ETH Supply Shock Incoming? Exchange Balances Drop to Historic Lows!

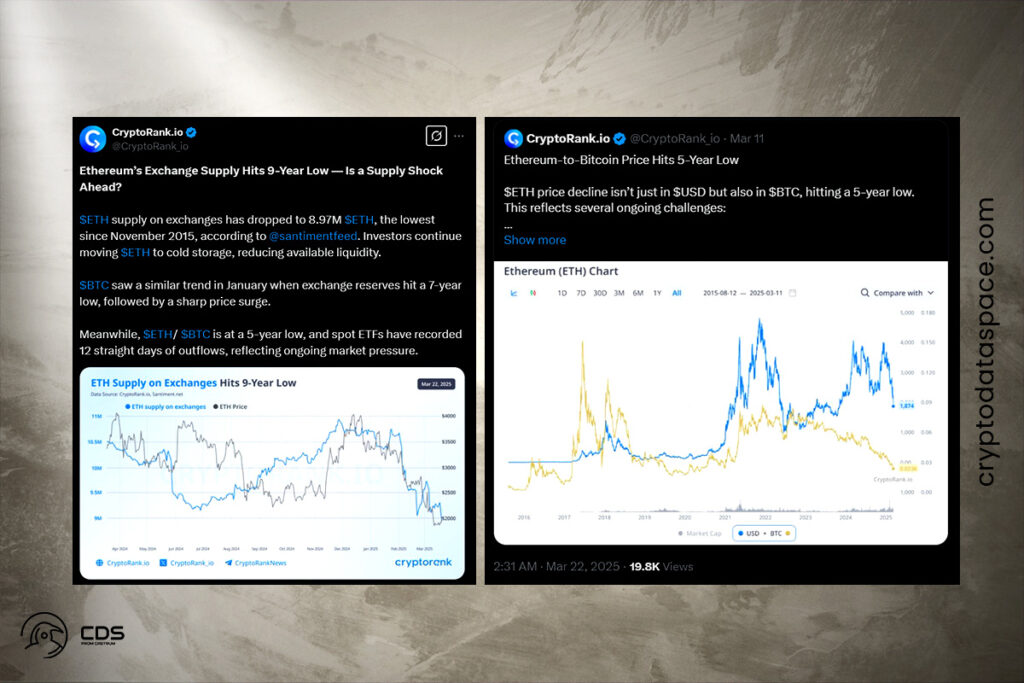

According to data compiled by CryptoRank and Santiment, the quantity of Ether (ETH) stored in wallets connected to centralized exchanges has fallen to 8.97 million tokens, a level not seen in almost nine years. The lowest number since November 2015 is that one.

Will ETH Price Follow Bitcoin’s January Rally?

There may be fewer coins available in the market as a result of the ongoing withdrawal of coins from centralized trading platforms, which might cause prices to rise. For instance, on January 13, the quantity of Bitcoin held on centralized exchanges fell to a seven-year low, and in the days that followed, values rose from about $90K to over $109K.

Investors continue moving ETH to cold storage, reducing available liquidity. BTC saw a similar trend in January when exchange reserves hit a 7-year low, followed by a sharp price surge,

CryptoRank

Many investors are choosing self-custody over short-term speculation, according to analysts, which indicates increased investor trust in ETH‘s long-term value. Furthermore, this positive momentum may be further accelerated by impending triggers like the Ethereum Pectra upgrade and growing institutional use, making the current accumulating phase of ETH a crucial time to monitor.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment