Bitcoin News- Bitcoin & Altcoins Price Forecast: Can Bulls Take Control?

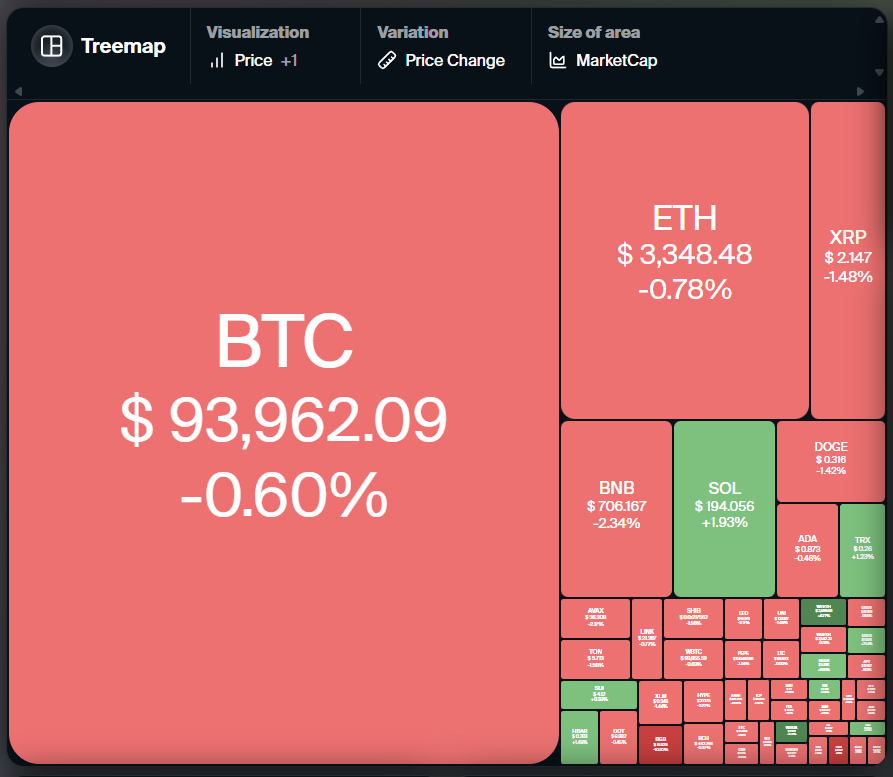

Bitcoin News– Bitcoin (BTC) has struggled to maintain its recovery efforts in the past week, with selling pressure emerging at higher price levels. Although buyers failed to push the price above the key psychological level of $100,000, they have not conceded significant ground either. This suggests that while the market is experiencing some volatility, bulls are holding their positions, potentially anticipating another upward movement.

Crypto mining firm Blockware Solutions, in its recent market forecast shared with Cointelegraph, highlighted Bitcoin’s potential for 2025. According to the report, Bitcoin’s base case target for 2025 is $225,000, while the bear case still places it at $150,000, both significantly higher than the current price. In the bullish scenario, Blockware sees Bitcoin reaching as high as $400,000.

Ethereum (ETH) is also seeing strong sentiment from traders. The United States has seen massive inflows into spot Ether exchange-traded funds (ETFs) in December, with over $2.5 billion invested—almost double the amount from November. Leading asset management firm VanEck has set a target of over $6,000 for Ether in 2025, further indicating bullish expectations.

As Bitcoin’s price fluctuates, many traders are closely watching key support and resistance levels, especially the $90,000 mark, to determine whether a rebound is imminent.

Bitcoin Price Analysis: Key Levels to Watch

Bitcoin recently closed below its 50-day simple moving average (SMA) of $96,124 on December 27, signaling that the bulls may be losing their grip on the market. Despite attempts to push the price back above the 50-day SMA on December 28, bears were able to maintain control. The 20-day exponential moving average (EMA) has begun to turn downward, and the relative strength index (RSI) has dipped into negative territory, further suggesting that bearish momentum is gaining strength.

The BTC/USDT pair may slide towards the critical $90,000 support level, where bulls are expected to mount a strong defense. If the price rebounds off $90,000 and manages to break above the moving averages, it will signal solid demand at lower levels and could set the stage for further upside.

However, buyers will need to push the price above the $100,000 mark to take control of the market. If they succeed, the pair could rise to the next resistance at $108,353. On the flip side, the 4-hour chart shows the formation of a head-and-shoulders pattern, which could lead to a sharp decline if the price breaks and closes below the neckline. In such a case, Bitcoin could fall to $85,000, and further downward pressure could bring it to the pattern target of $76,647.

This bearish outlook could be invalidated if buyers manage to sustain the price above $100,000. Such a move would open the door to a potential retest of Bitcoin’s all-time high of $108,353, with further upside targets of $124,206.

BNB Price Analysis: Will Bulls Overcome Resistance?

Binance Coin (BNB) has been oscillating between $635 and $722 for the past several days, indicating a period of consolidation with neither buyers nor sellers in full control. Despite the bears defending the $722 resistance level, bulls have successfully kept the price above the 20-day EMA ($694), which is a positive sign.

If the bulls manage to overcome the resistance at $722, the BNB/USDT pair could gather momentum and rise towards $760, and potentially reach $794. However, if the price turns down sharply and breaks below the moving averages, it would suggest that the range-bound action might continue for a while longer.

A break below the uptrend line would shift the advantage in favor of the bears, with potential targets of $635. On the 4-hour chart, bears are defending the $740 level, and if the price rebounds off the 20-EMA, the bulls may make another attempt to push the pair above $740. A successful breakout could push the pair to $761 and later to $794.

On the contrary, a break and close below the 20-EMA could signal that the bulls have lost control, and the bears might aim for a decline to $680 or even lower.

Aave Token (AAVE) Price Analysis: Battle Between Bulls and Bears

Aave (AAVE) has been in a tight range near the 20-day EMA ($329), with both bulls and bears locked in a battle for control. The upward-sloping 20-day EMA suggests that bulls have the upper hand, but the RSI near the midpoint indicates a slowing momentum. If the price falls below the 20-day EMA, the AAVE/USDT pair could drop to $261, marking a potential bearish trend.

To maintain the bullish momentum, buyers will need to push the price above $362. If successful, the pair could retest the overhead resistance at $400. If the bulls can sustain the pressure and break through $400, the next target could be $450.

On the 4-hour chart, AAVE has formed a symmetrical triangle, a continuation pattern that often signals further price movement in the direction of the trend. The flattish moving averages and the RSI just below the midpoint suggest that neither bulls nor bears have an advantage yet. If the price rises above the moving averages and stays there, AAVE could move towards the resistance line, and a breakout above the triangle could signal the resumption of the uptrend.

Alternatively, if the price falls below the moving averages, the pair could drop toward the support line, potentially signaling a deeper decline.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment