Bitcoin Bullish Case: BTC’s Path to $200K Backed by Fractal Complexity

Even though bitcoin is currently trading below the six-figure threshold, one company is certain that the price may more than double from the $90,000 market rate. Bitcoin may eventually reach over $200,000, according to BCA Research.

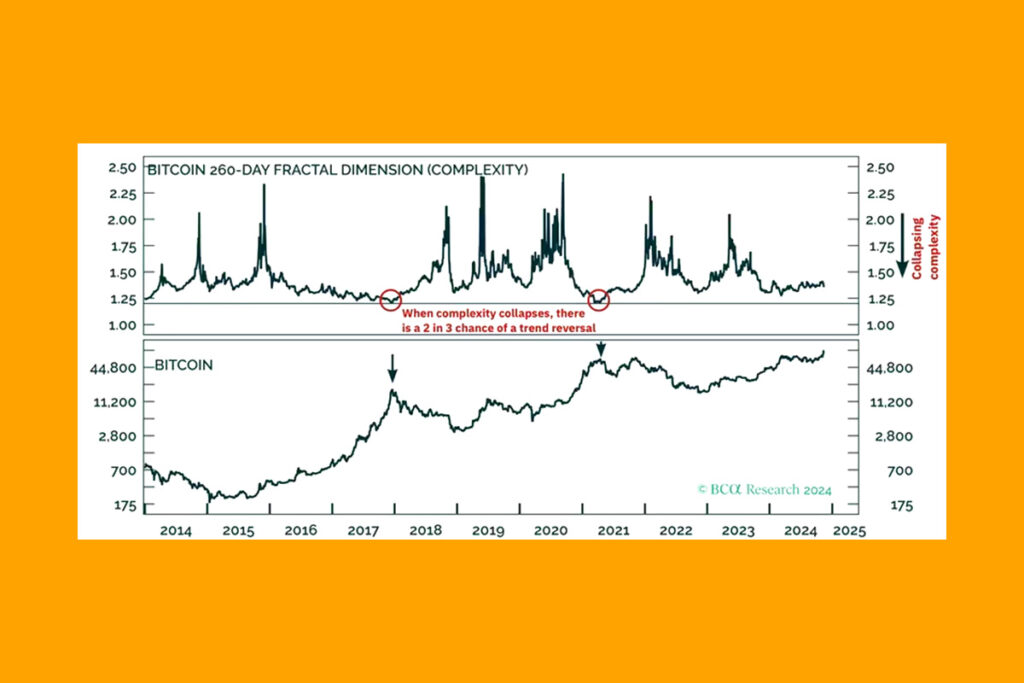

The 260-day fractal dimension complexity of Bitcoin, which quantifies the patterns found in price fluctuations, serves as the basis for the prediction. The indicator is still considerably over 1.20, which, when it is below, has indicated bull market peaks. This time, a decline below that threshold might translate into prices above $200,000, according to BCA Research.

Bitcoin’s Path to $200K Backed by Fractal Stability, Says BCA Research

More fractal dimension complexity makes it harder to understand price trends and increases the unpredictability of market moves. A falling number indicates that price trends are stabilizing and becoming more predictable. Low readings may indicate market complacency or traders’ delusion that prices will keep moving in a specific direction. Bull market peaks are typically when such a scenario occurs.

Despite bitcoin’s election-fueled rally, its 260-day complexity is not yet close to the 1.2 level that would signal the start of another crypto winter. Hence, while we should expect a near-term retracement, bitcoin’s structural uptrend is intact with an ultimate destination of $200,000+.

the BCA Research team led by Chief Strategist Dhaval Joshi

According to the team, there is significant upside potential in the value of bitcoin’s network effect, and as wealth increases globally, so too will the value of both gold and bitcoin‘s network effect.

In the case of both gold and bitcoin, their network effect comes from the collective belief that they are the non-confiscable assets to own in a fiat monetary system. And that certain portion of total wealth must be held in these non-confiscable assets as an insurance against hyperinflation, banking system failure, or state expropriation.

Joshi

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment