Cryptocurrency ETPs Experience Mixed Results: Bitcoin Inflows Offset by Ethereum Losses

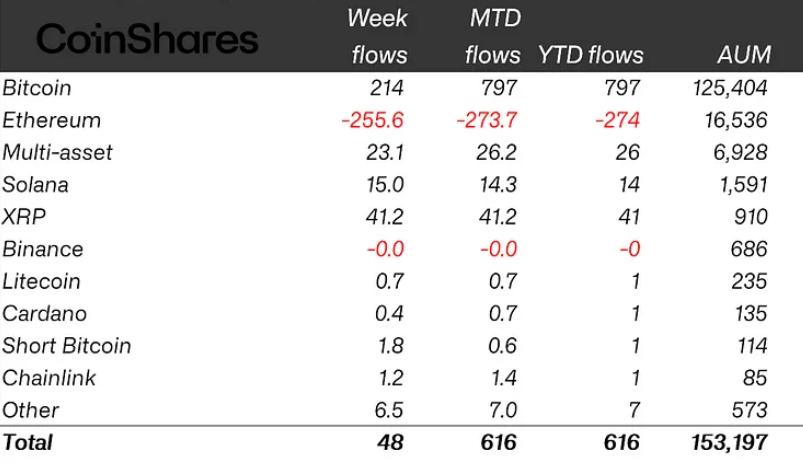

Cryptocurrency ETP– Cryptocurrency exchange-traded products (ETPs) experienced modest net inflows of $47 million last week, following a sharp sell-off in Bitcoin-based investment products. Despite this, the overall market sentiment shifted due to broader macroeconomic factors, with investors pouring nearly $1 billion into crypto ETPs during the second trading week of 2025. However, these inflows were largely offset by $940 million in outflows, according to CoinShares‘ January 13 report.

Bitcoin ETPs Lead with $213 Million in Inflows

Bitcoin (BTC) investment products led the inflows with $213 million during the week of January 6-10. Despite experiencing the largest outflows later in the week, Bitcoin remains the top-performing crypto asset in 2025, having attracted $799 million in net inflows year-to-date. However, total assets under management (AUM) in Bitcoin ETPs dropped by 3.5%, from $130 billion to $125.4 billion.

Ethereum Sees Major Outflows, XRP Gathers Momentum

Ethereum-based products faced the largest outflows of $256 million, primarily attributed to the broader tech sector sell-off. In contrast, XRP-based products saw positive momentum, with $41 million in inflows, driven by growing optimism surrounding its ongoing legal battle.

As the macroeconomic landscape evolves, crypto market participants will need to stay attuned to shifting trends and manage risk accordingly.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment