Bitcoin Price Reacts to TradingView Error: Short-Term Outlook

Bitcoin Price– Bitcoin experienced significant price fluctuations on December 26, as a glitch in TradingView’s Bitcoin dominance chart caused confusion in the market. The error, which showed Bitcoin’s market dominance crashing to 0%, triggered panic selling and resulted in a sharp price drop of around 4%, bringing Bitcoin down to approximately $95,000. This marked the end of relatively calm Christmas trading conditions.

TradingView Glitch Triggers Market Reactions

Cointelegraph Markets Pro data recorded the drop in Bitcoin’s price following the TradingView chart anomaly. Social media platforms quickly buzzed with reactions, as traders scrambled to make sense of the false data. “So there was a TradingView glitch surrounding $BTC dominance and this caused people to panic dump? People now dumping over TradingView?” trader Satoshi Flipper wrote on X.

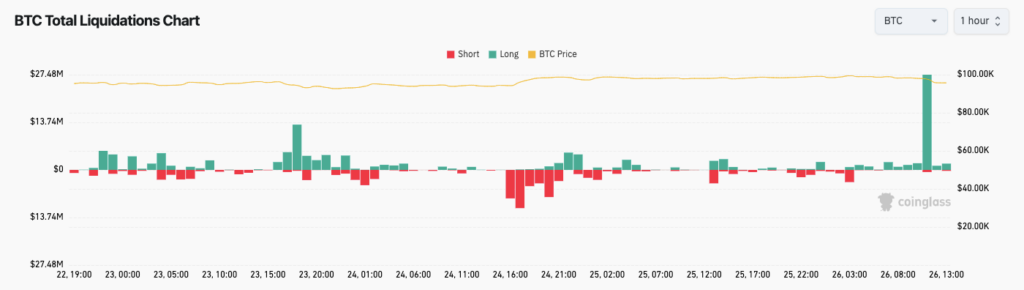

The glitch was rectified, but the damage had been done, with around $33 million worth of BTC longs liquidated over a four-hour period. The market dominance of Bitcoin had been a key topic among traders in recent weeks, as Bitcoin’s new all-time highs had left altcoins struggling to keep up.

Bitcoin Dominance and the Rise of Altcoins

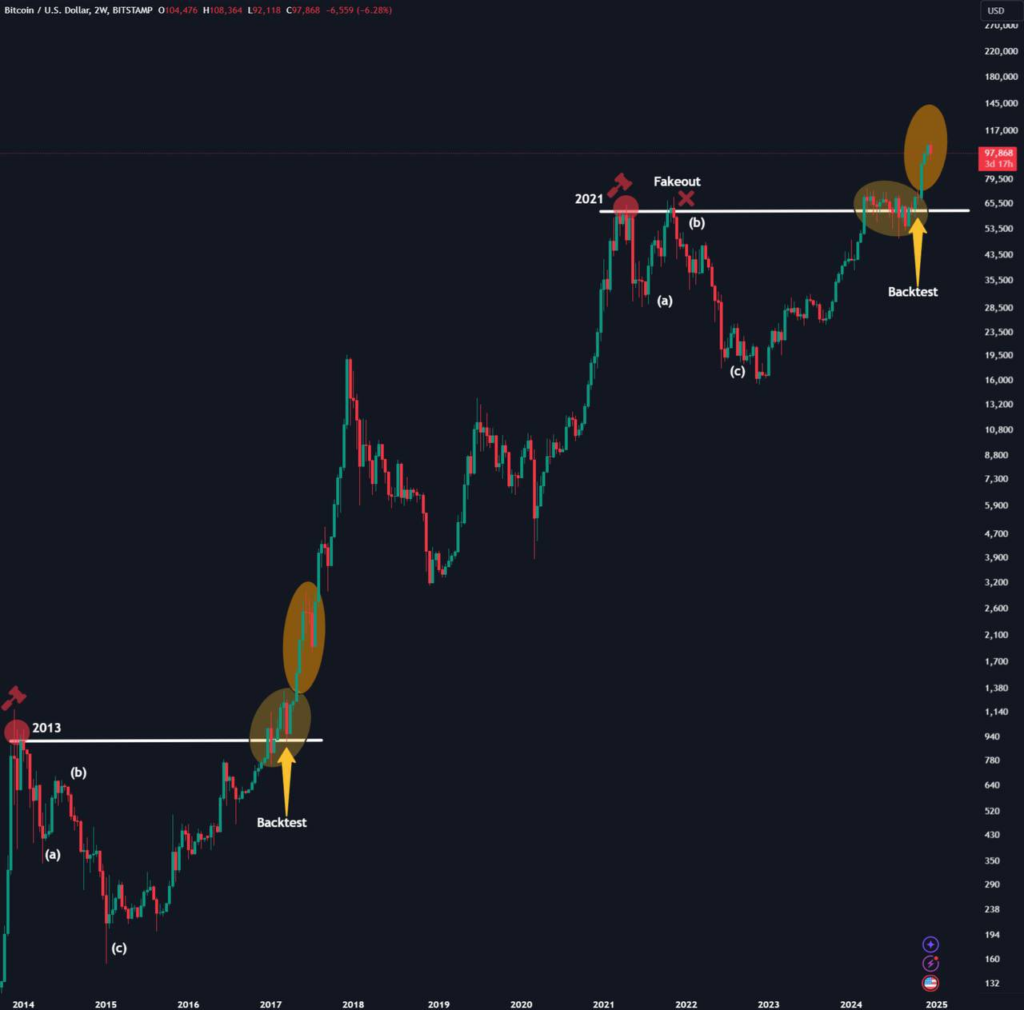

Bitcoin’s dominance in the crypto market briefly surpassed 61.5% in mid-November, before reversing and leaving traders hopeful for an “altseason.” However, Bitcoin dominance has been a hot topic for analysts. “BTC Dominance reached 2021 breakdown level and rejected,” said trading account Aqua in an analysis on X.

Analyst Michaël van de Poppe suggested that altcoins are on the verge of outperforming Bitcoin. He compared the current state of altcoin valuations to the Dotcom bubble, arguing that altcoins are still undervalued, with potential for substantial growth. The Altcoin valuations are still substantially low. The total market capitalization is barely $1.5T. The Dotcom bubble was $10-15T, van de Poppe stated.

Bullish Sentiment for Bitcoin in Q1 2025

Despite the recent volatility, market participants remained optimistic about Bitcoin’s short-term outlook. Bitcoin investor Eljaboom suggested that Bitcoin was gearing up for the next leg up, stating on X, “$BTC is preparing itself for the next leg up.”

Similarly, another trader, Xoom, highlighted bullish signals on the 1-day timeframes. “The chart just printed a bullish engulfing candle with rising volume, right off the lows in a megaphone pattern. This kind of action usually signals a breakout is on the way,” Xoom commented. If this pattern holds, Bitcoin could rise to the $110k–$130k range by the end of January, with $120k as a potential target.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment