Featured News Headlines

Altcoins Set to Surge: Grayscale ETFs and Monad Mainnet Drive Market Buzz

Altcoin Investors Watch – This week promises to be pivotal for altcoins, with a series of ecosystem-specific developments potentially driving significant market moves. From Grayscale’s latest ETF launches to Layer-1 network debuts and multi-chain expansions, the market is buzzing with activity that could influence investor sentiment and token performance.

Grayscale XRP ETF Debuts on NYSE Arca

The Grayscale XRP Trust ETF (GXRP) officially began trading on November 24 on NYSE Arca, granting investors regulated exposure to XRP via traditional brokerage accounts. The fund holds 6,017,179.9823 XRP, with each share representing 19.40 XRP at a net asset value (NAV) of $37.64 as of November 21.

GXRP offers a 0% management fee for the first three months or until assets reach $1 billion, after which a 0.35% fee applies. The ETF is accessible through major brokerages including Interactive Brokers, E-Trade, Charles Schwab, Fidelity, Robinhood, and TD Ameritrade.

Despite the launch, XRP’s price rose only modestly by 1.35% in the last 24 hours. GXRP follows earlier altcoin ETF entries by Canary Capital and Bitwise Invests, reflecting growing institutional acceptance of XRP in regulated products.

Grayscale DOGE ETF Hits the Market

Launching alongside GXRP, the Grayscale Dogecoin Trust ETF (GDOG) also debuted on NYSE Arca, holding 11,136,681.421 DOGE and offering 117.60 DOGE per share. The ETF manages $1,546,094 in assets, with a NAV of $16.33 and 94,700 shares outstanding.

GDOG mirrors GXRP’s fee structure, with 0% for the first three months. ETF analyst Nate Geraci highlighted its significance as the first Dogecoin ETF under the ’33 Act, marking a potential regulatory shift and confirming institutional adoption for altcoins beyond Bitcoin and Ethereum.

Monad Public Mainnet Launches

The Monad Layer-1 blockchain officially launched its mainnet on November 24, 2025, following years of development. Designed for full EVM compatibility, Monad emphasizes security, decentralization, and high throughput.

The network conducted a public token sale on Coinbase from November 17–22, selling 7.5 billion MON at $0.025 each. Monad’s initial supply is 100 billion MON, with 49.4 billion unlocked at launch and the remainder gradually released through Q4 2029. This substantial immediate supply could have a strong impact on early price discovery, positioning Monad as a formidable player in the Layer-1 space.

MegaETH Pre-Deposit Bridge Launches

On November 25, MegaETH will open its Pre-Deposit Bridge, enabling users to convert USDC on Ethereum to USDm on the Mega mainnet (Frontier). The bridge supports up to $250 million, allowing early access to the network while managing traffic and user experience.

The bridge also provides users with stablecoin utility immediately following MegaETH’s MEGA token sale, marking a key step in the network’s infrastructure development.

Solv Protocol Expands to Solana

In a cross-chain move, Solv Protocol completes its integration with Solana on November 24, enhancing DeFi interoperability. This expansion aligns with the growing trend of multi-chain DeFi protocols, boosting liquidity and attracting a broader user base.

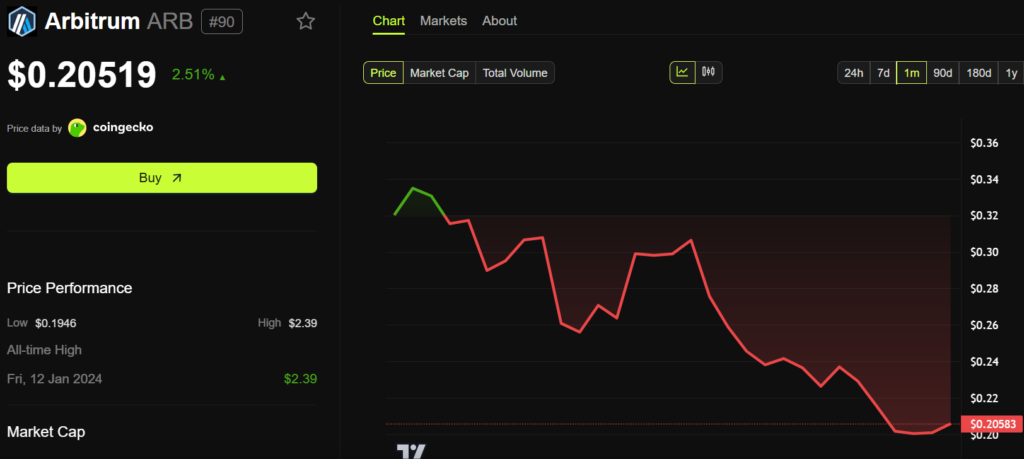

Arbitrum Community Event in Hong Kong

Finally, Arbitrum will host a community and developer event in Hong Kong on November 26, collaborating with HackQuest and CityUHK Web3AI Club. These events often trigger partnership announcements and upgrades, which could influence ARB token dynamics in the short term as Layer-2 projects compete for developer attention and transaction volume.

This week’s cluster of altcoin developments—from regulated ETFs to mainnet launches and cross-chain integrations—highlights accelerating crypto infrastructure growth. Traders and investors will likely keep a close eye on these events, as they could significantly shape token performance and market sentiment in the coming days.

[…] the institutional front, Grayscale’s Dogecoin and Ripple ETFs attracted attention. These developments reinforce confidence in digital assets. Some analysts are […]