Friday PCE Report Looms: Could It Be Bitcoin’s Next Big Catalyst?

Both conventional and cryptocurrency investors are looking forward to Friday’s US Personal Consumption Expenditures (PCE) report, which could allay worries about inflation and boost interest in riskier assets like Bitcoin. The next PCE report, which gauges the inflation of prices US consumers pay for goods and services, will be released by the US Bureau of Economic Analysis (BEA) on March 28. According to Singapore-based digital asset company QCP Group, the PCE inflation print might be the next major driver of Bitcoin and other risky assets.

As we approach Friday’s quarterly expiry, with the highest open interest in topside strikes above $100K, we don’t expect major volatility driven by options positioning alone. But attention will turn to the PCE inflation print, which could become the next key catalyst. Trump signaled twice on Monday that trading partners might secure exemptions or reductions, offering a reprieve that helped soothe market jitters,

QCP

Bitcoin’s April Boom? Analysts Predict a Surge to $110K Before a Pullback!

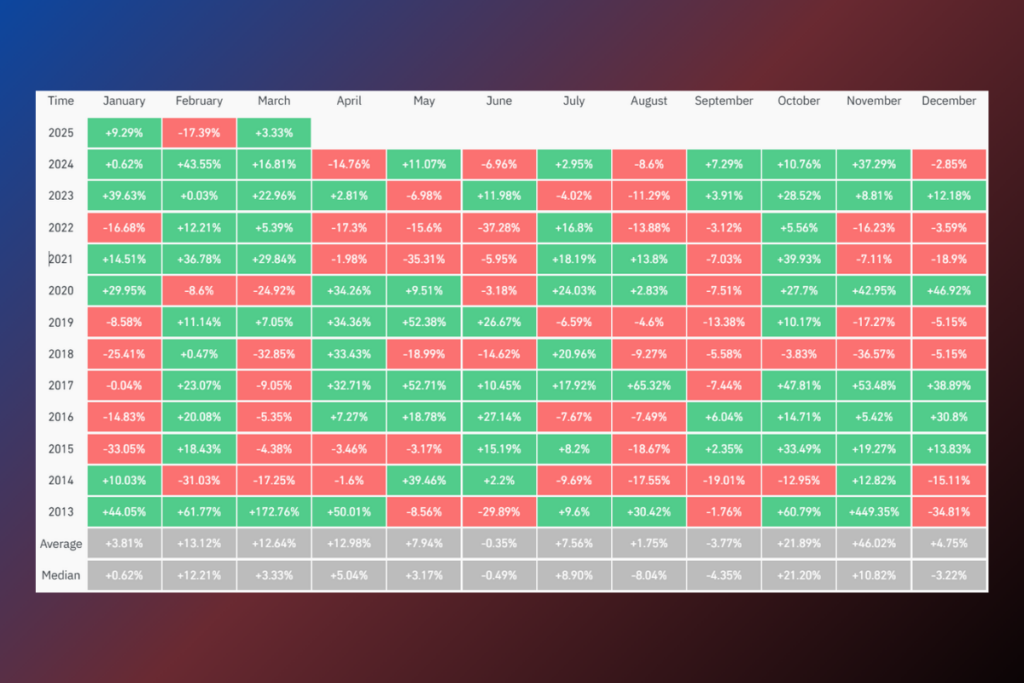

Since US President Donald Trump first declared import duties on Chinese goods on January 20, the day of his inauguration, the price of bitcoin has dropped by more than 14%. However, economists anticipate that the PCE report will allay inflation-related worries even more, sparking Bitcoin’s historic April rise. According to CoinGlass data, April was the fourth-best month for the price of Bitcoin based on historical returns, with an average monthly return of over 12.9%.

Bitcoin is more likely to reach a new all-time high of $110,000 before falling back to $76,500, according to Arthur Hayes, chief investment officer of Maelstrom and co-founder of BitMEX. According to Juan Pellicer, senior research analyst at IntoTheBlock, it seems likely that Bitcoin will reach the record $110,000 level, given the state of the market.

BTC is showing signs of recovery, driven by growing institutional interest and significant investments from large players. The Federal Reserve’s recent decision to ease its monetary tightening could further boost liquidity, favoring a price increase in the near term. While market volatility remains a risk that could lead to a pullback, the overall momentum and support levels suggest Bitcoin is more likely to hit the higher target first,

Pellicer

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment