Featured News Headlines

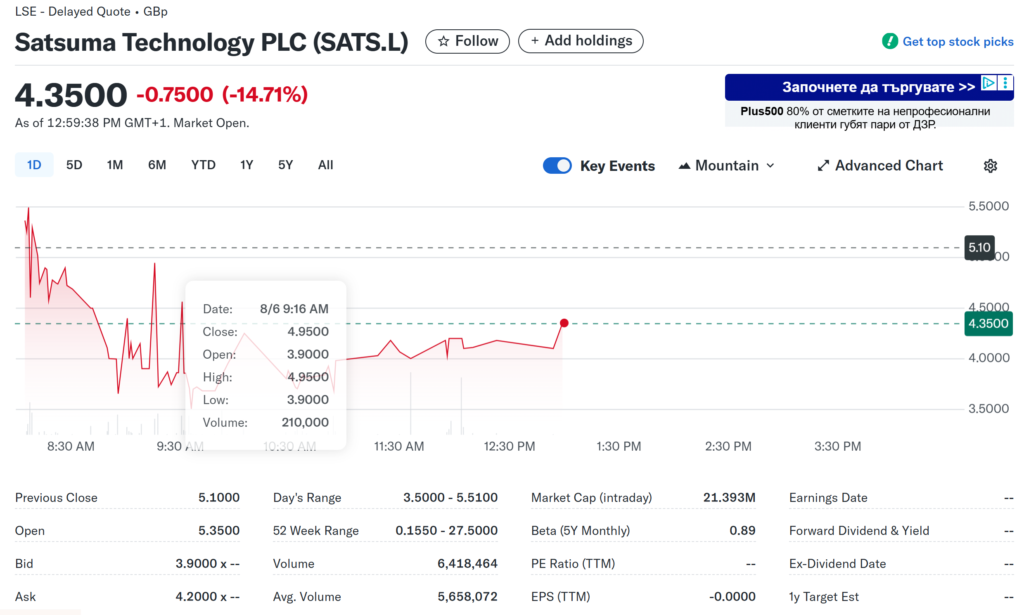

Satsuma Technology Leads with First Bitcoin Subscription in London

Satsuma Technology secured a massive £163.66 million ($217.6 million) from its second convertible loan note round, closing well above its minimum target of $129 million by 63%. The offering attracted strong interest from both crypto-native and traditional institutional investors, highlighting growing confidence in innovative treasury strategies combining Bitcoin and decentralized AI.

Significant Bitcoin Portion in Capital Raise

Notably, nearly $125 million of the funds were settled in Bitcoin, with 1,097.29 BTC accepted instead of cash. CEO Henry Elder emphasized that this was the first-ever Bitcoin subscription in London and reflects investor trust in Satsuma’s pioneering vision to fuse Bitcoin-native treasury management with decentralized AI technology, a move Elder calls “a paradigm shift in corporate value creation.”

Top Crypto Funds and Institutional Backers

Prominent crypto investment firms such as ParaFi Capital, Pantera Capital, Arrington Capital, Blockchain.com, Kraken, DCG, and Kenetic Capital backed the round. Additionally, London-based equity funds managing over £300 billion in assets participated, illustrating cross-sector support for Satsuma’s ambitious goals.

Future Plans and Use of Funds

The convertible notes will convert to equity at $0.013 per share, subject to shareholder and regulatory approvals. Funds raised will support operational expenses like developer hiring and expanding Bitcoin holdings through Satsuma Pte, the company’s Singapore-registered subsidiary.

Satsuma’s Growing Bitcoin Treasury and AI Infrastructure

Building on a prior $135 million raise in June, Satsuma now holds approximately 1,126 BTC valued at $128.66 million. The company develops infrastructure and AI agents for the decentralized AI marketplace Bittensor, running validator nodes and a Subnet Task Marketplace.

Industry-Wide Crypto Treasury Trends

Satsuma’s move aligns with broader trends as crypto treasury firms announced over $7.8 billion in planned purchases recently. While Ethereum leads in volume, Bitcoin remains a key asset, with firms like Strategy and others acquiring billions in BTC, highlighting ongoing institutional appetite for crypto assets.