Ethereum ETFs Steal the Spotlight: Is This the Start of a Major Rally?

Following weeks of vigorous corporate investment in Bitcoin, Ethereum is becoming a more attractive option. Given the potential for an altcoin season, this tendency might help the token’s market presence.

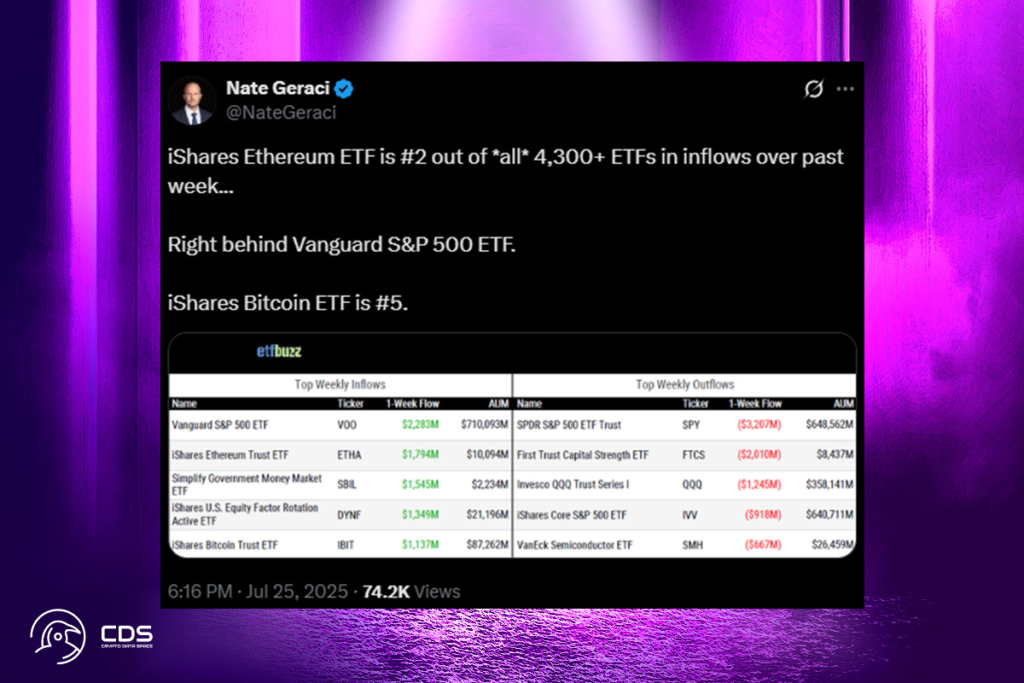

In this regard, despite being the market leader in crypto ETFs historically, BlackRock’s Ethereum product saw stronger inflows this week. Actually, ETHA had an outstanding record, with the second-highest inflows of any US ETF.

Ethereum ETFs Surpass Bitcoin: Is the Tide Finally Turning?

BlackRock’s Bitcoin ETF, IBIT, has been hailed as the biggest stock exchange debut ever. In terms of fee revenues, it surpassed Satoshi’s Bitcoin wallet last month and could overtake it in less than a year. But in a significant upset, this week’s inflows into BlackRock’s Ethereum ETF were even higher.

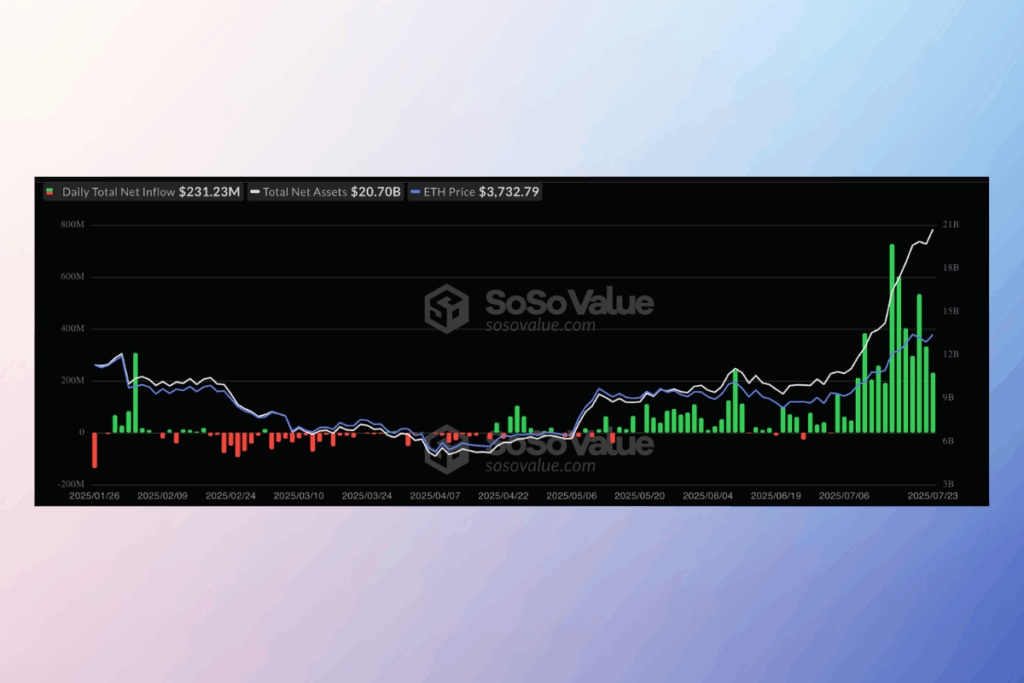

Since aggressive corporate investment has given Bitcoin ETFs strong institutional support, it’s a little surprising that Ethereum products are outperforming them. Due to the market being slowed by the asset’s all-time high, BTC ETF inflows have been declining over the past few days. In contrast, Ethereum ETFs are continuing to move steadily forward.

Is Bitcoin Losing Its Grip? Institutional Investors Turn to Ethereum

Due to the quick pace of corporate investment, even pauses in Ethereum’s growth haven’t significantly halted the trend. The majority of corporate cryptocurrency owners are using Bitcoin, which could have serious drawbacks. Therefore, since Wall Street investment isn’t completely influencing the market, ETH is a well-liked but less crowded alternative option. On the other hand, Bitcoin’s dominance has decreased by more than 5% in July as institutional investments in Ethereum pick up speed.

Additionally, Ethereum maximalism is becoming more popular on its own. The departure of BlackRock’s Head of Digital Assets to join an ETH treasury business today brought this matter very close to home.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.