Featured News Headlines

New York Crypto Tax Could Generate Millions for School Programs

New York Crypto Tax – New York State is considering implementing a 0.2% excise tax on cryptocurrency and NFT transactions, following the introduction of Assembly Bill 8966 this Wednesday. Democratic Assemblymember Phil Steck submitted the legislation that could reshape how digital assets are taxed in America’s financial capital.

The proposed bill would impose the tax on all “digital asset transactions,” including sales and transfers of cryptocurrencies, digital coins, and non-fungible tokens. If approved, the legislation would take effect immediately, with implementation beginning September 1st.

Revenue Target: School Substance Abuse Prevention

The bill outlines a specific purpose for the generated tax revenue, directing funds toward expanding substance abuse prevention and intervention programs in upstate New York schools. This targeted approach connects cryptocurrency taxation with public health initiatives, marking an innovative funding mechanism for educational programs.

Given New York City’s status as the world’s largest financial and fintech hub, the tax could generate substantial revenue. The city hosts numerous crypto industry giants that have invested billions in digital assets and offer crypto-based financial products.

Legislative Journey Ahead

Before becoming law, Assembly Bill 8966 must navigate several legislative hurdles. The bill requires committee approval before facing a full Assembly vote, followed by Senate consideration and potential gubernatorial approval or veto.

Crypto’s Complex Tax Landscape

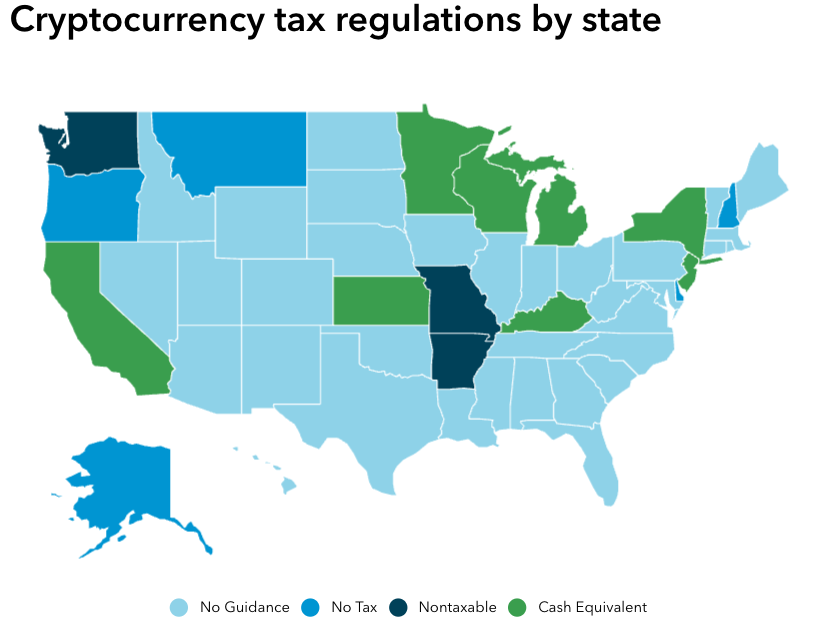

The proposed legislation highlights the varied approach to cryptocurrency taxation across U.S. states. While some states like California and New York treat crypto as cash equivalent, others including Washington exempt digital assets from taxation. Texas has eliminated corporate taxes entirely to attract crypto businesses.

New York’s Crypto Regulatory History

New York’s relationship with cryptocurrency has been complex since introducing the controversial BitLicense in 2015. This comprehensive regulatory framework caused many crypto companies to exit the state, though major players like Circle Internet Group, Paxos, Gemini, and Chainalysis chose to embrace regulation and maintain headquarters in the city.

The proposed tax represents another significant step in New York’s evolving approach to digital asset regulation and taxation.