Bitcoin Mining- Can Bitcoin Evolve into a Stable Currency by 2030?

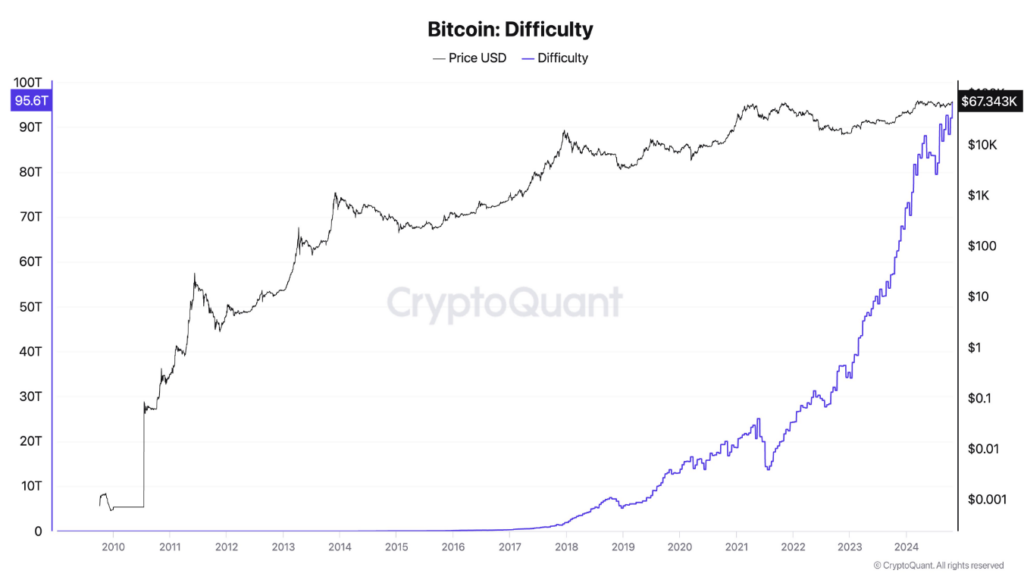

Bitcoin mining difficulty has skyrocketed over the past three years, witnessing a staggering 378% increase. This surge has been driven largely by institutional investments in large-scale mining operations, raising the bar for competition and creating significant entry barriers for individual miners. Despite these challenges, Ki Young Ju, CEO of CryptoQuant, views this trend as a potentially positive development for Bitcoin (BTC).

Implications of Increased Mining Difficulty

Ju forecasts that the rising mining difficulty could be a precursor to Bitcoin’s evolution into a stable currency by 2030. With more institutional dominance in the market, the volatility traditionally associated with cryptocurrencies might be significantly reduced. Historically, Bitcoin and the broader cryptocurrency market have been notorious for their price fluctuations, making them more speculative investments. However, as institutional investors continue to engage, mining difficulty has surged alongside the centralization of computing power, potentially leading to a more stable Bitcoin ecosystem.

In a recent post on X, Ju noted, major fintech players are expected to drive mass adoption of stablecoins within three years. He anticipates that by the next halving event in 2028, discussions surrounding Bitcoin’s use as a currency will gain serious traction.

The Role of Layer-2 Solutions

While layer-2 solutions like the Lightning Network are often touted as essential for Bitcoin’s scalability, their adoption rates have lagged behind those of venture capital-backed blockchains. Ju emphasizes that institutional support is crucial for the widespread acceptance of Bitcoin’s layer-2 solutions, especially as they face competition from alternatives like Wrapped Bitcoin (WBTC).

Wrapped Bitcoin allows for the integration of Bitcoin into various ecosystems without the complexities associated with layer-2 infrastructure, providing a more straightforward solution for users and developers alike.

Price Stability and Market Predictions

Current price analysis indicates that the $65,000 mark has become a critical support level for Bitcoin after it surged to $69,000 on October 21, the first time since June. Keith Alan, co-founder of Material Indicators, predicted that if Bitcoin can maintain its price above the 21-week moving average without significant fluctuations, it would signal that the current uptrend is likely to continue.

With macroeconomic data and anticipated market volatility on the horizon, analysts will closely monitor Bitcoin’s performance in the coming weeks. Some even predict a retest of all-time highs before the year concludes.

In conclusion, while Bitcoin faces challenges in the form of increased mining difficulty and competition, the involvement of institutional investors could ultimately stabilize the market. As the ecosystem evolves, the interplay between mining dynamics, institutional support, and price stability will play a crucial role in shaping Bitcoin’s future trajectory.

FAQs

Why has Bitcoin mining difficulty increased so much in recent years?

Bitcoin mining difficulty has surged by 378% over the past three years due to heightened institutional investment in large-scale mining operations. This increase has resulted in greater competition among miners and higher entry barriers for individual miners.

What impact does institutional investment have on Bitcoin’s stability?

Institutional investment can potentially stabilize Bitcoin by centralizing computing power, which may reduce volatility. As more institutional players enter the market, the dynamics of supply and demand may shift, leading to a more stable Bitcoin ecosystem over time.

1 Comment