Featured News Headlines

Altcoin Market on Alert: 3 Altcoins Facing Intense Liquidations This Week

The cryptocurrency market is experiencing increased volatility as November gets underway, with Ethereum (ETH), Aster (ASTER), and Dash (DASH) all dealing with severe liquidation pressures. Leveraged positions are unwinding quickly, according to early-week trading statistics, which indicates more short-term risk for both traders and investors. Because of the potential for dramatic price fluctuations to shift momentum and create openings for both bullish and bearish strategies, market participants are keeping a close eye on these altcoins.

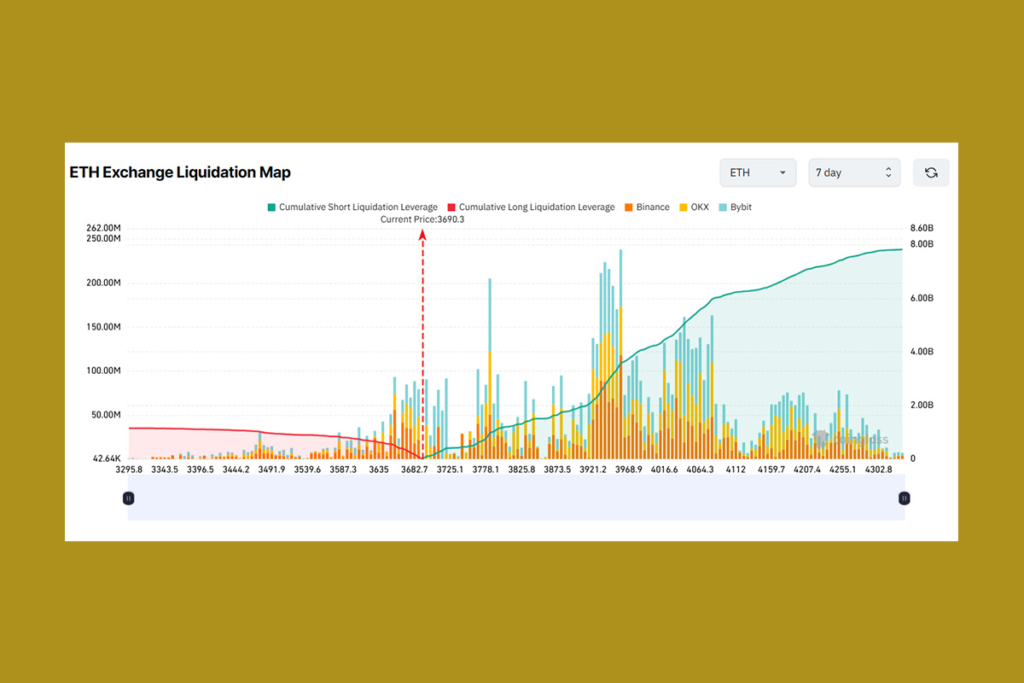

Short Sellers at Risk as Ethereum Shows Signs of Recovery

A bullish divergence is highlighted in recent BeInCrypto analysis, suggesting that ETH may be on the cusp of a comeback this week. Additionally, analysts pointed out that Ethereum‘s network keeps breaking records in spite of brief turbulence. These indicators support solid fundamentals and entice investors to buy Ethereum after significant declines. As the number of stablecoins on the network continues to increase, ETH’s application revenue has hit a record high. Because of these considerations, if ETH prices rebound significantly, short sellers who do not manage their risk well may suffer large liquidations.

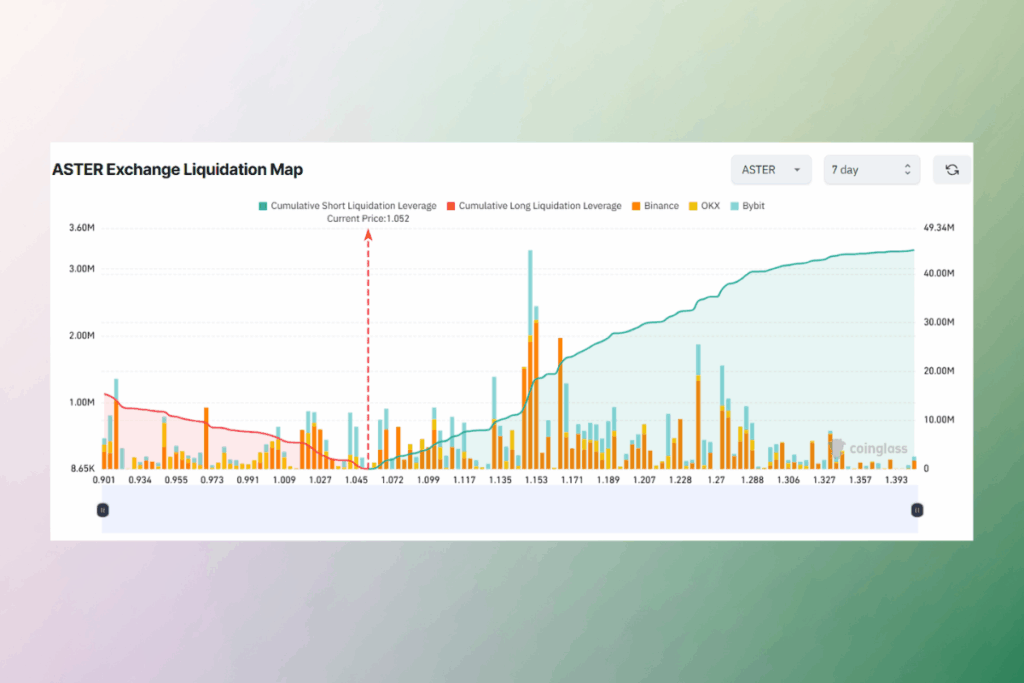

ASTER Skyrockets After CZ’s Purchase

After Changpeng Zhao, the founder of Binance, disclosed that he had personally bought $2 million worth of ASTER tokens for long-term keeping, ASTER saw a 30% increase. Several other KOLs made public disclosures about their own ASTER purchases as a result of this statement. Aster’s liquidation map also reveals a glaring mismatch on the first Monday of November during the opening week, with short-side liquidations outweighing long-side risks. ASTER may wipe out almost $44 million in short bets if it rises to $1.4. On the other hand, lengthy liquidations might cost more than $15 million if they fall below $0.9.

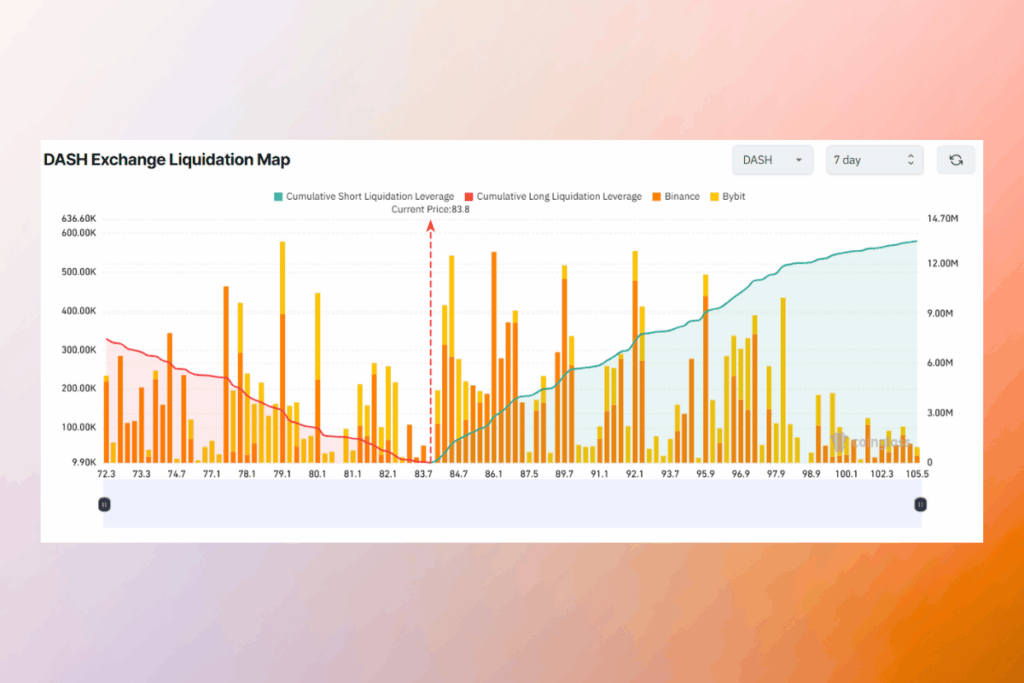

DASH Leads Privacy Coin Comeback: Traders Warned of Liquidation Risk

The hype of the privacy coin is still going strong in November. Dash has taken center stage this time, outperforming Zcash and hitting its best price in three years. The short exposure of derivative traders has increased due to their negative inclination. Over $13 million in short positions might be liquidated if DASH rises above $105. It is challenging to predict when the momentum may stall in a rally driven by FOMO. Shorting DASH may pose a significant risk of liquidation as long as community conversations are positive.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.