What is Proof of Liquidity (PoL)?

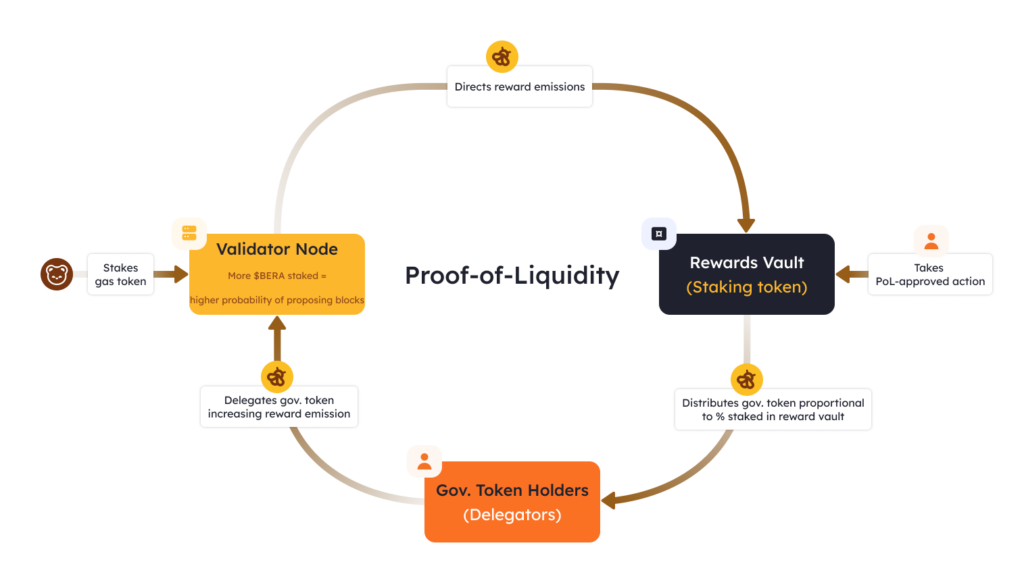

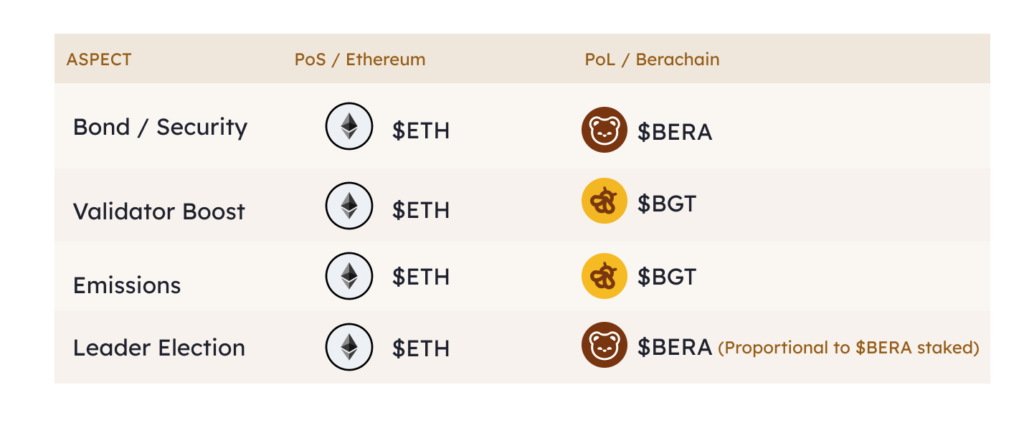

Proof of Liquidity (PoL) is an innovative consensus mechanism developed by Berachain, introducing a new approach to securing blockchain networks while incentivizing liquidity providers. Unlike traditional models such as Proof of Work (PoW) or Proof of Stake (PoS), PoL selects validators based on the liquidity they contribute rather than computational power or staked tokens.

But how does Proof of Liquidity work, and what advantages does it offer for the blockchain ecosystem? Let’s dive in.

What is Proof of Liquidity (PoL)?

Definition and Purpose of PoL

Proof of Liquidity (PoL) is a novel consensus mechanism designed to enhance network security while encouraging liquidity provision. Unlike PoW, which relies on computational power, or PoS, which depends on token staking, PoL bases validator selection on the liquidity a participant provides to the network.

The primary goal of PoL is to optimize economic incentives, ensuring that validators actively contribute to network liquidity rather than merely locking up assets. This approach fosters a more dynamic and sustainable blockchain ecosystem, where validators benefit from both governance participation and passive income opportunities.

Comparison with Traditional Consensus Mechanisms

PoL differs significantly from conventional consensus models:

| Consensus Mechanism | Operating Principle | Disadvantages |

|---|---|---|

| Proof of Work (PoW) | Uses computational power for mining | High energy consumption, scalability issues |

| Proof of Stake (PoS) | Selects validators based on staked tokens | Centralization risk, favors large token holders |

| Proof of Liquidity (PoL) | Selects validators based on provided liquidity | Requires adaptation as a new model |

Unlike PoW, which demands significant energy consumption, and PoS, which may concentrate power in the hands of major stakeholders, PoL introduces a more balanced approach by aligning network security with liquidity provision.

Berachain and Proof of Liquidity

Introduction to Berachain

Berachain is a Layer-1, EVM-compatible blockchain that operates on the Proof of Liquidity consensus model. Unlike traditional networks that require validators to stake tokens to secure the chain, Berachain incentivizes validators to contribute liquidity, leading to a more efficient and capital-productive ecosystem.

The Role of PoL in the Berachain Ecosystem

Berachain utilizes a tri-token model, comprising:

- $BERA: The network’s primary token, used for gas fees and transactions.

- $BGT (Berachain Governance Token): A governance token issued to liquidity providers.

- Liquidity Provider (LP) Tokens: Tokens obtained by participants who supply liquidity.

This model ensures that those who contribute liquidity gain governance power, allowing them to participate in network decisions while simultaneously benefiting from liquidity rewards.

Berachain and Proof of Liquidity

Introduction to Berachain

Berachain is a Layer-1, EVM-compatible blockchain that operates on the Proof of Liquidity consensus model. Unlike traditional networks that require validators to stake tokens to secure the chain, Berachain incentivizes validators to contribute liquidity, leading to a more efficient and capital-productive ecosystem.

The Role of PoL in the Berachain Ecosystem

Berachain utilizes a tri-token model, comprising:

- $BERA: The network’s primary token, used for gas fees and transactions.

- $BGT (Berachain Governance Token): A governance token issued to liquidity providers.

- Liquidity Provider (LP) Tokens: Tokens obtained by participants who supply liquidity.

This model ensures that those who contribute liquidity gain governance power, allowing them to participate in network decisions while simultaneously benefiting from liquidity rewards.

Advantages of PoL

Restructuring Economic Incentives

PoL redistributes incentives to align network security with liquidity provision, reducing capital inefficiencies commonly found in PoS and PoW systems.

Enhancing Network Security and Liquidity

- PoL enhances network security while simultaneously increasing on-chain liquidity.

- It mitigates the risk of centralization, as governance power is earned through liquidity provision rather than asset accumulation.

PoL vs Proof of Stake (PoS): A Comparison

Key Differences and Similarities

| Feature | Proof of Stake (PoS) | Proof of Liquidity (PoL) |

|---|---|---|

| Security Mechanism | Based on staked tokens | Based on provided liquidity |

| Incentive Structure | Rewards based on staked assets | Rewards based on contributed liquidity |

| Centralization Risk | High (large stakeholders dominate) | Lower (open to all liquidity providers) |

Pros and Cons of Both Models

While PoS remains a popular staking model, it often disadvantages smaller participants by favoring those with large holdings. In contrast, PoL enables a broader range of users to participate, fostering greater decentralization and economic fairness.

Use Cases for Proof of Liquidity

DeFi Applications

PoL is particularly beneficial for decentralized finance (DeFi) platforms, as it enhances capital efficiency and provides a more sustainable incentive model for liquidity providers.

Benefits for Decentralized Applications (dApps)

By aligning security with liquidity, PoL enables dApps to operate in a more capital-efficient manner, reducing friction and increasing financial flexibility within the ecosystem.

The Future of PoL and Its Development

Planned Updates and Improvements

The Berachain team continues to refine PoL mechanics, ensuring that it remains scalable, efficient, and adaptable for future blockchain applications.

The Importance of Community Participation

PoL’s decentralized nature allows the community to play a key role in its evolution. Active participation from liquidity providers ensures that governance remains balanced and representative of the broader ecosystem.

Frequently Asked Questions (FAQ)

What is PoL and how does it work?

PoL is a consensus mechanism that selects validators based on the liquidity they contribute rather than computational power or staked assets.

What are the roles of $BERA and $BGT tokens?

$BERA serves as the primary transaction token for gas fees and payments.

$BGT is a governance token earned by liquidity providers, granting them decision-making power within the Berachain ecosystem.

How is PoL different from other consensus mechanisms?

PoL prioritizes liquidity provision as a security mechanism, whereas PoW and PoS rely on computational power and token staking, respectively.

How do liquidity providers benefit from PoL?

By contributing liquidity, providers earn rewards, participate in governance, and benefit from a more dynamic capital structure compared to traditional staking models.

What are the future plans for PoL?

Berachain aims to expand and optimize PoL, improving its scalability and adoption across DeFi and blockchain ecosystems.

Proof of Liquidity (PoL) represents a groundbreaking shift in blockchain consensus models, aligning network security with active liquidity provision. By introducing a capital-efficient and decentralized incentive system, Berachain is paving the way for a more sustainable and participatory blockchain ecosystem. As PoL continues to develop, its impact on DeFi, governance, and economic models will likely reshape the blockchain landscape for years to come.

Leave a comment