Bitcoin and XRP, Solana Lead Inflows as Ethereum and Tech Stocks Struggle

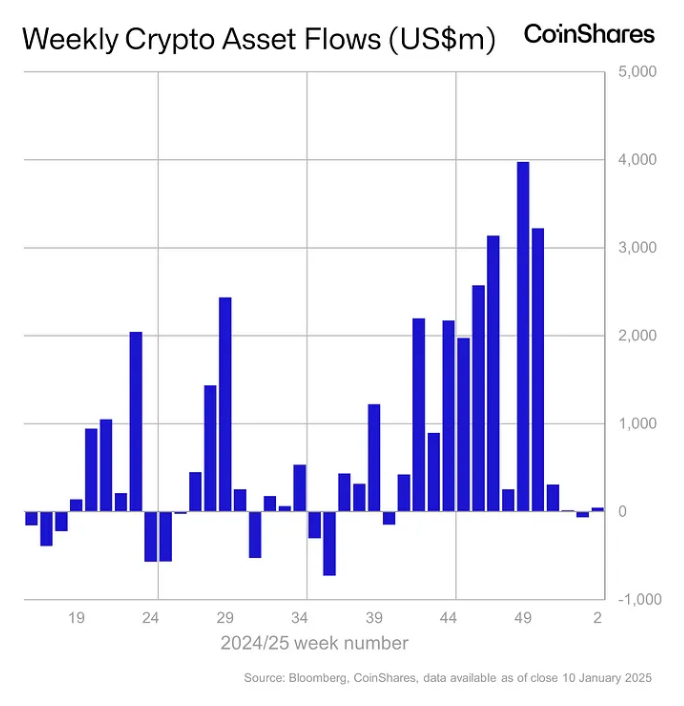

Bitcoin and XRP– Global crypto funds saw modest net inflows of $48 million last week, according to CoinShares. Asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares contributed to this figure, though the overall market sentiment was impacted by shifting macroeconomic and monetary policies. The first half of the week saw nearly $1 billion flowing into crypto investment products, but the release of new macroeconomic data, alongside minutes from the Federal Open Market Committee’s (FOMC) latest meeting, pointed to a stronger U.S. economy and a more hawkish Federal Reserve. This led to outflows of $940 million in the latter part of the week, as CoinShares Head of Research James Butterfill noted in his Monday report.

Bitcoin Leads the Charge, Despite Market Volatility

Bitcoin-based investment products led the net inflows globally, contributing $214 million, despite witnessing the largest outflows towards the end of the week. Butterfill commented that Bitcoin remains the top-performing crypto fund in 2025 so far, with $799 million in net inflows to date. The surge in U.S. spot Bitcoin exchange-traded funds (ETFs) accounted for $312.8 million of these inflows, though U.S. markets were closed on Thursday in observance of former President Jimmy Carter’s national day of mourning.

Ethereum and Altcoins See Outflows

Ethereum-based funds suffered significant losses, with net outflows of $256 million for the week. Butterfill attributed this to the broader tech sector sell-off, which saw the Nasdaq 100 decline by 3.5%. In contrast, XRP-based products saw positive momentum, generating $41 million in net inflows. This surge was attributed to growing optimism surrounding the SEC’s appeal deadline in the ongoing Ripple case, set for January 15. Solana-based funds also saw net inflows of $15 million.

Market Performance and Altcoin Gains

Despite a decline in overall market prices, some altcoin-based funds experienced positive inflows. Aave, Stellar, and Polkadot saw net inflows, despite the challenging market conditions. Bitcoin fell by 7.8%, now trading at $90,897, while Ethereum dropped 14.8%, priced at $3,063, according to The Block.

This mixed performance highlights the ongoing volatility in the crypto space, driven by macroeconomic developments and regulatory uncertainty.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment