Stellantis Secures Major Investment: What Does This Mean for the Automotive Giant?

One of the top automakers in the world, Stellantis N.V., has been in the news lately for its innovative spirit and impressive financial results. In order to remain competitive in the rapidly changing automotive industry, the firm, which is well-known for its wide range of brands, including Jeep, Dodge, Peugeot, and Fiat, has been making significant investments in EV technology and software-defined vehicles. Today, however, the investment in Stellantis stands out. The recent purchase of 33,032 Stellantis shares by Royal London Asset Management Ltd. indicates a rise in institutional trust in the carmaker’s prospects for long-term growth.

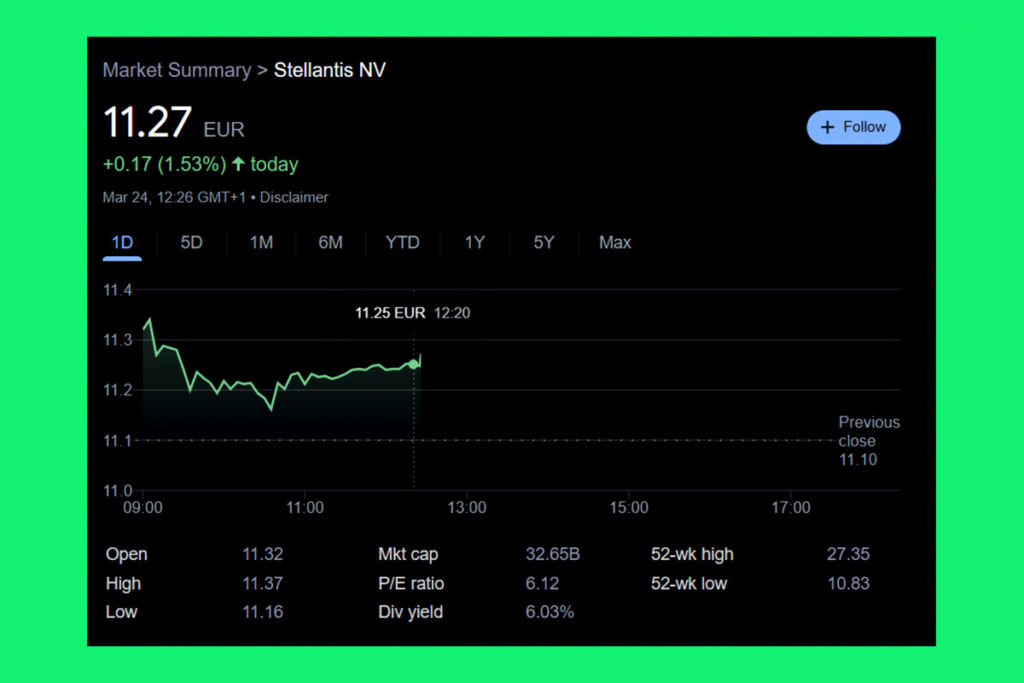

Stellantis Stock Gains Strength as Institutional Investors Step In

This purchase is made at a time when Stellantis‘ stock has shown tenacity in the face of market volatility and supply chain issues facing the entire sector. Growing institutional interest should support investor sentiment and stock momentum in the upcoming months as Stellantis continues to build its EV selection and solidify its place in the worldwide market.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment