Crypto Market Volatility Returns: Altcoins Take the Biggest Hit

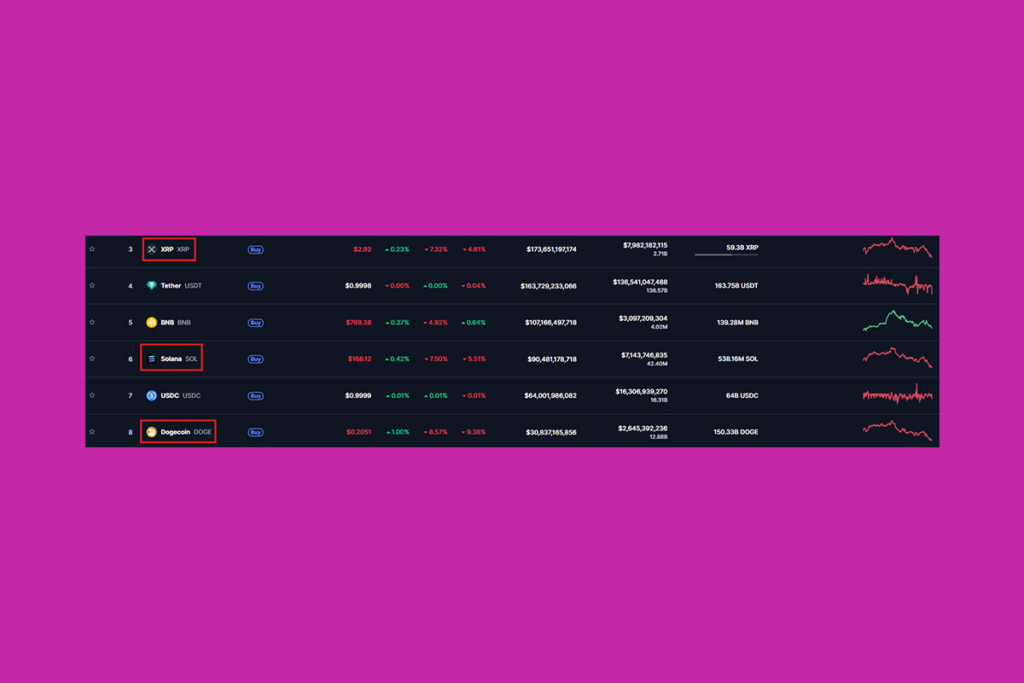

Major cryptocurrencies are suffering from a waning appetite for risk, despite Bitcoin being stable for a second week in a small trading range. According to CoinMarketCap, XRP, Solana, and Dogecoin saw daily declines of 7.32%, 7.50%, and 8.57%, respectively. The correction follows a quick decline in Bitcoin on Thursday, which caused a market-wide wave of liquidations.

Crypto Market on Edge: $250 Million in Longs Liquidated for 5 Straight Days

The latest market downturn was ascribed by Shawn Young, Chief Analyst at MEXC Research, to investor caution in the face of limited summer liquidity. Analysts at Bitfinex share this opinion, stating that the market was nearing a turning point because of excessive cryptocurrency leverage, which left it open to a liquidation cascade.

Leveraged long holdings have been continuously eliminated, according to CoinGlass data, with liquidations totaling at least $250 million every day for the last five days. For the time being, the long-to-short liquidation ratio is approximately 3. In other words, at least three traders who were betting on a price increase have left their position, for every trader who was driven out of their position for a price decline.

Bitcoin & Altcoins Under Pressure as Macroeconomic Headwinds Persist

Young also identified growing real yields and the recent strength of the US dollar as major factors affecting not only Bitcoin but the entire cryptocurrency industry. The push and pull of macroeconomic forces is consistent with what the Singapore-based trading company QCP has observed. The company emphasized on Wednesday that the sluggish reaction of cryptocurrency to uplifting stories is a typical indication of late-cycle behavior. It can be a while before the market finds new impetus as a result of these factors.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.