XRP ETF on the Horizon? BlackRock Expected to Expand Beyond BTC and ETH

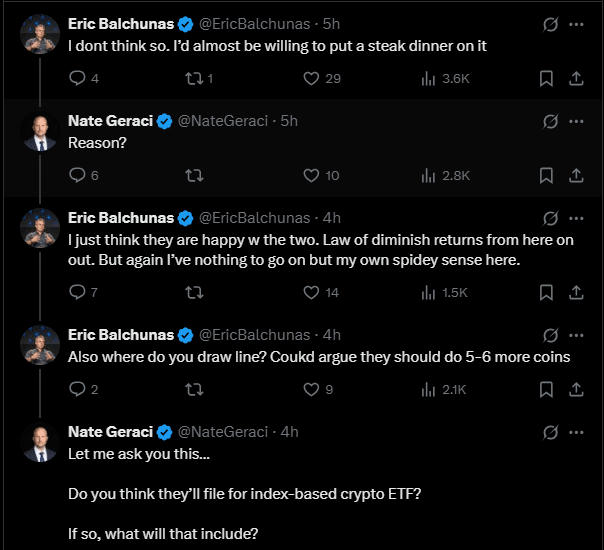

XRP ETF Approval – Speculation is swirling around BlackRock possibly filing for a spot XRP ETF following the conclusion of appeals between the U.S. SEC and Ripple Labs. Nate Geraci, President of the ETF Institute, boldly projected that BlackRock may now move forward, stating, “Yes, I think BlackRock was waiting to see this before filing for iShares XRP ETF.”

According to Geraci, limiting ETF offerings to only Bitcoin (BTC) and Ethereum (ETH) would be shortsighted. “It would make zero sense for BlackRock not to explore beyond BTC and ETH,” he noted, hinting that XRP and Solana (SOL) could soon join the ETF race.

XRP ETF Approval Odds Surge to 80%

Although BlackRock has not yet officially filed for XRP or SOL ETFs, approval odds for a spot XRP ETF have surged to 80%, up from 66% on August 7, following the dismissal of SEC and Ripple Labs’ appeals.

Bloomberg’s Eric Balchunas acknowledged that while Commissioner Caroline Crenshaw may oppose further crypto ETFs, she is “outnumbered”, and the broader approval outlook remains at 95%.

Whale Activity and Market Reactions

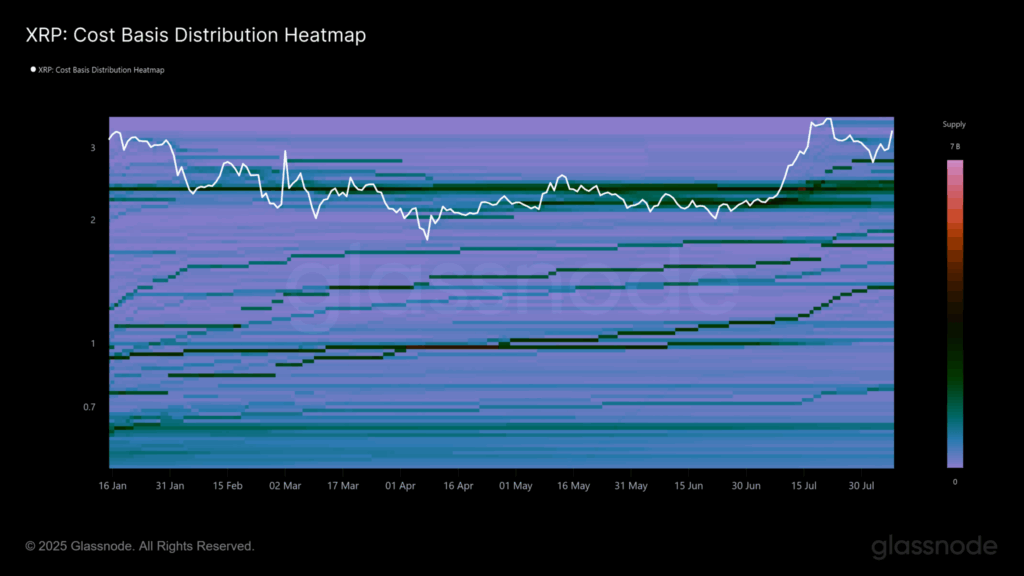

Despite a sharp 11% rally in XRP price to $3.30, over $6 billion in XRP has been sold recently, flipping whale demand to the negative side. Traders continue to hedge against downside risks, as data from Laevitas shows increasing premiums on short-dated put options and a negative 25 Delta Skew across multiple timeframes.

Still, key support levels remain firm, with over 1.8 billion XRP bought in the $2.70–$2.80 and $2.40–$2.50 zones, suggesting strong buyer interest in the event of a pullback.

Comments are closed.