Bitcoin Price- Bitcoin, Blockchain, and the Future of Digital Payments Explained

Bitcoin Price– At the recent Exchange conference in Las Vegas, which brought together over 2,000 investment advisors and asset managers, Dominic Rizzo, the global technology portfolio manager at R. Rowe Price— a firm that manages more than $1 trillion in assets—shared his perspective on the current state of Bitcoin and its potential for investment.

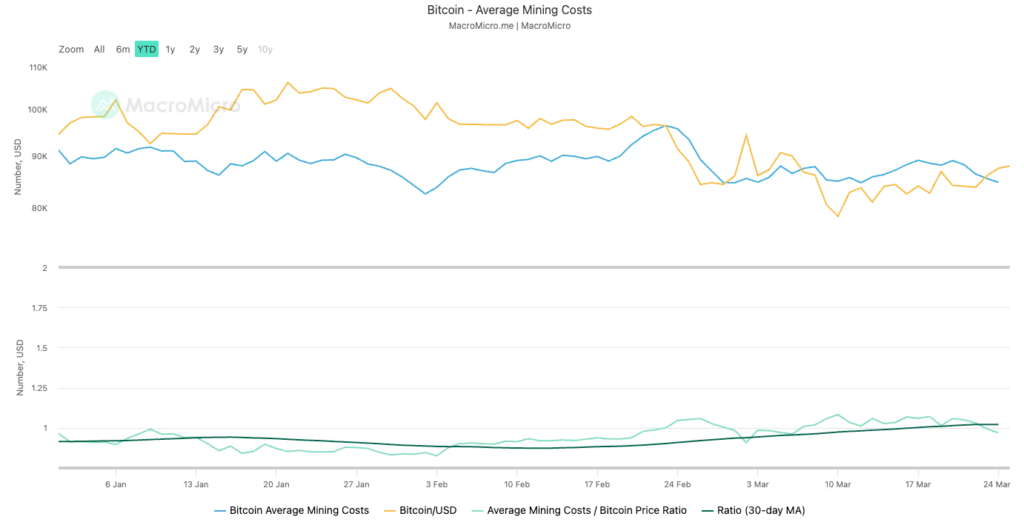

Rizzo emphasized that now might be a good time for investors to consider having exposure to Bitcoin. He compared Bitcoin’s price trends to those of a traditional commodity, highlighting the importance of understanding the cost of mining when evaluating its investment potential.

“Bitcoin itself has traded very close to its average cost of mining,” Rizzo explained. “So if you think about it like a traditional commodity, that’s actually historically a really good time to have exposure to it when it’s close to its cost of mining.”

This analogy is important because, in traditional commodity investing, when the cost of extracting or mining a commodity aligns closely with the spot price, it often signals that the commodity’s price has reached a floor, with limited downside potential. This dynamic is typically attractive to contrarian investors, as bearish market sentiment may already be priced into the asset when it hits these levels.

Rizzo’s comment on Bitcoin suggests that we are witnessing a similar situation in the cryptocurrency market. If one compares Bitcoin’s current price cycle to commodity price cycles, Bitcoin may be at or near a key support level. This means that for long-term investors looking for opportunities with relatively low downside risk, Bitcoin may be worth considering as part of a diversified portfolio.

Historically, commodities that have been mined or extracted at close to their cost levels tend to stabilize and recover, and many investors see this as an opportunity to enter the market before prices start to rise again. Rizzo’s view is that Bitcoin is not just a speculative asset but rather one that behaves similarly to commodities, and when priced near its mining cost, it could signal a strong entry point for those looking to capitalize on its potential future upside.

Blockchain and Digital Payments: Key to the Future of Fintech

Aside from Bitcoin, Rizzo also discussed the broader implications of blockchain technology and digital payments in the context of financial technology (fintech) and artificial intelligence (AI). He argued that both of these technological trends are poised to transform the global economy.

“The world is getting more global, we’re moving from cash to digital payments,” Rizzo said, emphasizing the shift in how people manage and transfer money. “Digital payments are really at the nexus of moving money cheaply and taking a software-driven approach to areas that have historically been not software-driven.”

In this digital transformation, blockchain plays a crucial role. Rizzo believes that blockchain’s decentralized nature makes it a vital part of the future of fintech and beyond. He sees blockchain as a fundamental technology for digital payments, enabling cheaper and faster transactions on a global scale.

Rizzo’s outlook on blockchain and digital payments aligns with his belief that investors should have exposure to these sectors. Whether it’s through investing in stocks of companies like Coinbase (COIN) or Robinhood (HOOD), which provide services in the cryptocurrency space, or investing in crypto miners who stand to benefit from the evolving AI landscape, Rizzo suggests that the potential for growth in these areas is substantial.

For investors looking to diversify and position themselves for the next wave of technological innovation, blockchain and AI are key sectors to consider. According to Rizzo, as the world becomes increasingly digital, especially in terms of money transfers and payments, these technologies are at the heart of the future of finance.

The Role of AI in the Blockchain Revolution

Rizzo also emphasized the growing role of AI in the financial and tech industries. As AI continues to evolve, it is expected to drive significant advancements in blockchain technology, creating new efficiencies and capabilities within digital payments and fintech. Investors who are interested in these trends may look to AI-focused companies as well as those involved in blockchain development to capitalize on this shift.

AI’s impact on the blockchain sector is already being felt, as it aids in everything from transaction verification to improving the security and scalability of blockchain networks. The combination of AI and blockchain could result in innovative solutions for financial institutions and individuals alike.

With the increasing importance of digital payments and blockchain technology, Rizzo’s comments underscore how the financial market landscape is evolving. As traditional financial systems continue to adapt to digital currencies and decentralized networks, blockchain is positioned to become a critical infrastructure for the future of finance.

For investors, the message is clear: blockchain and AI are not just niche technologies but are fundamental to the future of global finance. Whether through Bitcoin, blockchain-based companies, or AI-driven innovations in digital payments, these technologies offer a wide range of opportunities for those looking to participate in the ongoing revolution in fintech.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment