loss.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment