BeraFi Price Surges After Launch: What’s Driving the Hype?

BeraFi (BERAFI) is a new decentralized finance (DeFi) platform that uses blockchain technology to improve financial efficiency and accessibility. By offering smooth lending, staking, and liquidity options, BeraFi hopes to transform the DeFi market with an emphasis on security, scalability, and creative return potential.

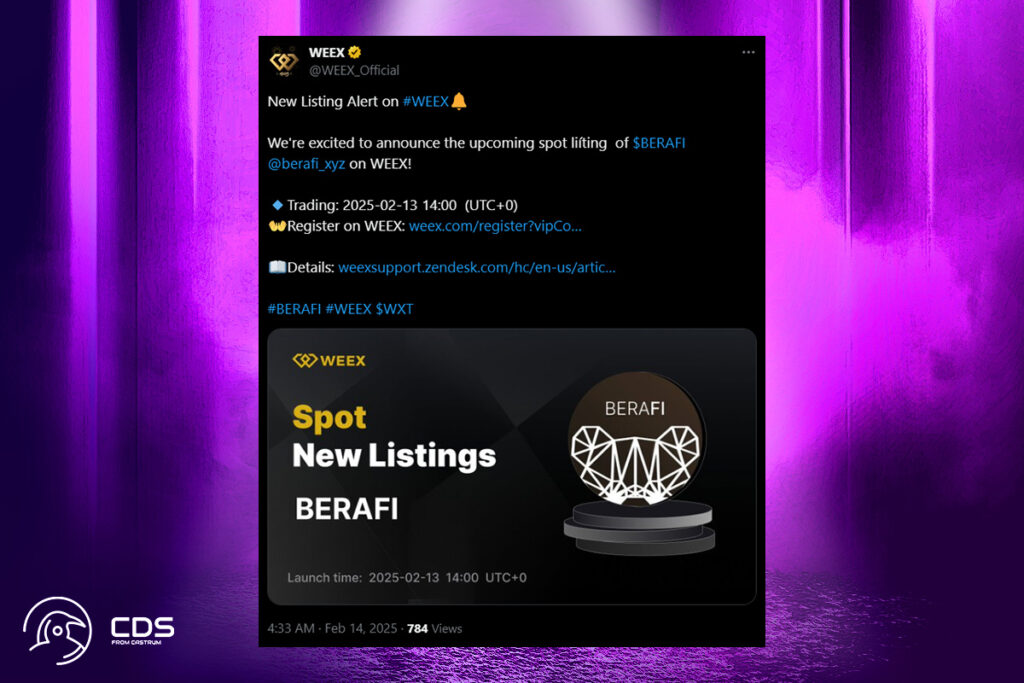

At 14:00 UTC on February 13, BeraFi went live with listings on Uniswap, Kodiak, and MEXC. BeraFi was also listed on WEEX today, February 14. With a total supply of 800 million, the token made its launch at a price of $0.000845. The price jumped to $0.00316 after debut, which is a 273% pump. According to CoinGecko, it is currently trading at $0.001966, up 31.4%.

Berachain’s BeraFi Sparks DeFi Excitement Despite Insider Concerns

Built on the layer 1 blockchain Berachain, which debuted on February 6 and generated a lot of excitement due to its novel consensus process as well as worries about insider trading and tokenomics, is where BeraFi operates. In particular, experts discovered problems with the tokenomics that favored insiders and early investors.

However, the news of BeraFi, the first project ever built on Berachain, has generated enthusiasm because of its novel approach to DeFi. To be more precise, BeraFi does not charge consumers manual gas fees because the platform fully supports them. The BERAFI token serves as a buyback mechanism to promote ecosystem expansion, as well as a governance tool and liquidity incentive.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment