Featured News Headlines

Aave On-Chain Metrics Remain Strong Despite Increased Liquidations

Aave has experienced renewed downside pressure, with its token price falling more than 10% as trading activity sharply increased. According to market data, trading volume surged by 226%, reaching approximately $577 million. This heightened activity followed a reported large-scale sell-off worth $17 million by a single whale, which intensified bearish sentiment and led to increased liquidations among long perpetual traders. As a result, long-position liquidations climbed to $1.59 million.

Despite the negative price movement, on-chain indicators suggest that Aave’s broader fundamentals remain resilient. Data analysis points to a growing divergence between short-term market behavior and the protocol’s underlying performance.

Capital Inflows Rise Amid Market Uncertainty

While price action remains under pressure, Aave has recorded a notable increase in capital inflows. Between December 18 and the time of writing, DeFiLlama data showed that Total Value Locked (TVL) on the protocol rose by approximately $1.42 billion.

This increase occurred during a period of heightened market fear, making the inflow particularly notable. Capital is typically locked into decentralized finance protocols when participants anticipate long-term utility, yield generation, or continued protocol relevance. The movement of funds into Aave, rather than into stablecoins or off-platform storage, indicates sustained confidence in the protocol’s infrastructure and role within the DeFi ecosystem.

Protocol revenue further supports this trend. Over the past 24 hours, Aave generated $1.88 million in fees, while weekly fees totaled $11.58 million. Consistent fee generation reflects ongoing borrowing and lending activity, reinforcing the protocol’s operational stability.

Record Earnings Highlight Protocol Strength

Aave’s long-term appeal is further underscored by its recent profitability metrics. During Q4 2025, the protocol recorded $22.56 million in quarterly earnings, calculated as gross profit after incentives. This marked the highest quarterly earnings figure in Aave’s history.

Strong profitability often aligns with reduced circulating supply pressure, as participants may choose to retain tokens rather than exit positions. Additionally, token holder net income remains positive at $7.11 million for the current quarter, indicating continued value distribution despite a decline from previous periods.

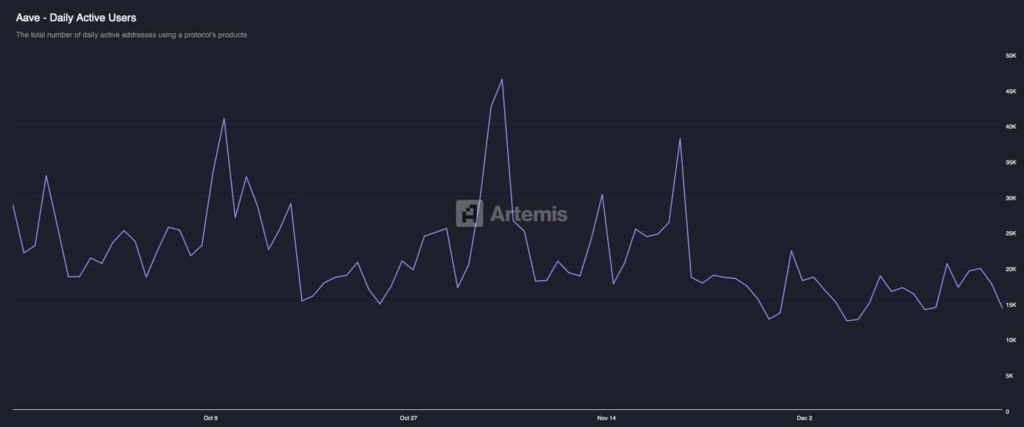

On-Chain Activity Shows Temporary Cooling

While capital inflows have risen, on-chain activity has moderated. Artemis data shows declines in both daily transaction counts and active users. However, this slowdown may reflect a reduction in short-term participation rather than structural weakness.

A contraction in activity during volatile periods can indicate that speculative participants have stepped aside, leaving behind a more conviction-driven user base. Should broader market sentiment improve, sidelined participants may return, potentially increasing engagement levels.

Comments are closed.