Bitcoin Defies Wall Street Bloodbath: Crypto Resilience Amid Market Turmoil

Notwithstanding the bloodbath on Wall Street this week, the price of Bitcoin and the cryptocurrency market as a whole have shown incredible strength. However, the leading cryptocurrency remained steady at $83,000 and avoided the instability brought on by Trump’s tariff conflicts. The Nasdaq Index has suffered the largest decline since the COVID-19 pandemic, plunging almost 2000 points, or 11.4%, in the last two days of the US stock market storm.

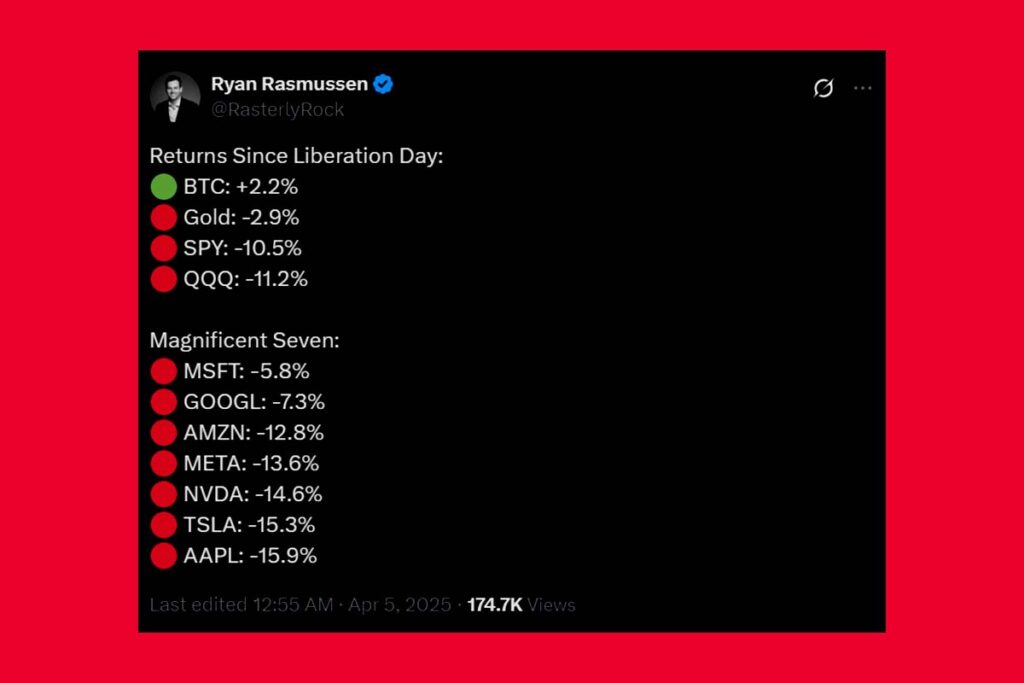

Everyone is talking about how Bitcoin is now genuinely making a comeback as a hedge against the uncertainties of the global market due to its resilience against the US equity market’s decline. Compared to gold, silver, and Magnificent 7 stocks, Bitcoin has been the only asset in the green since the Trump reciprocal tariffs went into effect on April 2, Liberation Day.

Bitcoin Defies Traditional Markets: Is a $90K Breakout Coming?

Even if the price of Bitcoin was rejected at $89,000, it has remained stable around the $82,000 support level. At the time of writing, Bitcoin was up 0.20% at $83,193. It has a $1.65 trillion market capitalization and daily trading volumes of $28.96 billion, a 30.95% decrease. Investors, meanwhile, are still holding out hope for a $90K Bitcoin breakout. Blockstream CEO and well-known Bitcoin contributor Adam Back says that Bitcoin seems to be detaching from traditional financial markets.

Back posited that the long-standing association between Bitcoin and conventional stocks might have been fabricated. He conjectured that market makers might be setting up an automatic correlation during U.S. market hours by taking advantage of Bitcoin’s liquidity constraints, specifically the lack of currency liquidity.

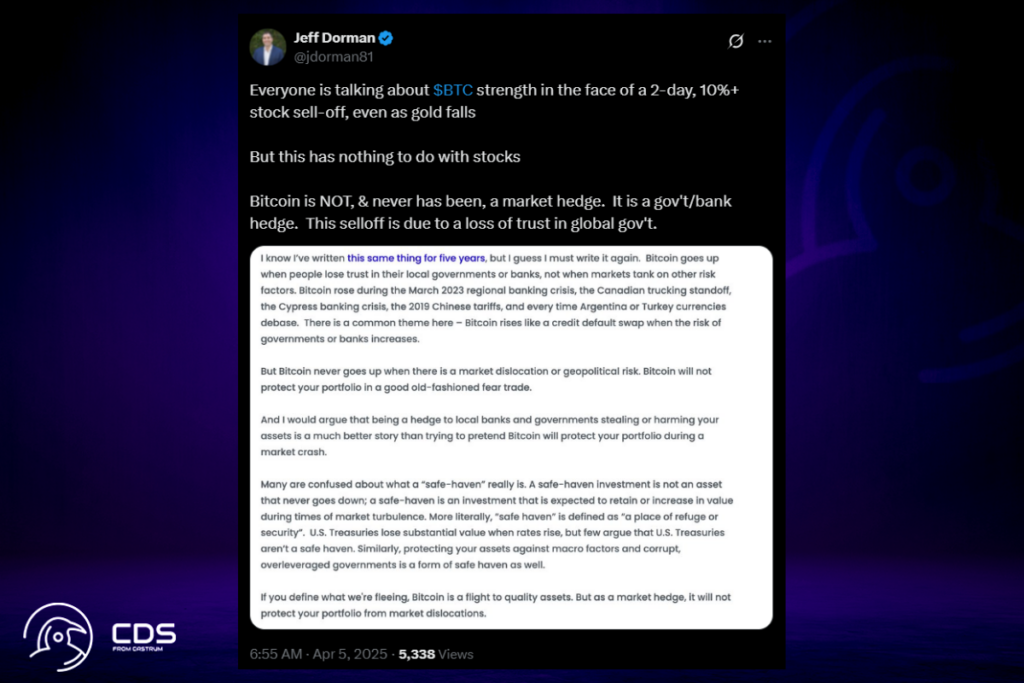

Everyone is talking about BTC strength in the face of a 2-day, 10%+ stock sell-off, even as gold falls. But this has nothing to do with stocks Bitcoin is NOT, & never has been, a market hedge. It is a gov’t/bank hedge. This selloff is due to a loss of trust in global gov’t.

Jeff Dorman, CIO of Arca institutional investment

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment