Ether Social Media Mania: Is a Major Crash Next?

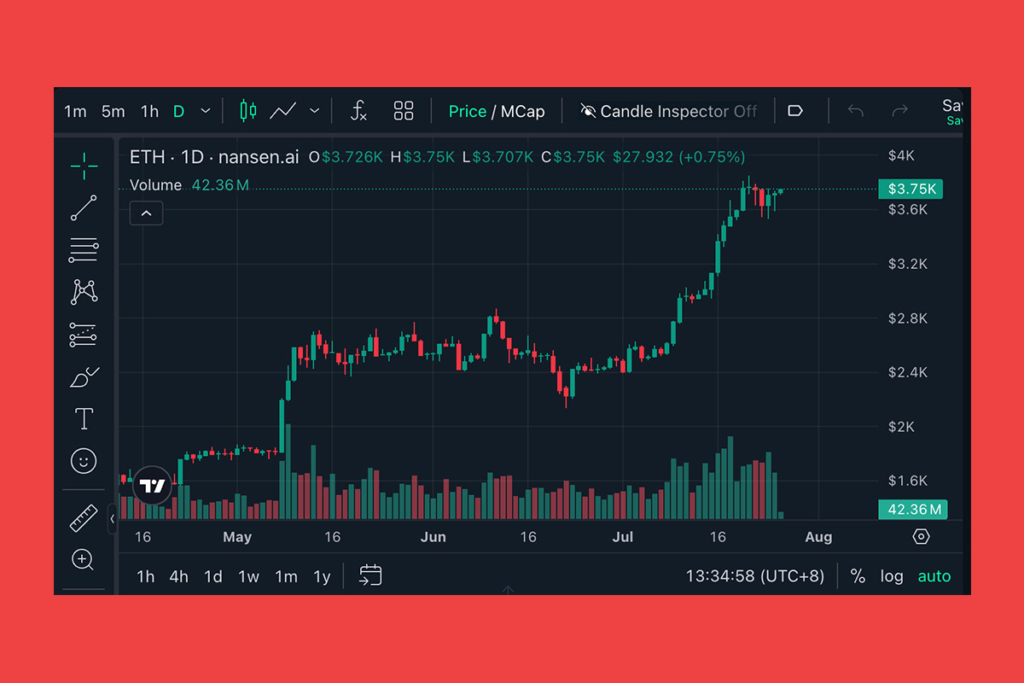

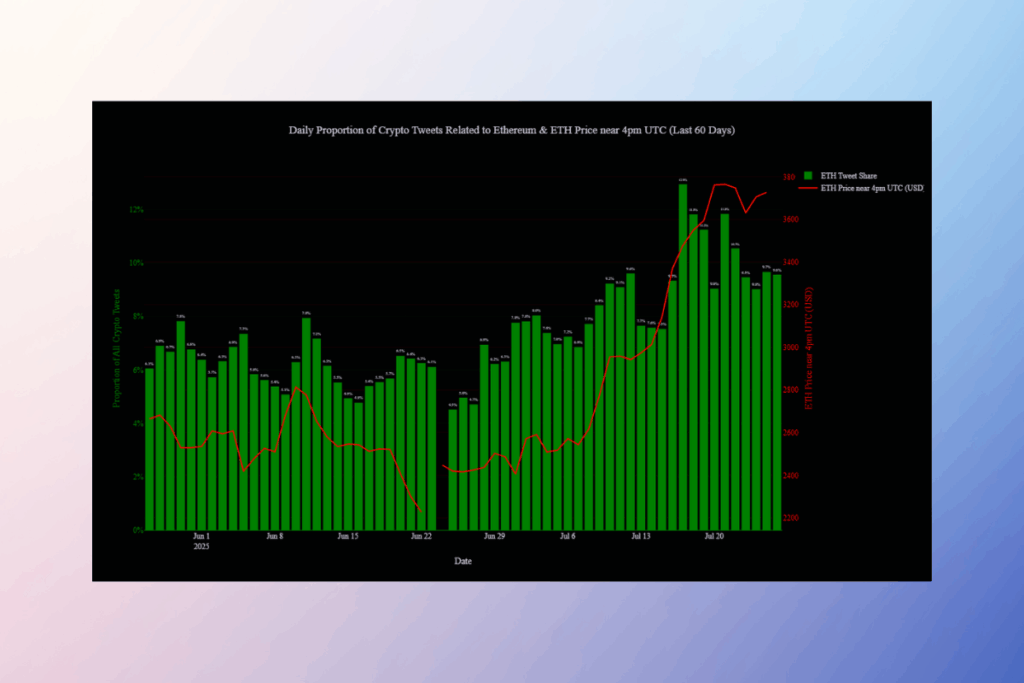

According to sentiment platform Santiment, a spike in social media mentions that reached extreme euphoria suggests that Ether’s recent price gain may be about to cool down. Ether’s rally, which has increased by more than 50% in the last 30 days, may still have room to go, according to other indicators.

Social metrics are flashing warning signs. Since early May, Ethereum’s price ratio against Bitcoin has surged by an incredible 70%. This has led to extreme euphoria and a massive spike in social dominance, which is often a red flag,

Santiment

Ethereum Price Spike: Bull Run or Bubble About to Burst?

The platform explained that a cryptocurrency may be overvalued if its social influence peaks at abnormally high levels.

It suggests the asset is over-hyped and the trade is becoming crowded, increasing the risk of a price correction,

Santiment

According to CoinMarketCap, Ether is currently trading at $3,744, up 50.29% over the previous 30 days. However, other indicators indicate that the market hasn’t reached peak frothiness. So, it’s also possible that Ether’s rally isn’t finished yet, according to Santiment.

Social dominance for memecoins is currently quite low. A true marketwide top is often characterized by widespread, irrational speculation, and the absence of that could suggest this rally isn’t over,

Santiment

ETH Supply Shrinks as Companies Load Up

In the meantime, there are increasing indications that corporate treasuries are interested in Ether, as evidenced by the significant acquisitions made by Bitmine Immersion Technologies and SharpLink Gaming. This developing “Michael Saylor for Ether” story may be the impetus that propels the asset to all-time highs, according to Santiment analyst Maksim Balashevich.

There’s not a lot of supply of ETH, and so I think ETH probably has a chance to outperform Bitcoin in the next three to six months.

Galaxy Digital CEO Michael Novogratz

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.