Bitcoin Options Expiry Friday: Will BTC Price Swing Wildly?

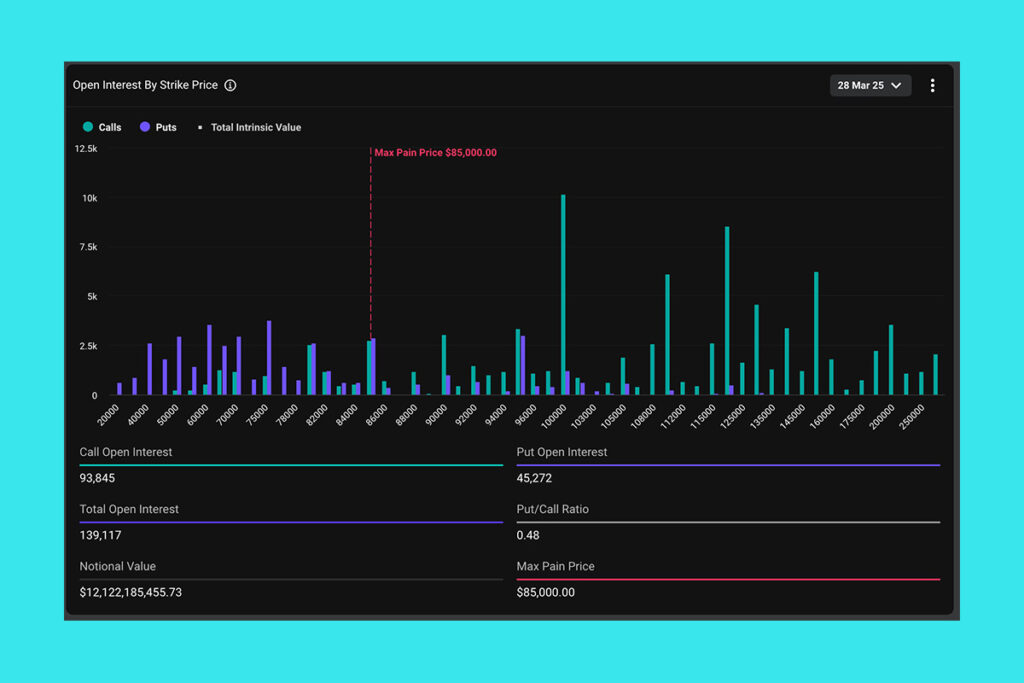

On Friday, billions of dollars worth of Bitcoin (BTC) options will expire on Deribit. The exchange informed CoinDesk that despite the size of the upcoming settlement, there might not be much market volatility. According to data source Deribit analytics, over 139,000 Bitcoin option contracts, valued at $12.13 billion, or around 45% of all current Bitcoin contracts across all expiries, are scheduled to settle this Friday.

Quarterly Expiry Alert: Bitcoin Market Braces for a Potential Volatility Shift

Call options, which give purchasers asymmetric bullish exposure, account for over 65% of all open interest, with put options, which offer downside protection, making up the remaining portion. Given the ongoing drop in the Bitcoin 30-day implied volatility index (DVOL), that may not be the case this time around. Quarterly expiries of this size are known to cause market volatility.

In the weeks preceding the expiry, the index fell from an annualized 62% to 48%, indicating muted expectations for volatility. The exchange’s annualized perpetual futures basis of about 5%, which indicates a more relaxed funding climate, supports similar findings.

Despite the size of the expiry, the overall setup—low DVOL, moderate basis, and balanced options positioning—points to a relatively subdued expiry unless external catalysts emerge,

Luuk Strijers, CEO of Deribit

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment