Is Bitcoin ETF Growth a Mirage? Report Suggests Institutions Are Just Playing the Spread

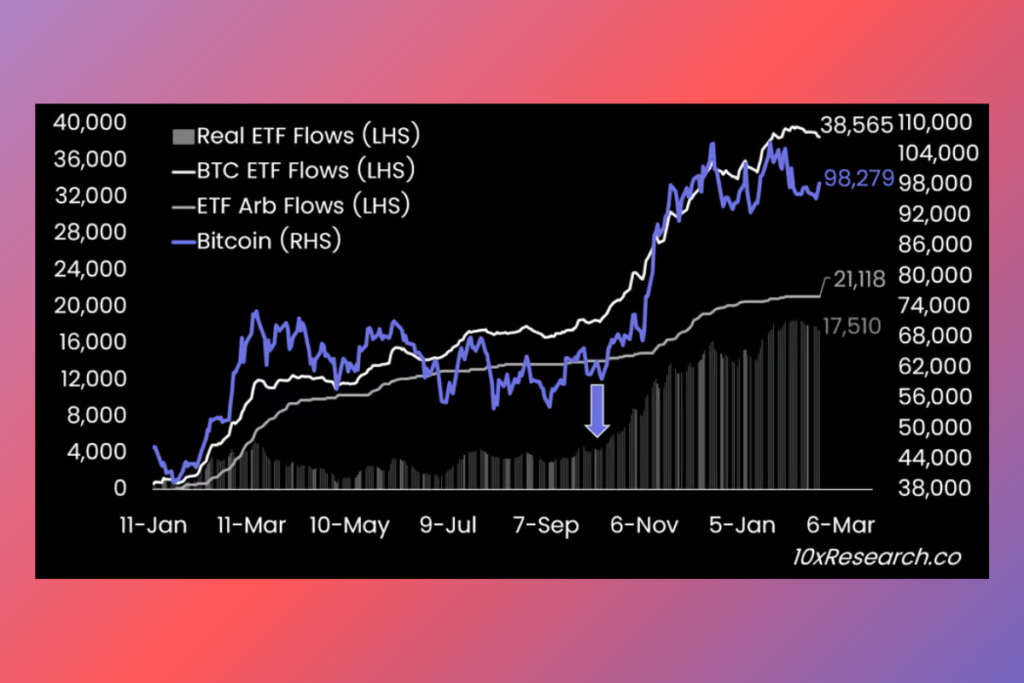

According to a crypto research firm, investors in spot Bitcoin exchange-traded funds have mostly been using the vehicle for arbitrage techniques, with only 44% of inflows linked to long-term investments. Since their January 2024 inception, spot Bitcoin ETFs in the US have seen net inflows of about $39 billion. Markus Thielen, the head of research at 10x Research, stated that only $17.5 billion, or less than half, reflects true long-only buying.

Approximately 56% of the inflows are probably related to arbitrage tactics, in which traders counter their ETF purchases with short bets in Bitcoin futures. This tactic, called the carry trade, entails shorting Bitcoin futures and purchasing spot Bitcoin through ETFs in order to profit from the price differential. According to Thielen, this indicates that there is much less demand for Bitcoin as a long-term asset in multi-asset portfolios than is generally believed by the media.

Rather than reflecting broad-based institutional adoption, the buying and selling of Bitcoin ETFs is primarily driven by funding rates (basis rate opportunities), with many investors focusing on short-term arbitrage rather than long-term capital appreciation.

Thielen

Hedge Funds Ditch Bitcoin ETFs: $552B Outflows Shake Market Sentiment

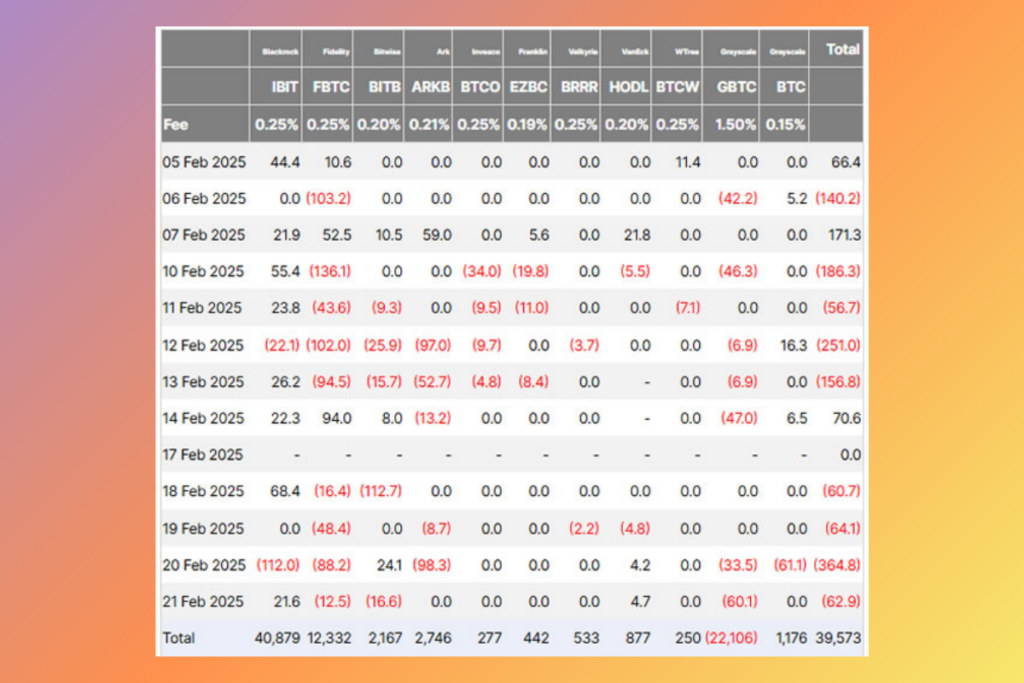

According to Thielen, hedge funds and trading organizations that focus on taking advantage of market inefficiencies and capturing yield spreads rather than taking outright directional risk are the biggest holders of BlackRock’s IBIT ETF. Since the funding rates and basis spreads for Bitcoin ETFs are too low to sustain new arbitrage positions, hedge funds and trading companies have ceased investing in these products. Instead, they are actively eliminating positions that don’t offer the profitable arbitrage opportunities accessible just a few months ago.

According to Farside Investors, there were outflows from the products for four straight trading days last week, totaling $552 billion. For the week, spot Bitcoin, meanwhile, stayed range-bound.

This hurts market sentiment, as media reports often frame these outflows as bearish signals. The unwinding process is actually market-neutral since it involves selling ETFs while simultaneously buying Bitcoin futures, effectively offsetting any directional market impact.

Thielen

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment