Bank of England Steps Up Crypto Oversight with New Disclosure Request

Bank of England– The Bank of England’s Prudential Regulation Authority (PRA) has asked businesses to disclose both current and anticipated exposures to cryptocurrency by March 2025. This move aims to improve the monitoring of crypto-related risks and help the central bank shape its policies on digital assets. The PRA’s request comes as part of broader efforts to assess financial stability risks posed by crypto-assets, especially in light of their increasing adoption by companies worldwide.

The Purpose of the Disclosure Request

In a statement released on December 12, the PRA emphasized the importance of businesses reporting their “current and expected future cryptoasset exposures” to help the Bank of England better assess the stability of the financial system. The authority explained that the information gathered would assist in calibrating the prudential treatment of cryptoasset exposures and analyzing the relative costs and benefits of different regulatory approaches.

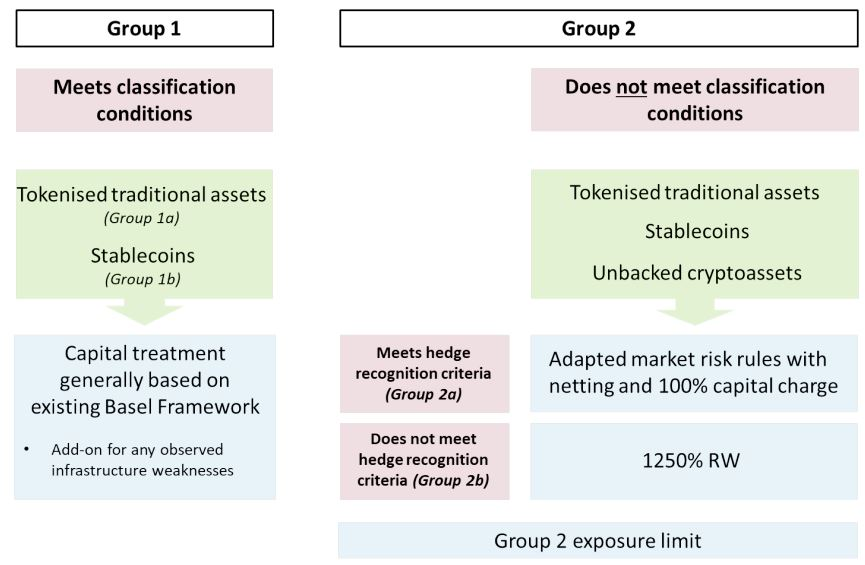

The PRA also noted that this data would be instrumental in understanding how businesses are using the Basel framework to manage crypto assets. The Basel framework, introduced by the Basel Committee on Banking Supervision (BCBS) in December 2022, outlines capital and risk management requirements for banks’ exposure to crypto.

This will inform work across the PRA and the Bank of England on cryptoassets, the PRA explained. “It will help us calibrate our prudential treatment of cryptoasset exposures, analyze the relative costs and benefits of different policy options.”

Understanding the Basel Framework for Crypto

The Basel framework, which focuses on regulating cryptoassets, is a crucial part of the PRA’s approach to ensuring financial stability. It defines the capital requirements that banks and other financial institutions must adhere to when holding crypto assets. The aim is to reduce the risk of volatility associated with cryptocurrencies, particularly for institutions that are exposed to them.

The PRA’s disclosure request will enable it to track how businesses are implementing this framework. Firms are also being asked to consider their crypto-related activities up to 2029, as part of a longer-term strategy to manage potential risks.

The PRA also plans to use this information as a “base from which to monitor the financial stability implications of these assets,” ensuring that the adoption of crypto assets does not pose a threat to the broader financial system.

Risks of Permissionless Blockchains

As part of the PRA’s request, firms must address how they are utilizing the Basel framework in relation to permissionless blockchains. While these decentralized ledgers offer several benefits, such as increased transparency and reduced reliance on intermediaries, they also pose significant risks, according to the PRA.

While there are benefits that these new types of ledgers can bring, they also pose risks such as lack of settlement finality, settlement failure, and no guaranteed link between the intended owner of the asset and the entity that may have control of the authentication, validation mechanism, the PRA noted in its request.

The authority also highlighted that the use of permissionless blockchains “cannot be sufficiently mitigated at present,” though it remains under review. This reflects the ongoing concerns about the security and reliability of permissionless systems, especially as more firms incorporate cryptocurrency into their business models.

Growing Interest in Bitcoin from Global Firms

The request for disclosure comes at a time when cryptocurrency adoption among businesses is gaining momentum. Many companies around the world are investing in Bitcoin and other digital assets, driven by the potential for high returns. Bitcoin, which recently reached a six-figure value, continues to attract institutional investors.

For example, on November 29, Hong Kong-based online gaming company Boyaa Interactive International disclosed that it had adjusted its treasury assets by swapping nearly $50 million worth of Ether (ETH) into Bitcoin. Similarly, Japanese investment firm Metaplanet announced on November 28 that it planned to raise over $62 million to purchase more Bitcoin for its treasury. Metaplanet’s treasury already holds 1,142 Bitcoin, valued at over $114 million.

While some companies are taking the plunge into the world of cryptocurrencies, others remain cautious due to the regulatory uncertainties and potential risks associated with digital assets. The PRA’s request for transparency aims to address these issues, providing the Bank of England with the information it needs to regulate the growing crypto market effectively.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment