Ether Dominates Futures Trading Volume: Is a New Era Ahead?

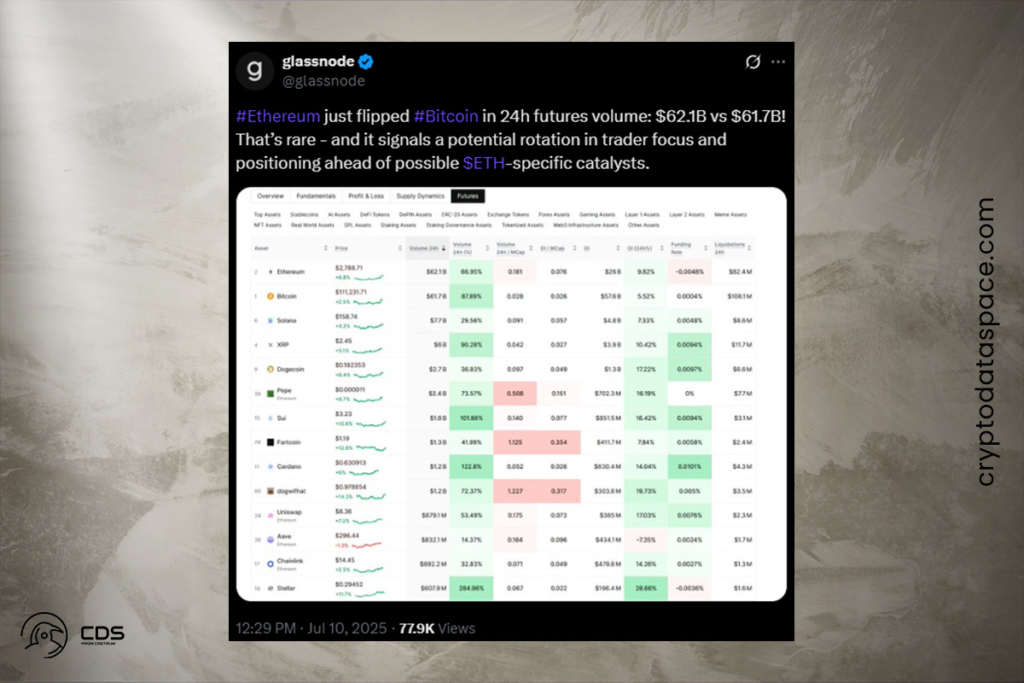

There was an unusual but potentially important change in the market. On July 10, the trading volume of Ethereum futures reached $62.1 billion, surpassing that of Bitcoin in a single day. During the same time frame, Bitcoin’s volume was $61.7 billion. The market analytics platform Glassnode has brought attention to this reversal, which could indicate a minor but significant shift in trader mood. Ethereum’s surge may indicate increased trust in its ecosystem, even though the original cryptocurrency still leads the market in terms of price and dominance.

Why Are Investors Betting on Ethereum Over Bitcoin in 2025?

There are other reasons for this unexpected dominance. Among these is Bit Digital’s plan to convert its entire $173 million Bitcoin holdings to Ethereum. This plan demonstrates increased institutional confidence in the second-largest cryptocurrency by market value.

On the other hand, over the course of two days, deep-pocketed investors just acquired 200,000 ETH, which is worth over half a billion dollars. They demonstrated their long-term belief in ETH in addition to increasing their combined holdings to 22% of the market.

Furthermore, there is growing interest in the possibility that the U.S. Securities and Exchange Commission (SEC) will approve staking in spot Ethereum ETFs. This has the potential to raise the price of ETH much more than technical network enhancements have, according to K33 Research.

Ethereum Holds Strong, but Bitcoin Remains the Market’s Key Driver

During Bitcoin’s surge to a new all-time high, Glassnode noticed an odd change in the futures market’s structure. There may have been short squeezes in late June when rising Bitcoin prices were accompanied by falling open interest. On this occasion, however, open interest increased in tandem with the price of Bitcoin, indicating the entry of new long positions.

To sum up, Ethereum has performed well, but care is still advised. Bitcoin is still the primary indicator of cryptocurrency and commands a larger percentage of institutional products.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.